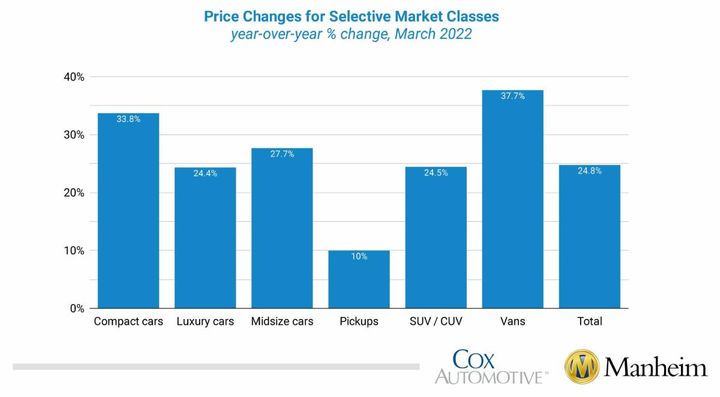

All major market segments saw seasonally adjusted prices that were higher year over year in March.

Source: Manheim Market Index

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 3.3% in March from February, according to the Manheim Used Vehicle Value Index, which declined to 223.5, up 24.8% from a year ago. The non-adjusted price change in March was an increase of 0.6% compared to February, leaving the unadjusted average price up 23.2% year over year.

Manheim Market Report (MMR) values saw weekly price increases that accelerated in each full week of March after the first week saw the smallest decline of the year. Over the last four weeks, the Three-Year-Old Index increased a net 1.2%. During March, daily MMR Retention, which is the average difference in price relative to current MMR, averaged 99.6%, which meant that market prices were slightly behind MMR values. The average daily sales conversion rate increased to 57.1% but was below normal for the time of year. For example, the sales conversion rate averaged 62.7% in March 2019. The lower conversion rate indicates that the month saw buyers with more bargaining power for this time of year, but the sales conversion rate increased as the month progressed.

Major market segments saw seasonally adjusted prices higher year over year in March: Vans had the largest year-over-year performance, followed by compact cars, while pickups and luxury cars lagged the overall market. On a month-over-month basis, all major segments saw seasonally adjusted price declines, with pickups declining the most. The seasonal adjustment drove most of the declines. Most major market segments saw price gains from February, with midsize and compact cars increasing the most, while vans declined.

Retail used sales down in March as tax refunds fail to reach critical mass: Leveraging a same store set of dealerships selected to represent the country from Dealertrack, Manheim estimates that used retail sales increased 37% in March from February but failed to show the typically even larger seasonal increase driven by tax refund season. The Dealertrack estimates indicate used retail sales were down 15% year over year. The issuance of tax refunds is several weeks behind the normal pace. Based on IRS statistics through March 22, Manheim estimates that 45% of this year’s likely number of tax refunds had been issued, when for the same week in 2019, 71% had been disbursed. The market will likely see a stronger April performance as most refunds expected will have been distributed as the month starts, and the average refund is at a new record and up 12% year over year.

Using estimates of used retail days’ supply based on vAuto data, March ended at 44 days, which was down from 53 days at the end of February but higher than how March ended in 2021 at 32 days. Leveraging Manheim sales and inventory data, it estimates that wholesale supply ended March at 23 days, which is higher than how March 2021 ended at 18 days but lower than how February ended at 29 days.

March total new-light-vehicle sales were down 22% year over year, with one less selling day compared to March 2021. By volume, March new-vehicle sales were up 19% over February. The March SAAR came in at 13.3 million, a 24% decline from last year’s 17.6 million, and down 5% from February’s 15 million pace.

Combined sales into large rental, commercial, and government buyers: These declined nearly 4% year over year in March. Sales into rental were down 19% year over year, while sales into commercial fleets were up 19% and sales into government fleets were down 2%. Including an estimate for fleet deliveries into the dealer and manufacturer channels, we estimate that the remaining retail sales were down 23% year over year in March, leading to an estimated retail SAAR of 11.3 million, which was down 27% from 15.4 million last March and down 7% from last month’s 12.2 million rate.

Rental risk mileage stable with last year: The average price for rental risk units sold at auction in March was up 30% year over year. Rental risk prices were down 1% compared to February. Average mileage for rental risk units in March (at 62,800 miles) was down 6% compared to a year ago but up 6% from February.

Measures of consumer sentiment mixed in March: Consumer Confidence according to the Conference Board increased 1.4% in March when a decline had been expected; but the February index was revised down, so the March index came close to expectations. The underlying measures of present situation and future expectations moved in opposite directions as present situation improved but future expectations declined. Plans to purchase a vehicle in the next six months declined and remained down year over year. The sentiment index from the University of Michigan declined 5.4% in March as both current conditions and expectations declined, with inflation accelerating. The Morning Consult daily index declined 1.4% in March, but it was down 6% at mid-month at the peak of gas prices and recovered much of the early March decline as gas prices stopped increasing and moderated slightly.

Originally posted on Vehicle Remarketing