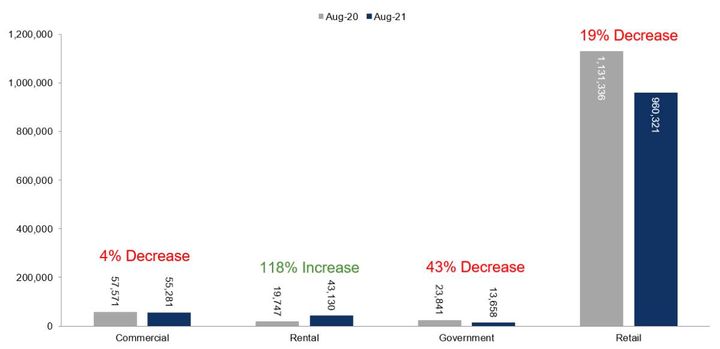

Fleet Unit Sales – August 2021 Versus August 2020

Graphic: Cox Automotive

In August, 112,069 total fleet units were sold, a 3% month-over-month decrease compared to 115,976 in July and an 11% increase from August 2020 which recorded 101,159 units, Cox Automotive reported Sept. 3 in a news release.

This brings the 2021 year-to-date total combined large rental, commercial, and government purchases of new vehicles to 1.2 million units, a 6% increase from this time in 2020 when 1.1 million units were sold and a 41% decrease from the same time in 2019 when two million units were sold.

Sales into large rental, commercial, and government buyers were up 11% year-over-year in August. Sales into rental increased 118% year over year in August and are up 7% compared to the same time period last year. Commercial sales are down 44% year-over-year and are up 17% in 2021. Including an estimate for fleet deliveries into the dealer and manufacturer channel, Cox estimates the remaining retail sales were down 19% year-over-year in August, leading to an estimated retail SAAR of 11.5 million, which was down from 13 million last August and down from August 2019’s 13.8 million rate.

Total new-vehicle sales in August were down 17% year over year with one less selling day compared to last year. Month over month, August new-vehicle sales were down 15%. The August seasonally adjusted annual rate (SAAR) was 13.1 million, which was the lowest sales pace in 15 months and down 14% from last year’s 15.2 million and 23% lower than August 2019’s 17.1 million rate.

Looking at automakers, year-over-year changes in fleet sales differed by manufacturer, ranging from a decline of 20% to an increase of 107%. Toyota saw the largest growth last month with more than 15,000 sales with General Motors seeing a 20% decrease compared to August 2020.

Originally posted on Vehicle Remarketing