New Delhi: Auto major Tata Motors on Saturday reported a growth of 24% to 66,307 units in its domestic sales in December 2021. The company had sold 53,430 units in December 2020.

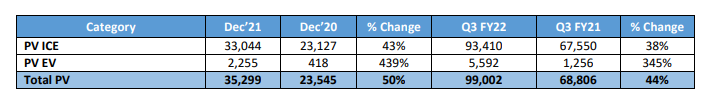

In the passenger vehicle segment, the automaker witnessed 50% growth to 35,299 units in December 2021, as against 23,545 units in December 2020.

Tata Motors sold 33,044 units of ICE cars and 2,255 units of electric cars in the month under review.

Shailesh Chandra, president, passenger vehicles business unit, Tata Motors Ltd, said, “Decade high quarterly and monthly sales- 99,002 units in Q3 FY22 and 35,299 units in December 2021 were recorded. The company also posted calendar year sales of 3,31,178 units (CY21), highest ever since the inception of the PV Business.”

Records were also created on the EV front as EV sales witnessed a new peak of 5,592 units in Q3 FY22. Consequently, EV penetration touched 5.6% of PV Sales during the quarter versus 1.8% in the same period last financial year. EV sales also touched 10,000 units in 9MFY22 and crossed 2,000 monthly sales landmark for the first time in December 2021 (2,255 units).

The ever-increasing demand for Nexon EV and Tigor EV as well as progressive revival of the EV fleet segment were instrumental in driving this steep growth. Going forward, semiconductor supplies will remain the key source of uncertainty. Additionally, the impact of the new strain of Covid needs to be closely tracked. We will continue to work on the business agility plan and take proactive actions to mitigate these risks, he said.

Tata Motors overtook Hyundai to become the second-largest seller of passenger vehicles in the domestic market for the first time in close to a decade in December 2021.

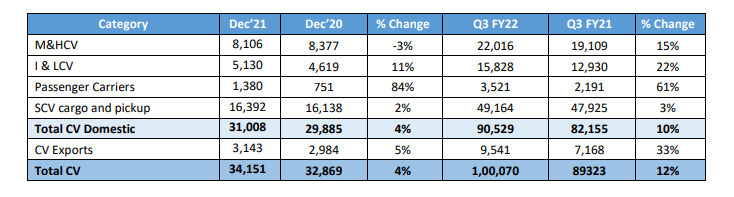

In the commercial vehicle segment, its domestic sales stood at 31,008 units in December 2021, marking a growth of 4% as against 29,885 units in December 2020.

Exports in the CV segment stood at 3,143 units as compared to 2,984 units in December last year, with a growth of 5%.

Girish Wagh, executive director, Tata Motors Ltd, said, “The retail was ahead of wholesale by 15% in December 2021, enabling inventory alignment. The SCV and ILCV segments continued to benefit from the growth in e-commerce and the increasing need for last-mile delivery. Construction and infrastructure spending by central and state Governments plus rising activity in sectors such as mining, petroleum-oil-lubricants and allied industries facilitated the demand for M&HCVs. International business also continued its recovery momentum and grew by ~10% over the previous quarter (Q2 FY22) and 33% over the same quarter last year (Q3 FY21).”

“Going forward, we expect the situation to remain fluid as the semiconductor shortage continues, instances of Covid begin to rise and underlying demand continues to remain under pressure. We are keeping a close watch on the evolving situation and sharpening our agile, multi-pronged approach to fulfill customer orders, he said.

Also Read: