Hyundai Motor India recently announced a six-pack EV strategy and Rs 4,000 crore investment in dedicated EV and ICE-derived platforms. Tarun Garg, Director for Sales, Service and Marketing, speaks to Hormazd Sorabjee on the carmaker’s EV roadmap and localisation plans.

Do you think Hyundai is a bit of a late starter in EVs? You have the Kona Electric in India but a very small market share. Is that a disadvantage?

I beg to differ about being a late starter. In 2019, when EVs were only being talked about, we launched the Kona Electric, which was not only SUV body type and the flavour of the season but with a 450km range. We offered a free EV charger with every Kona, partnered our dealers for EV charging stations and were able to generate very good customer feedback. We are all excited about expanding our battery EV portfolio to six by 2028.

What is your target in terms of EV market share by 2028 and are you aiming to be the top player in India?

I would not really get into the No. 1 EV player angle but would like to mention a few important facts. The passenger EV market in India is probably less than 0.5 percent and one, therefore, has to see market share or leadership from that perspective. What is more important is how critical a role one plays going forward. I believe the six-EV announcement is a very significant one, coming from a player which is global as well as Indian.

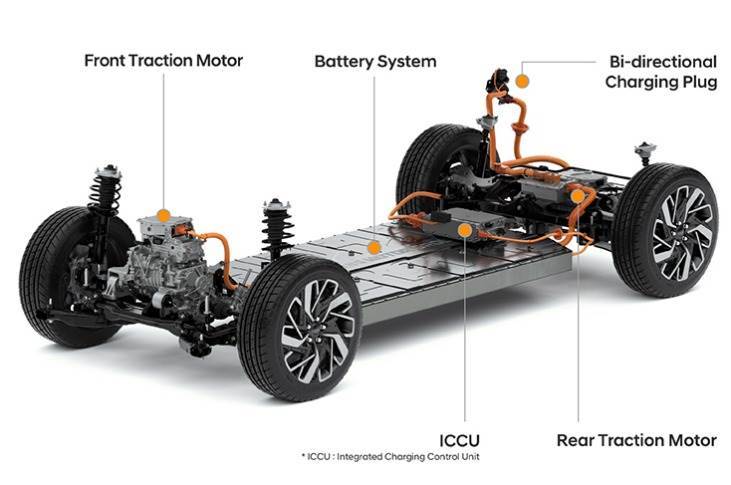

The other highlight is E-GMP (Electric Global Modular Platform), which is the Hyundai Motor Group’s unique and dedicated platform. It is very scalable in terms of the wheelbase and facilitates different body types, length and width. Also, with HVAC pushed inside the engine compartment, there is more interior room, a slim cockpit, flat floor as well as flexibility of seating configuration.

Hyundai;s Battery Electric Vehicle line-up for India by 2028 will comprise 6 models across segments and body styles including an SUV built on the E-GMP platform.

In terms of performance, there’s a top speed of 260kph and range of up to 800km. In terms of reliability, there is ultra-high-strength steel and a low centre of gravity. When the talk is about EVs, it is also about the Hyundai quality and that is where I believe this is significant.

We have also announced that some IC-derived EVs are going to come. Of the six, maybe three would be E-GMP-based models and probably three IC-derived BEVs. Even for a mass-market EV, we are going to have a range of 350km.

Sustainability, innovation and intelligent technology are key pillars in our ‘Beyond Mobility’ brand campaign and the six-EV announcement is in sync with that brand thought.

Can one assume that the mass-market EVs will be on IC platforms and the top end on E-GMP?

While I cannot divulge too much at this point in time, I think you are in the right direction because range, performance and power are attributes of the E-GMP, which is more of a premium platform. Also, the localisation levels, especially in the initial few years, are going to be low and managing costs will be a challenge.

Therefore, the derived platform also becomes very important because that is where we already have some localisation and volumes in terms of petrol, diesel and turbo-petrol. I think it will be both going forward, which will be a good advantage as a good mix and both will serve their own purpose.

Does that mean the Santro platform, which doesn’t support a turbo-petrol or diesel, could be ruled out? Have you identified the platform for the ICE-derived EV?

In terms of body type, we are going to look at SUVs, CUVs and sedans for BEVs. SUVs are a no-brainer because, the category has grown from 16 percent market share in 2016 to 37 percent in 2021. Also, customer preference is very clearly in favour of SUVs. That said, we are not discounting any other format and will see what the market feedback is.

The advantage of the E-GMP platform is that we can really adapt and be very flexible. But we have to be very practical and see what is it that the Indian customer is really looking for in an EV. Sometimes, we tend to assume just because it is an EV, the customer will not want space or features. I do not think that is a right assumption to make because a customer would not really want to compromise on some of these basic hygiene factors which he / she is now getting used to.

SUVs probably take care of a lot of things and probably this is where it appears the trends are. We are a very significant player in hatchbacks and sedans as well and that is why we are going to have a sedan as well when it comes to EVs.

You have forecast an India EV market of 175,000 units by 2028. Do you think this number could be revised upwards due to high fuel prices or conversely the reverse if some subsidies are taken away?

It is very hard to predict and this number which we have given is actually an IHS Markit seventh-months of 2021 survey and it will also be revising the numbers. So we do not know exactly what it’s going to be, but there has to be some base case which says the market would be 175,000 units in 2028.

As regards the volume target, that is also very difficult to answer. Of course, when it comes to mass-market EVs, we will be looking at volumes. But I think probably an internal benchmark would be that in any segment where we are present with BEVs, we should have a market share which should be higher than what we are having in the same segment in the ICE space.

Hyundai’s first new EV for India will be the Ioniq 5, expected by mid-2022 as a CBU.

How would you react to the fact that the strategy to go with ICE-derived platforms is right but the supply chain is not fully developed?

We are in talks with various global vendors, both for the battery and other components as well because localisation is the key to affordability and affordability is the key to volumes. It’s a chicken-and-egg situation but we know we have to play a role there. At the opportune moment, we will announce what our plans are in that area.

But yes, it is a big challenge because at present the cost of producing a BEV is obviously much higher than say a petrol or a diesel. That gap has to be really plugged and a lot of effort will need to be made on that count. The Centre is doing its bit with all kinds of schemes coming up and I am sure we will get clarity as we move forward as to how many players are joining and what kind of opportunities exist in terms of being part of the EV ecosystem.

What, in your opinion, is the one single trigger for mass adoption of EVs? By 2028, technology will take care of range and EV infrastructure should be in place. Is it then finally about price and running costs in India?

No doubt about that. Today we see that the early adopters, who are buying EVs, want to be seen as people who are contributing to the environment, to society, and are looking into the future. A green numberplate is a matter of great self-esteem and also shows the kind of person you want to be seen and perceived. At the same time, when it comes to mass adoption of EVs, first-time buyers are looking at total cost of ownership.

All these things are going to make a very important difference and that is where I believe that localisation and in turn affordability probably will be that trigger which is going to really drive the shift towards electric mobility.

At present, global EV penetration is five percent and less than 0.5 percent in India. We have a long way to go and over the next few years ICE and EVs are going to co-exist. But as things stand, I am sure the market will slowly but surely move towards EVs.

This interview has been first published in Autocar Professional’s December 15-2021 magazine edition

/interview/hyundai-motor-india’s-tarun-garg-‘affordability-will-be-the-trigger-for-shifting-to-evs’-80773 Hyundai Motor India’s Tarun Garg: ‘Affordability will be the trigger for shifting to EVs’ Tarun Garg, Director for Sales, Service and Marketing, Hyundai Motor India on the carmaker’s EV roadmap and localisation plans. https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/6bfc4321-ae87-417e-886a-800756e061e5.jpg