Increased in mineral prices… Burden from increased manufacturing cost

Uncertainties from supply contract to delivery date

Batteries industry already received a green light from ‘finished vehicles i

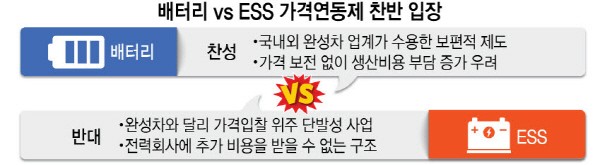

The battery and energy storage system (ESS) industries clashed over a price linkage system for raw material. This situation occurred due to a significant increase in battery manufacturing costs as mineral and raw materials costs also increased. While auto manufacturers have already accepted the price linkage, the ESS industry did not accept the new system.

Samsung SDI and LG Energy Solution recently requested the price linkage system from domestic ESS companies such as Hyundai Electric, Hyosung, LS Electric, and LG Electronics. They made a request on the basis that the auto industry has accepted the system.

However, the ESS industry expressed displeasure, saying that it is difficult to accept the price linked system because most of its bidding methods are single competitive bidding, unlike EVs that receive batteries for several years continuously.

The price linkage system is a system in which each buyer compensates for the burden of costs between ‘battery materials-battery cells-finished product’ companies when raw material prices rise. The buyers bear additional costs or get back the difference as the price of raw materials fluctuates.

Samsung SDI readjusted the cost of battery supply with the ESS industry two months before the delivery date after making the battery contract. LG Energy Solution did likewise for the price of three before the delivery date. The price of minerals and raw materials rises irregularly, and results in a loss with the original contract price.

The price of non-ferrous metals that are main raw materials for lithium battery cathode, such as lithium, cobalt, and nickel, has increased significantly.

Nickel prices increased by 70%, and lithium and cobalt increased by 6 and 2 folds, respectively, compared to last year.

The ESS industry stood its ground and said that it could not accept the price linkage system as price competitiveness determines the bid to purchase batteries. Unlike finished vehicles such as EVs, ESS is mostly centered around one-off projects, and is structured in a way that it cannot readjust additional costs from the price linkage system since the its price is fixed at the time of the ESS contract with customers such as electric power companies.

An official from ESS company said on the 18th, “If a contract was made for KRW 100, and the price goes up to KRW 200, the battery industry demands to be paid more for increased cost.

The finished car industry can deal with the burden by raising the price of a vehicle, but the ESS business is a one-off, and customers are not regular; hence it is not possible to pass off the burden to be compensated.”

It came to a point where SMEs in the ESS sector could not even receive batteries at all as the ESS industry boycotted the battery price linkage system. It is highly unlikely that SMEs, with their capital, will be able to bear the additional increase from the price linkage system; therefore, the battery industry is not continuing the business in the first place. There are also concerns that the ESS ecosystem may collapse if the battery and ESS industries do not find a compromise.

Meanwhile, Tesla has raised vehicle prices three to four times this year due to a subsequent rise in raw material prices. The cost of flagship models, ‘Model 3’ and ‘Model Y’, have increased by KRW 4 to 5 million compared to last year.

By Staff Reporter Taejun Park (gaius@etnews.com)