The future of mobility is at a critical point of inflection. Every time oil prices spike or climate change is debated and discussed, Electric Vehicles (EVs) are inevitably mentioned as a part of the solution. Yet, despite several new Indian companies entering various parts of the EV value chain, significant capital infused in the space and large-scale execution efforts, EVs are not mainstream yet. It is 2021 and it seems we have hit the inflection point for EVs to take off, finally.

Let us rewind to 2001.

Amongst massive buzz and nearly seven years of development, Reva from the Maini Group was unveiled as India’s first electric car. As it took to the roads, Chetan Maini of the Maini Group was ecstatic with the possibility of adding a strong voice to the global conversation around electric mobility. Reva became the country’s most affordable electric car and soon became one of the world’s bestselling electric cars, having sold in 24 countries. In 2001, the success of Reva hinged heavily on significantly lower total cost of ownership (TCO) as compared to the other vehicles on the road, good range for regular intra-city commute, high initial torque, the promise of lower reliance on international crude oil imports, and the associated aspect of sustainability.

It has been 20 years since, and one would have expected electric vehicles to become a norm and a lifestyle in the country. However, the reality seems to be far from this. When we turn to the Indian roads of today, we see that about 1 in 125 vehicles is electric, most being three wheelers and two wheelers. And the narrative around the factors affecting the success of EVs seem to have seen no change in the past two decades. Before we look at what it takes for mass EV adoption in the country, let’s understand why we failed to make EVs mainstream.

Why EVs have seen limited adoption (so far)?

Despite the launch of products by incumbent OEMs (Original Equipment Manufacturers) and new players, the EV penetration is extremely low at 0.8%. The split of overall EVs in India, by two-wheelers, three-wheelers and four-wheelers, is 17%, 79%, 4% respectively. The reasons for the failure can be looked at under the following dimensions.

1) Lack of Product Innovation

One of the key reasons for limited adoption of electric vehicles can be attributed to the lack of innovation on the product front. So far, companies failed to spotlight the practicality of an electric vehicle for the value-conscious Indian consumers. Sustainable performance was not built into the product and EVs failed to provide a satisfactory range suitable for inter city travel. Lack of charging infrastructure is popularly believed to be the number one reason for low EV adoption. However, while it is one of the reasons, it is not the primary reason limiting the success of EVs. Instead, it is the dearth of customer-first and appealing products despite the premium being charged for EVs.

2) Cost Concerns

For two-wheelers and four-wheelers, EVs are sold at a 20% and 50% premium respectively as compared to the Internal Combustion (IC) vehicles. This high upfront cost is not favorable for the value-conscious Indian consumers who would rather prefer a cheaper IC vehicle. With the increase in size of the vehicle, the price delta increases too. For example, while a two-wheeler EV will breakeven with the IC counterpart at approximately 15000 kms, a 4W needs approximately 1 lakh kms to breakeven. To add to the high upfront cost concerns is the painfully low penetration of financing and limited clarity on the resale value of EVs.

3) Lack of Charging/ Swapping Infrastructure

This comes as no surprise. For six lakh electric vehicles on the road today, we have roughly 2,000 public charging stations. This poor density of the charging stations is limiting the ease of EV usage. Lack of battery and charger standardization coupled with high capital intensity of setting up charging or swapping stations has emerged as a major infrastructural bottleneck.

This is rather a chicken and egg problem where setting up expansive CapEx heavy charging infrastructure would be financially viable for companies only when there is a critical mass of vehicles on the road. And unfortunately we do not have the required critical mass of vehicles in India today. This is, however, changing rapidly.

Buckle up, EVs are (finally) ready to take off

In September 2021, Ola Electric sold e-scooters worth 1,100 crores in just two days in India. At a cost of about 1.3 lakh per scooter, this translates to a sale of approximately 85,000 e-scooters. In comparison to the total number of electric vehicles on the road which is about six lakhs, this is a sizable number for just two-day sales – an indicator that there is a fundamental shift in consumer behavior and an increasing inclination towards electric vehicles.

While the narrative today is still largely the same as that in 2001 (i.e. significantly lower total cost of ownership for EVs, need to reduce India’s reliance on crude oil imports, and the aspect of sustainability & climate change), here are some key developments propelling EV adoption.

1) Progress in Product Innovation

People do not buy a Tesla because they want to buy an electric vehicle. They do so because they want to buy a Tesla. And what makes Tesla what it is? It is the product. Broadly, we can see a major shift with respect to the practicality offered by EVs of today.

Practicality takes into account the vehicle pricing and the range. Vehicle range has drastically improved owing to significant improvements in battery chemistry. Moreover, Lithium ion prices saw a 98% dip over the last three decades, of which 90% reduction took place over the last decade alone. This resulted in a massive drop in the cost of manufacturing batteries. And since the battery forms 25% to 40% of a vehicle’s cost, the price of EVs has also seen a decline.

Now, when consumers pay a premium, they aspire to own a premium, well-designed and feature-rich vehicle. New age tech-first OEMs are building products that are appealing both in terms of design and features and are now attracting customer interest. Ola Electric scooter offers top speed of 115kmph, range of more than 150km, phone sensing unlock through a digital key, voice control, ability to control the vehicle remotely and safety features such as geofencing alert and tamper alert. Ather also offers hi-tech features such as reverse assist, ability to manage the vehicle from the consumer’s smartphone and perform actions like accepting/rejecting calls and playing music. Based on the sales data reported by Ola Electric, one can safely infer that customers are now willing to pay a premium for these vehicles.

2) New Model Alert: Full Stack Approach

Historically, automotives have adopted a vertical-focused business model. Companies manufactured and marketed the vehicle, but did not get into retailing, servicing or fuel infrastructure. New age OEMs are going full-stack. Companies are now going beyond manufacturing and distribution, and selling directly to consumers, setting up charging infrastructure and providing financing options. This is key to accelerating initial adoption as customers are assured of charging infrastructure support and financing. The full-stack approach is going to play an important role in helping EVs reach critical mass on Indian roads. However, over time, OEMs might start verticalising by hiving off the charging business to a separate entity in collaboration with other strategic partners.

3) Turn to Total Cost of Ownership

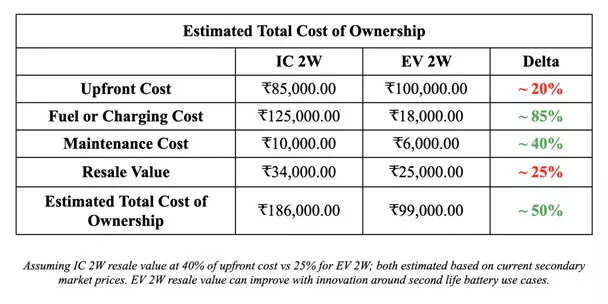

Generally, consumers believe that they will incur high costs when they purchase an electric vehicle. While the upfront cost of an EV is still at a premium, it is important that we look at it from a total cost of ownership perspective. Total cost of ownership (TCO) is the lifetime cost of running a vehicle that is a summation of the upfront cost to buy the vehicle, running costs (fuel/charging costs & maintenance costs) after adjusting the resale value. Considering the upfront cost for two-wheelers, EVs are sold at a 20% premium compared to an IC counterpart. For four-wheelers, the premium paid for EVs goes as high as 50% more than the cost of an IC four-wheeler.

Nonetheless, there is an upside on the running and maintenance costs. For a two-wheeler Electric Vehicle, the cost of charging is at about 15 to 20% of the cost of fuel for an IC vehicle. With the fuel prices increasing rapidly, this delta is only getting larger. Since EVs also have fewer moving parts, the maintenance cost for an electric vehicle is actually about 30 to 40% cheaper than that of its IC counterpart. Due to lack of clarity on the resale value of an EV, a very conservative estimate is taken. A TCO comparison tells us that two-wheeler EVs turn out to be 50% cheaper (over the life of the vehicle) than an IC vehicle, signaling that the mass adoption for EVs will be driven by two-wheelers. In the case of four-wheelers, the TCO of an EV is 20% cheaper than its IC counterpart at a 1.5 lakh km run over the vehicle life. The TCO for EV four-wheelers is slated to improve significantly with the reduction in the premium paid for owning them.

Refer to Figure 1 for detailed Total Cost of Ownership (TCO) calculation.

So, for EVs, customers would be paying a slightly higher premium on the upfront cost and saving money throughout the life of the vehicle.

Figure 1: Total Cost of Ownership (TCO) Calculation

4) Positive regulatory tailwinds

Contributing 7% to the Indian GDP, the automotive industry is a rather important sector for the economy, demanding attention from the policy bodies. However, mass adoption of EVs does not particularly need subsidies from the government. The existing subsidies are mostly focused on manufacturing and aim to drive awareness for electric vehicles. Positive regulatory intervention through schemes such as Faster Adoption and Manufacturing of Hybrid and Electric vehicle (FAME) and Production Linked Incentive Scheme (PLI) is expected to benefit the OEMs and elevate efforts to make India a global hub for EV manufacturing. As many as 18 states have or are formulating policies that stand to benefit EV manufacturing. The government is also supporting the local industry via the Phased Manufacturing Programme (PMP), where there is introduction/increase in custom duty, as well as mandatory local component sourcing to allow OEMs to be eligible for demand side subsidies.

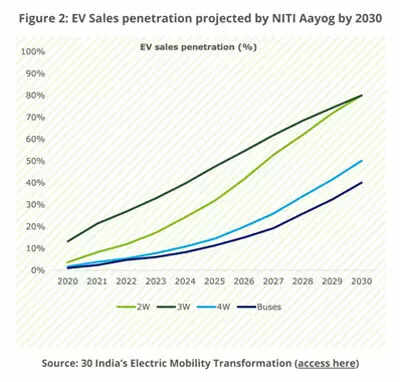

In all, the developments in the aforementioned spaces have set a solid foundation for the mass adoption of EVs. According to NITI Aayog and RMI, EV sales penetration is slated to reach as high as 80% for two and three-wheelers, and 50% for four wheelers by 2030, elucidating the massive opportunity for not just emerging startups but also traditional OEMs. (Refer to Figure 2)

How do we get there and where does the opportunity for innovation lie?

The potential of EV mass adoption does not just present a promising mobility opportunity but is also slated to create a ripple effect in the direction of innovations in other spaces such as FinTech and EdTech. For VCs, there are some areas which are truly exciting.

● The Mobility Opportunity

1) Connected vehicles and telematics

It would be interesting to see innovations in the software layer of EVs – a layer that would facilitate building applications on top of it. Connected vehicles generate extensive data that could have varied use cases. Products that leverage this data and build innovative solutions on top would be interesting to watch out for.

2) Creating robust charging/swapping infrastructure

There is a massive opportunity to develop tech-first charging platforms or networks that are form-factor and brand agnostic and can support both regular and fast charging. Charging would be a more interesting play than swapping in the short-term. In the long-term, swapping works best because it has multiple benefits for a consumer. One doesn’t have to wait for three or four hours to charge their vehicle, instead, can swap the battery in less than five minutes. Though seamless, swapping infrastructure is much more CapEx heavy than charging infrastructure and hence not a preferable short-term play due to the current limited EV adoption. We might see hybrid models in the future, where charging and swapping co-exist.

3)Battery Technology and Battery Management Systems

EV batteries could be made more user friendly, easy to charge and use. The battery management system could be further improved and the battery revamped with a compact design – minimising energy loss and maximizing performance.

Battery recycling is also an important area for innovation. EV batteries are rendered unusable in vehicles when they hit less than 80% battery capacity. However, they can still have other use cases such as energy storage. Companies solving for battery reusability can be a large market, and viable for venture firms to back.

Currently, India falls behind on its role in the battery industry. Access to raw materials and progress in cell chemistry tech can help the country catch up with its global counterparts. In the long term, cell manufacturing is expected to get localized and the assembly of battery packs is an area India could have a significant role to play in.

4)Fleet Management for Commercial Usage

Given the significant cost benefits of operating EVs, we can expect strong B2B demand for them. However, owing to the higher upfront costs for EVs, companies would rather lease or subscribe than buy. Hence, this becomes an opportunity for entrepreneurs to innovate on ways of supplying EVs to B2B customers and enabling efficient fleet management at scale.

5)Mobility as a Service

More than a billion Indians do not own a personal vehicle primarily due to limited purchasing power. Even so, Indian roads are highly congested, with alarming pollution levels. One of the key ways to tackle this is by offering Mobility as a Service (MaaS), wherein consumers don’t own vehicles but are able to access them when the need arises. Since the upfront cost of an EV is higher than an IC vehicle, providing MaaS becomes critical to large scale adoption. We hope entrepreneurs will innovate in this space, and provide solutions to onboard a greater number of Indians into the EV revolution.

● The FinTech Opportunity

Data gathered from connected EVs can be leveraged to offer embedded finance solutions, for example personalized insurance. This is an opportunity to leverage massive volume of customers’ mobility data to provide them with personalized financial services.

● The EdTech Opportunity

Platforms centered around upskilling mechanics have the promise to be a lucrative EdTech Opportunity since EVs would require electrical maintenance from more skilled mechanics. This can be venture scale if additional layers such as B2B supplies, continuous learning and development, lending to mechanics, assistance in setting up infrastructure, branding, standardization and setting up SOPs are added to the mix.

With legacy players coming up to speed and the emergence of disruptive startups, the future of electric mobility is here, paving the way for several innovations to take shape. Now is the right time for the entire ecosystem to jump on the EV bandwagon to propel its mass adoption. Progress in product innovation is going to be relatively more consequential than setting up charging/swapping infrastructure. While four-wheelers have some catching up to do in terms of the upfront costs and total cost of ownership, the mass adoption will be set in motion by the two-wheelers. There are infrastructural and demand challenges, however, the future of electric mobility in India is full of promise – a promise of a more connected, sustainable, and intelligent mobility landscape.

Also Read: