Influence of soaring prices of raw materials such as lithium.

The price of semiconductors for vehicles also increased.

Electric vehicle battery prices have risen for the first time in 10 years. It is unusual for prices that have fallen every year since the creation of the electric vehicle market due to increased production. This is due to the aftermath of the rise in battery raw material prices despite explosive demand. In fact, prices of lithium, cobalt, and nickel, which are key raw materials for batteries, have also soared. This year’s battery price increase will be reflected in next year’s vehicle price. As semiconductor prices for vehicles, which have recently soared due to a lack of supply, overlap, pressure to raise electric vehicle prices is expected to increase.

It was confirmed on the 14th that the domestic battery industry recently raised the price of battery cells supplied to automotive manufacturers by around 2%.

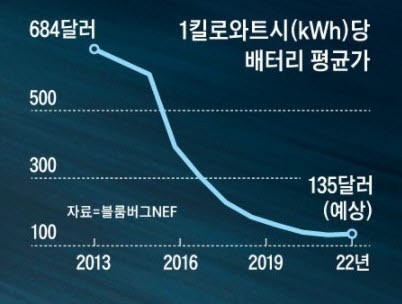

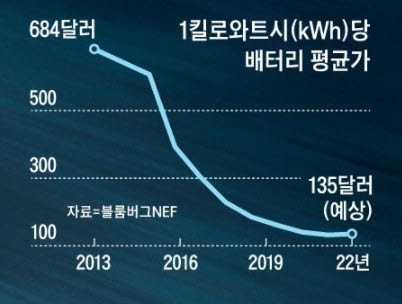

BloombergNEF also predicted in a recent report that the price of lithium-ion battery packs will rise 2.3% from this year to $135 per kWh next year. The rise in battery prices is the first time since 2012 when Bloomberg began conducting a price survey. The global demand for electric vehicles is expected to surpass 4.1 million to 4.2 million units this year, up more than 1 million units from about 3 million units last year. It is normal for battery prices to fall due to the realization of economies of scale. However, as the price of battery raw materials soared, the opposite situation occurred.

According to the Korea Resources Corporation, cobalt prices reached $69,000 (about KRW 81.18 million) per ton earlier this month. This is an 119% increase compared to the average over the past year. Lithium prices also jumped 410% from last year’s average price, recording 190.5 yuan (about KRW 35,300) per kg. Nickel prices also rose to $20,305, up 47% from last year’s average price.

If raw material prices rise, the burden of increasing battery materials, batteries, and finished vehicles will be compensated by buyers through the supply price linkage system. On the other hand, only the consumers are affected by the cost increase for automotive manufacturers. In other words, automotive manufacturers have no choice but to raise electric vehicle prices next year in order to maintain profits. Of the total production costs of electric vehicles, batteries account for 40%.

There is one more factor in raising the price of finished cars. This is a prolonged shortage of semiconductors. Semiconductor prices for vehicles such as micro controller units (MCU) are rising steeply. ‘Company N’, a large U.S. semiconductor company, is known to have recently delivered a guide to raise MCU prices by 20% next year to domestic carmakers. South Korean MCU chip makers, which are mainly used for display and navigation for vehicles, are also in the process of raising supply prices by 20% next year.

By Staff Reporter Tae-jun Park (gaius@etnews.com)