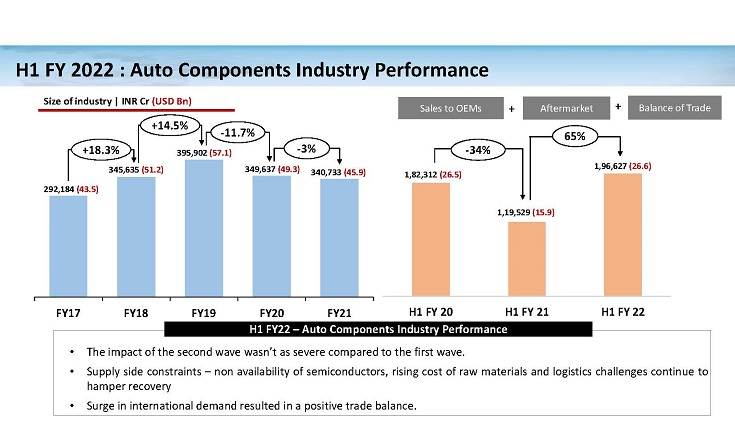

The Automotive Component Manufacturers Association of India (ACMA) today announced the findings of its performance review for the first jfalf of FY2022. Turnover stood at Rs.1.96 lakh crore ($26.6 billion) for the period April 2021 to September 2021, registering a growth of 65 percent over the year-ago period.

According to Vinnie Mehta, director general, ACMA, “Despite the slow offtake in vehicles sales due to supply side issues, especially in the first quarter, the auto component industry demonstrated a remarkable turn-around in the first-half of FY2022. With significant growth in all segments – supply to OEMs, exports as also the aftermarket, the component industry grew to Rs.1.96 lakh crore ($26.6 billion) registering 65 percent growth. Exports grew by 76 percent to Rs.68.7 lakh crore ($9.3 billion) while imports grew by 71 percent to Rs.64.3 lakh crore ($8.7 billion) leading to trade surplus of $600 million. The Aftermarket, estimated at Rs. 38,895 crore also witnessed a steady growth of 25 percent. Component sales to OEMs in the domestic market grew by 76 percent to Rs.1.53 lakh crore.”

Sunjay Kapur, president, ACMA said, “Despite resurgence of demand for vehicles, supply-side issues of availability of semiconductors, increasing input costs, rising logistics costs and availability of containers, among others, continue to hamper recovery in the automotive sector. The auto component industry, in this backdrop, displayed remarkable resilience. Increased value-addition to meet regulatory compliance, fast recovery in external markets and traction in the domestic aftermarket market have contributed to the growth of the sector in the first-half of FY2021-22.”

“Going forward, whilst the performance of the vehicle industry during the festive season has not been on expected lines, however there are indications that the vehicle demand, in the coming months, will improve. This, together with the increased focus by the auto industry on deep-localisation and the recent announcements by the of PLI schemes by the government on Advanced Chemistry Cell (ACC) Batteries and Auto & Auto Components will facilitate the creation of a state-of-the-art automotive value chain and developing India into an attractive alternative source of high-end auto components.”

In terms of outlook for the near and mid-term, Kapur mentioned that according to a recent survey of ACMA leadership, despite concerns of another wave of pandemic, “the industry is cautiously optimistic about the prospects of the Indian economy and the automotive sector for FY2022.” He said that auto component manufacturers have now, by and large, recovered and the “investment cycle has also commenced”.

Kapur mentioned that to be future-prepared, the auto component industry has to make the transition to EVs; 60 percent of the respondents stated that they were already equipped to be part of the EV supply chain, while the rest would be ready in the next two-odd years.

Key figures and statistics

Exports: Overseas shipments grew by 76 percent to Rs.68,746 crore ($9.3 billion) in H1 FY2022 from Rs 39,003 crore ($5.2 billion) compared to same period last year. Europe accounting for 31 percent of exports, saw an increase of 81 percent, while North America and Asia, accounting for 32 percent and 25 percent respectively also registered increase of 81 and 73 percent respectively.

Imports: Imports grew by 71 percent from Rs.37,710 crore ($5.0 billion) in H1 2020-21 to Rs 64,310 crore ($8.7 billion) in H1 2021-22. Asia accounted for 63 percent of imports followed by Europe and North America, with 29 percent and 7 percent respectively. Imports from all geographies witnessed steep increase reflecting growth in domestic manufacturing activities.

Aftermarket: The aftermarket in H1 FY2022 witnessed a growth of 25 percent to Rs 38,895 crore ($5.3 billion) from Rs 31,116 crore ($4.1 billion) YoY.

Infographics courtesy: ACMA

/news-national/resilient-component-industry-records-65-growth-in-h1-fy2022–80722 Resilient component industry bounces back in H1 FY2022 Despite challenging H1 FY2022, component industry cautiously optimistic for FY2022 https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/af356ddb-cc05-49c9-af59-e91b7f7adf32.jpg