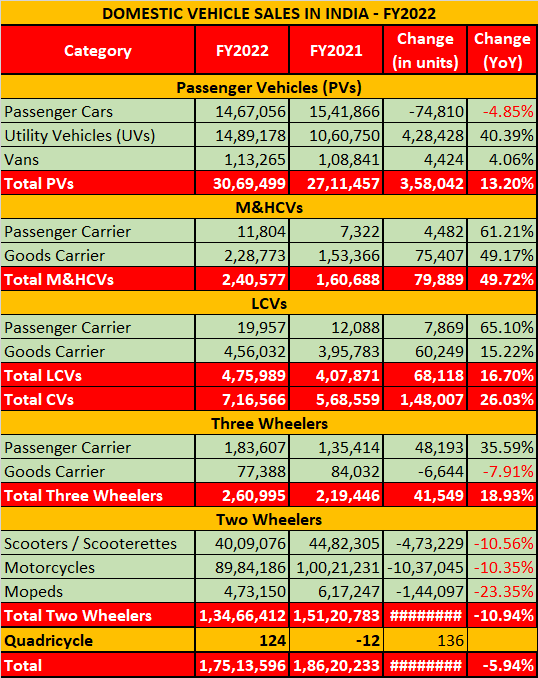

India’s overall domestic sales across all vehicle categories in FY2022 stood at 17,513,596 units, registering a 6 percent year-on-year decline compared to 18,620,233 units sold in FY2021, SIAM sais in its monthly update on vehicle wholesale numbers.

While the passenger vehicle (PV), commercial vehicle (CV) as well as three-wheeler segments have registered an uptick in performance, albeit, over a low year-ago base, two-wheelers continue to be the worst-hit segment, marred by high ownership costs and expensive fuel.

“The two-wheeler segment is facing serious affordability issues as prices have gone beyond the reach of the normal consumer,” said Kenichi Ayukawa, president, Society of Indian Automobile Manufacturers (SIAM).

Two-wheelers in red

Two-wheeler sales in FY2022 were pegged at 13,466,412 units, registering an 11 percent YoY decline (FY2021: 15,120,783). Of the total sales, scooters went home to 4,009,076 buyers (FY2021: 4,482,305 / -10.55%), while motorcycles clocked volumes of 8,984,186 units (10,021,231 / -10.34%). With schools, colleges and offices remaining closed for the better part of the last fiscal, demand for two wheelers was weak, with rising fuel prices further impacting their sales and also hitting rural demand despite a good monsoon. The impact of the deadly second wave of the pandemic led to major job and income losses. “While we expect some support from the government, the larger focus and priority should be to recover the overall economy,” Ayukawa added.

The PV segment, on the other hand, breached the three-million-unit mark to close FY2022 with cumulative volumes of 3,069,499 units (FY2021: 2,711,457 / +13.20%). However, while passenger car sales de-grew by 4.85 percent to clock 1,467,056 units (1,541,866), the utility vehicle category single-handedly powered out PVs towards FY2018 levels, when the segment had clocked 3,377,436 units.

Despite a notable growth, the segment witnessed several unforeseen challenges, including a second Covid wave in April-May 2021, followed by a continuing semiconductor shortage, high raw material prices, and now the ongoing Russia-Ukraine conflict which has impacted precious metal prices.

According to Ayukawa,“The supply of components still remains a challenge and might have an impact on production going forward. High raw material prices have been further aggravated by the Ukraine, and Covid cases are again on the rise in some parts of the world.”

Tata Motors emerged as the most promising PV manufacturer in FY2022, clocking 370,372 units and registering a substantial 67 percent YoY growth over 222,025 units sold in the domestic market in the previous fiscal.

Commercial vehicles recover

The CV sales volumes in FY2022 were pegged at 716,566 units (568,559 / +26%), with the growth coming over a relatively low base when sales were down in 2020 due to the outbreak of the Covid pandemic which led to most infrastructural activities coming to a grinding halt.

However, the uptick still indicates towards a recovery of the economy at large, with increased government spend on infrastructure activities both in rural and urban centres. Out of the total CV sales, M&HCV sales grew 49.71 percent to 240,577 units (FY2021: 160,688), while LCV sales also registered a 16.70 percent uptick to 475,989 units (407,871). Most LCV sales were of cargo carriers.

The three-wheeler segment too registered a 19 percent YoY growth to clock 260,995 units in FY2022 compared to 219,446 units sold in FY21. The passenger-carrying three wheelers registered an uptick of 35.58 percent to 183,607 units (135,414), while goods carriers clocked 77,388 units (84,032 / -7.90%).

“There has been no growth in the auto industry over the last five years, with all vehicle segments lagging behind the FY2018 levels. Customers at the lower end of the spectrum are particularly impacted. However, in the current situation of uncertainty and challenges, it is very difficult to predict the future. The industry can only work on factors within its control – ensuring safety of its people, and try to maximise production and sales, mitigate supply chain risks, and try to bring costs down,” Ayukawa signed off.

/news-national/overall-auto-sales-in-slow-lane-in-fy22-siam-81548 Overall auto sales in slow lane in FY22: SIAM Overall auto sales in slow lane in FY22: SIAM https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/00c40407-ed0b-4d1e-89d2-f0e904fc6815.jpg