Rising interest rates, supply chain constraints and Russia’s invasion of Ukraine are all issues currently plaguing the macro climate. The problem with all three, says Tony Dwyer, Canaccord Chief Market Strategist, is that for each problem there’s “no easy exit strategy.”

The tough conditions are likely to persist, then. However, on the plus side, while these issues have sent most corners of the stock market into a tailspin, now investors are presented with stocks for which the term “oversold” readily applies.

“Our playbook remains the same – our tactical indicators are oversold/ pessimistic enough to suggest a summer rally that should make up losses from here,” Dwyer commented.

Against this backdrop, some Street analysts have pointed out three “oversold” stocks that are due to let off some steam and push higher. We’ve used the TipRanks database to see why they are poised for a rebound. Let’s take a closer look.

Aptiv (APTV)

We’ll start off with Aptiv, an automotive technology firm with a global footprint. Aptiv provides products, systems, and software to the automotive industry – namely to vehicle manufacturers which use the company’s offerings to make cars safer, improve efficiency and increase interconnectivity. The tech firm used to be known as Delphi before it spun off its powertrain segments and rebranded to Aptiv. This is a big operation, with 155,000 employees and 14 technical centers, in addition to customer support centers and manufacturing sites spread across 45 countries.

The auto industry’s struggles during recent times have been well-documented with supply chain bottlenecks and chip shortages impacting production. Despite these issues, Aptiv managed to dial in a solid 1Q22 report.

The company beat the forecasts on both the top-and bottom-line. Revenue increased by 4% year-over-year to reach $4.18 billion, beating the $4.06 billion consensus estimate. Non-GAAP EPS of $0.63 also came in above the analysts’ forecast of $0.61.

The 2022 outlook was also positive; Aptiv anticipates revenue in the $17.75 billion to $18.15 billion range. Consensus had $17.79 billion.

However, the stock has been unable to withstand the bearish trends and is now down by 43% year-to-date. It is the combination of its standing in the sector, and the shares’ depressed level that is enticing to Raymond James’ 5-star analyst Brian Gesuale.

“APTV’s leading position in electrification and active safety, award momentum and proactive cost controls provide the foundation for our 2022 outlook and sets up 2023 to be a very interesting year as headwinds abate. We continue to believe APTV is one of the best positioned companies to benefit from an auto production rebound given its strong portfolio geared to electrification, connected, and autonomous adoption themes… In our opinion [APTV] appears to be reaching oversold territory amidst shorter-term concerns impacting auto production and mixed reviews on the Wind River acquisition,” Gesuale opined.

Based on all of the above factors, Gesuale rates Aptiv shares a Buy and sets a $158 price target. The analyst, apparently, believes the stock could surge 66% over the next twelve months. (To watch Gesuale’s track record, click here)

Most on the Street agree. Brushing aside 1 Sell and 2 Hold ratings, with 15 Buys, the analyst consensus rates the stock a Strong Buy. The forecast calls for 12-month gains of ~58%, considering the average price target clocks in at $149.94. (See Aptiv stock forecast on TipRanks)

Avid Technology (AVID)

We’ll stay in tech mode for our next name but move to a company that operates in an entirely different field. Avid is a major player in the media and entertainment industry for which it provides a wide spectrum of tools and workflow solutions – including both hardware and software. These high-end offerings are used in the making of everything from award-winning feature films and blockbusters to TV shows to some of the most successful music on the planet, the products being a staple of editing suites and music studios. Avid’s portfolio of products includes Pro Tools, Media Composer, Sibelius, Avid VENUE, Avid NEXIS, MediaCentral and FastServe.

AVID stock was faring rather well in 2022’s rough stock market but took a severe beating after delivering Q1 earnings in early May.

Revenue increased by 6.7% from the same period last year to reach $100.6 million. However, that managed to come in near the low end of guidance for $100 million-$106 million. It also fell short of the Street’s forecast of $103 million. The company cited a lack of key components for its audio solutions as to why revenue came in softer than expectations. Adj. earnings of $0.33 per share also missed, coming in just shy of the $0.34 consensus estimate.

Supply chain problems are also expected to impact near-term results. For Q2, Avid guided for revenue between $92 million-$104 million, lower at the midpoint than the consensus estimate of $99.61 million. The company called for adj. EPS in the $0.19-$0.32 range; the Street had $0.28 – higher than the mid-point of the guidance.

With the shares still down ~19% since the earnings report, Maxim analyst Jack Vander Aarde views the stock’s performance as “significantly oversold and unjustified.” But that is not the only reason why Vander Aarde finds Avid’s value proposition appealing.

“Avid has converted less than ~10% of its existing enterprise customers to a subscription model (launched in 4Q20), so there is clearly a significant opportunity to drive subscription growth from converting existing enterprise customers alone, as well as additional growth opportunity from winning new enterprise customers,” the 5-star analyst opined.

Vander Aarde rates AVID a Buy while his $42 price target makes room for one-year returns of ~61%. (To watch Vander Aarde’s track record, click here)

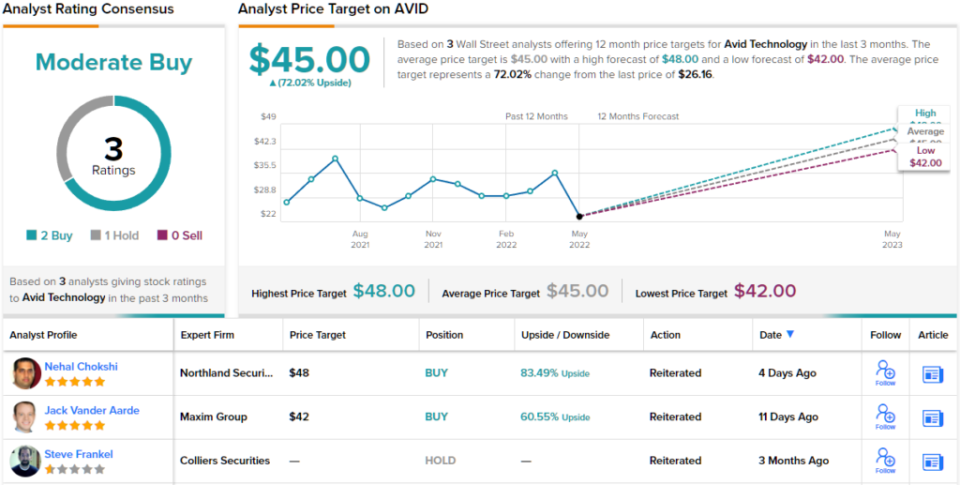

Overall, this stock holds a Moderate Buy rating in the Street’s consensus view, based on 3 recent reviews that include 2 Buys and 1 Hold. At $45, its average price target suggests ~72% one-year upside from the share price of $26.16. (See Avid stock forecast on TipRanks)

Coinbase Global (COIN)

For the last “oversold” stock we’ll switch gears again and enter the newfangled realm of the crypto sphere. Coinbase is a leading cryptocurrency exchange enabling its users – both institutional and retail – to buy, hold and sell cryptocurrencies such as Bitcoin, Ethereum, Litecoin and many others. The company is at the forefront of the crypto economy and has grown considerably since forming in 2012, when crypto was still very much the wild west. Coinbase now boasts around 98 million verified users and 13,000 institutions using its services in more than 100 countries.

The company entered the public markets to much fanfare last May in what has proven to be unfortunate timing; both growth stocks and crypto coins have suffered over the past year. And Coinbase’s latest quarterly statement did not help matters either.

In 1Q22, net revenue fell by 35.6% year-over to reach $1.17 billion, coming in below the Street’s forecast of $1.48 billion. Coinbase also saw a sharp drop in users and trading volume while dialing in a big miss on the bottom-line. EPS landed at -$1.98, far off the $0.91 the Street had in mind. Although the company largely stuck to its full-year 2022 outlook, to-date, Q2 trading volume has continued to trend south.

As for the stock, with all these developments at play, it is now trading 81% below last November’s highs. However, believing the “long-term adoption thesis” remains intact, and considering the shares in “oversold territory,” Oppenheimer’s Owen Lau lays out the bullish case.

“Despite macro challenges including inflation and supply chain constraints likely putting pressure on COIN near term, fundamentally: 1) crypto adoptions continue; 2) COIN has strong balance sheet and is able to weather the storm; and 3) COIN continues to diversify, which makes COIN an attractive long-term investment,” the analyst said. “This challenging environment is a real test to many platforms, with strong balance sheet and brand COIN is likely to be one of the consolidators… the stock appears to be oversold and could come out stronger on the other side.”

Lau rates COIN shares a Buy, backed by a $197 price target. The implication for investors? Upside of a hefty 192%. (To watch Lau’s track record, click here)

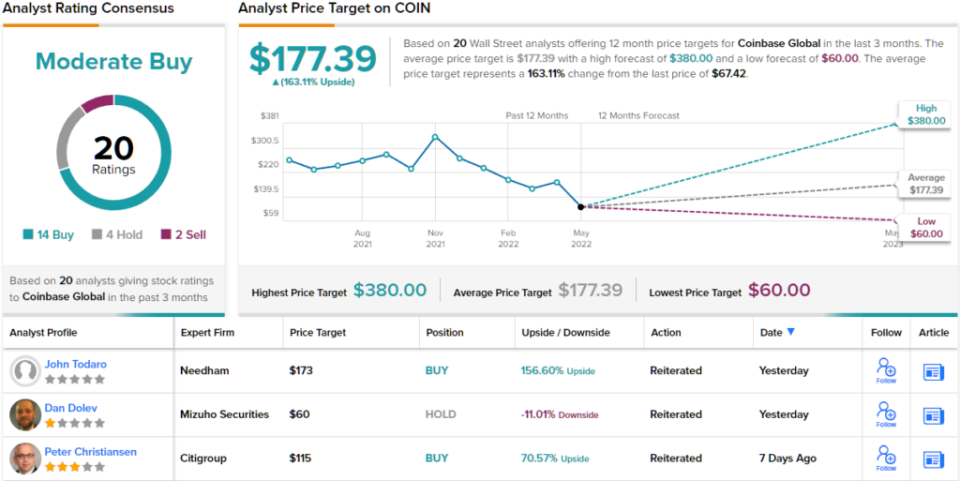

It’s not as if Lau’s objective is an anomaly on Wall Street; based on 14 Buys, 4 Holds and 2 Sells, the analyst consensus rates COIN a Moderate Buy. Shares are priced at $67.42, and the average price target, at $177.39, suggests it has a 163% upside potential. (See Coinbase stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.