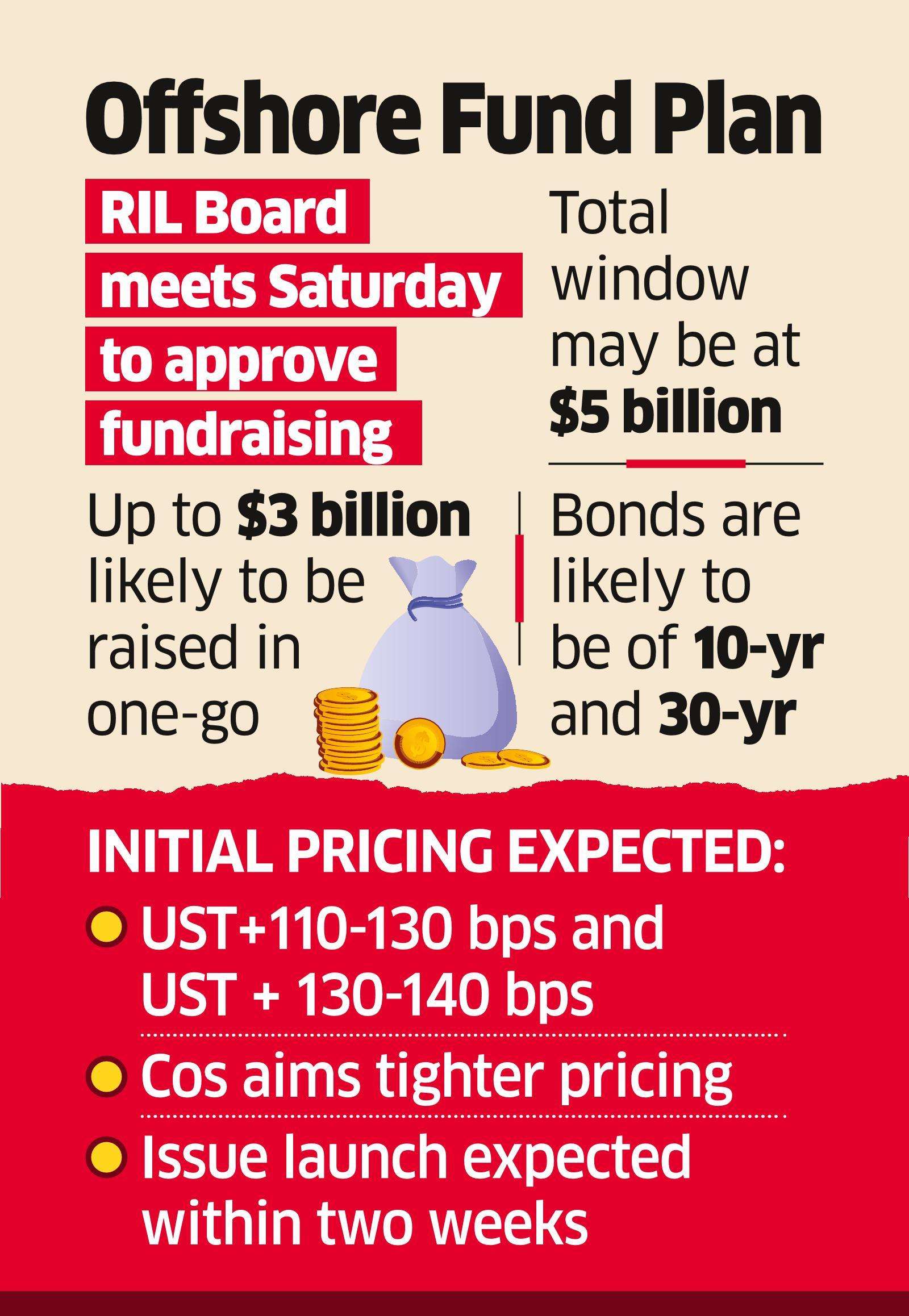

Mumbai: Reliance Industries plans to raise up to USD3 billion via overseas bond sales, which would be the largest offshore raising by an Indian borrower in one go, people familiar with the matter told ET. The bond sale is expected to be launched in the next two weeks.

The proceeds would be used to refinance existing loans and bonds raised from international investors earlier. While international bonds issued 8-10 years ago are maturing early this year, a bundle of loans are coming up for maturities in the next three-four months.

The move, which is debt neutral, will help the company either to save funding cost as much as by 50 basis points or elongate maturities.

Bonds are likely to be of 10-year and 30-year maturities. The company is seeking an enabling resolution from the board, which is meeting on Saturday.

“The focus would be on tight pricing as the company is on a sound footing. The final size depends on that,” said one of the persons cited above.

If the company obtains encouraging investor response, the total sum could be larger than $3 billion in one go, which in turn would be the largest deal from Asia, sources said.

“The company is closely holding discussions with investment bankers as they are structuring the deal and planning road-shows,” said a senior executive.

Although pricing is not yet fixed, back-of-the-envelope calculations suggest that the 10-year paper may initially be offered after adding about 110-130 basis points over the US Treasury benchmark.

Similarly, the company may propose the 30-year series at similar maturity US Treasury plus 130-140 basis points.

RIL did not reply to ET’s query immediately.

“This is to inform that a meeting of the Finance Committee of the Board of Directors of Reliance Industries Limited is proposed to be held on January 1, 2022, for considering an issuance of senior unsecured US$ denominated fixed rate notes,” the company said in a notification on stock exchange last Wednesday. It did not mention any further details on the quantum, pricing and timing.

Investors across the globe including from the US can invest in those bonds, which is known as 144A in market parlance. Bonds will be of investment grade.

“The company has a strong balance sheet post fund raising while its traditional business will continue to generate steady cash flows,” ICICI Securities said in a report about a month ago.

“Long term prospects and dominant standing of RIL in each of its product & service portfolio provide comfort for long-term value creation,” it said.

The oil-to-retail conglomerate has been increasing focus on non-conventional business expansions.

Reliance New Energy Solar just obtained a green signal from Competition Commission of India to acquire a 40 percent stake in Sterling and Wilson Solar.

Reliance New Energy Solar (RNESL), a wholly owned subsidiary of the company, has entered into an agreement with Faradion and its shareholders for acquiring 100% of the equity shares of Faradion through secondary transactions for a total value of GBP 94.42 million based on an enterprise value of GBP 100 million, the company said Friday.

The company reportedly plans to use about 3 gigawatt (GW) of solar energy to generate 400,000 tonnes of hydrogen at its proposed electrolyser Gigafactory.

Also Read: