Tata Power is in talks with large pension and sovereign asset managers, including Canada Pension Plan Invest Board (CPPIB) and Government of Singapore Investment Corp. (GIC), to raise at least $500 million ahead of a planned initial public offering (IPO) by its renewable energy unit.

Negotiations are entering the formal stage just after the salt-to-steel conglomerate announced that it was raising $1 billion from investors, including TPG, by selling a minority stake in the electrical vehicle (EV) unit of Tata Motors.

Some bulge-bracket funds from the US and sovereign funds from the Middle East are also exploring investments in Tata Power Renewables, people with knowledge of the matter told ET.

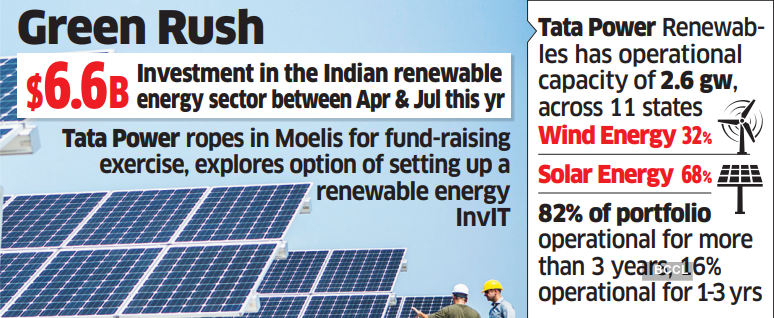

Tata Power is understood to be working with Moelis & Co. to run a formal process to find a buyer, they said.

“They have hired a banker and are now getting formal in their engagement,” said one of them. “I think they are looking to conclude a transaction sooner as there is a lot of appetite from global funds towards green energy businesses.”

The company also has explored the option of setting up a renewable energy infrastructure investment trust (InvIT) with its operational power assets.

Tata Power and CPPIB declined to comment. GIC didn’t respond to queries sent Wednesday.

The unit is one of India’s largest renewable energy businesses with an operating capacity of 2.6 GW comprising wind and solar in a 32:68 ratio spread across 11 states.

The shift to clean energy, in keeping with the current environmental sustainability focus, is getting a lot of investor interest, said experts. “There is a visible change in the company’s big focus from traditional areas to bet on green energy,” said an executive close to the company. “And this plan will fetch its businesses better valuations.”

Tata Power has said it plans to phase out coal-based capacity and expand its clean and green capacity to 80% by FY30. Renewable energy currently comprises over a third of its total capacity of 13 GW.

ET reported recently that the company had kicked off the fund-raising process by clubbing its entire renewables portfolio under an umbrella entity. This includes operating and pipeline independent power producer (IPP) assets, charging stations, rooftop solar, microgrids, panel manufacturing, engineering, procurement and construction (EPC). It aims to raise equity for the entire platform, restarting fundraising efforts for the renewables business six months after pulling out of negotiations with Malaysia’s Petronas for investments of up to $2 billion.

ICRA upgraded the Tata Power Renewables credit rating in June to stable. This reflects its strengths arising from the well-diversified renewable power portfolio across 11 states, it had said.

“The portfolio reduces vulnerability of generation to location-specific issues, and a diversified customer mix, which partly mitigates the counterparty credit related risks,” ICRA said. “Further, the rating draws comfort from the demonstrated operating track record-82% of the portfolio has a track record of more than three years and 16% of the portfolio has an operational track record of one to three years.”

The renewable energy space has seen substantial fund inflows from financial investors in recent years.

Also read: