More than half of the large GWh battery production plants under construction in the U.S. are led by Korean companies. This is contrary to the European situation in which Korean, Chinese, and Japanese companies are competing. As major battery plants in the U.S. are made with Korean technology, stable profitability is expected to be secured for at least 10 years.

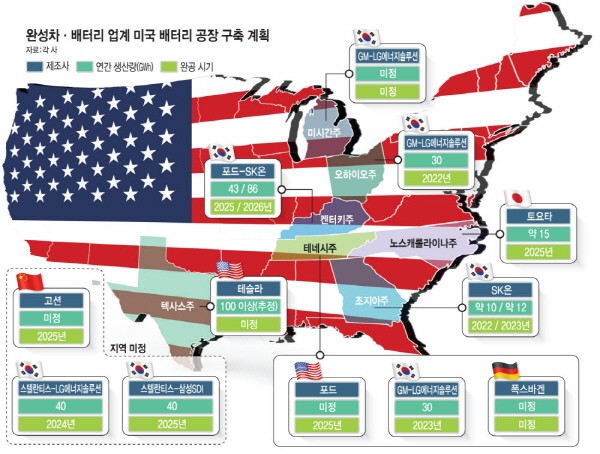

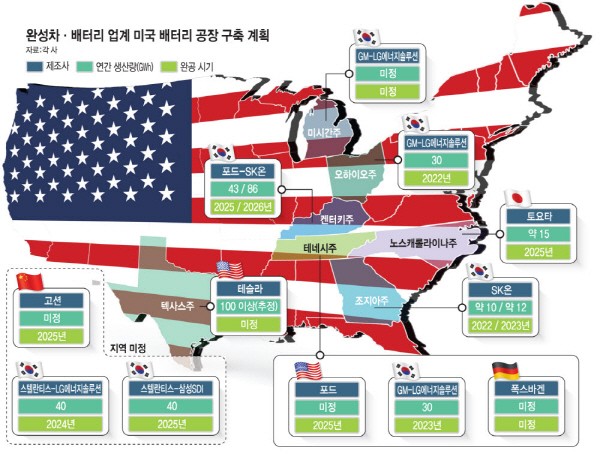

According to the industry on the 27th, 9 out of 14 GWh battery plants that global car manufacturers and battery companies are being built or planned in the U.S. are led by Korean battery companies.

These car manufacturers and battery companies will build battery factories with a capacity of 400GWh or more within the next five years from 2022 to 2026. This is an amount that can produce 5 million to 6 million electric vehicles per year. In other words, about 70% of electric vehicle battery production produced in the U.S. in five years will be made with domestic technology.

All three car manufacturers (GM, Ford, and Stellantis) representing the U.S. are establishing a close cooperation system with Korean battery companies. On top of that, Toyota and Volkswagen, the world’s No. 1 and No. 2 automobile market share, have confirmed plans to build battery plants in the U.S., raising the possibility of further cooperation with domestic batteries.

An official from the battery industry said, “A Korean company is drawing attention as a battery partner as the U.S. and China trade dispute and the U.S. administration Joe Biden is driving to expand the electric vehicle market.” “Europe is fiercely competitive with China and Japan, but the U.S. market will be a key market for Korean batteries for the time being,” they said.

The largest investment in battery plants in the U.S. was found to be “BlueOvalSK,” a Ford·SK ON joint venture. They plan to build a battery factory worth $5.8 billion (about KRW 6.9 trillion) in Glendale, Kentucky, and $5.6 billion (about KRW 6.6 trillion) in Stanton, Tennessee. GM is also building a joint battery plant for electric vehicles worth $2.3 billion in Tennessee with LG Energy Solution. Samsung SDI also plans to exchange MOUs for the establishment of a joint venture with Stellantis and build a 23GWh battery plant in the U.S. from the first half of 2025.

By Staff Reporter Tae-jun Park (gaius@etnews.com)