NEW DELHI: Marriage season across the country is likely to bring cheer for auto companies, especially those who make two-wheelers (2Ws) for the second consecutive month in May, said analysts tracking the industry.

They also see commercial vehicle (CV) makers reporting strong sales. Passenger vehicle makers are also likely to deliver sequential growth in sales. Tractor volumes are likely to be lower on a high base in April as there were higher sales due to anticipated price hikes.

“Our channel checks indicate a sequential improvement across most segments: 1) 2W growth is supported by strong marriage season demand in the North and East regions; 2) Passenger vehicle (PV) volumes are better on a marginal improvement in production/dispatches and 3) CV volumes remain in an uptrend on improved haulage demand,” said Raghunandhan NL of Emkay Global.

“In comparison, tractor volumes are lower sequentially due to a high base, and there is some hit on farmer sentiments due to the reduction in wheat crop realizations on account of government restrictions on exports,” he added.

Analysts said the year-on-year comparison of the volumes is not meaningful due to the low-base effect owing to the second Covid wave-induced lockdowns last year.

Some analysts pointed out that in the PV category, the overall semiconductor situation is improving on a sequential basis, but due to higher demand, vehicle makers are unable to meet the required production.

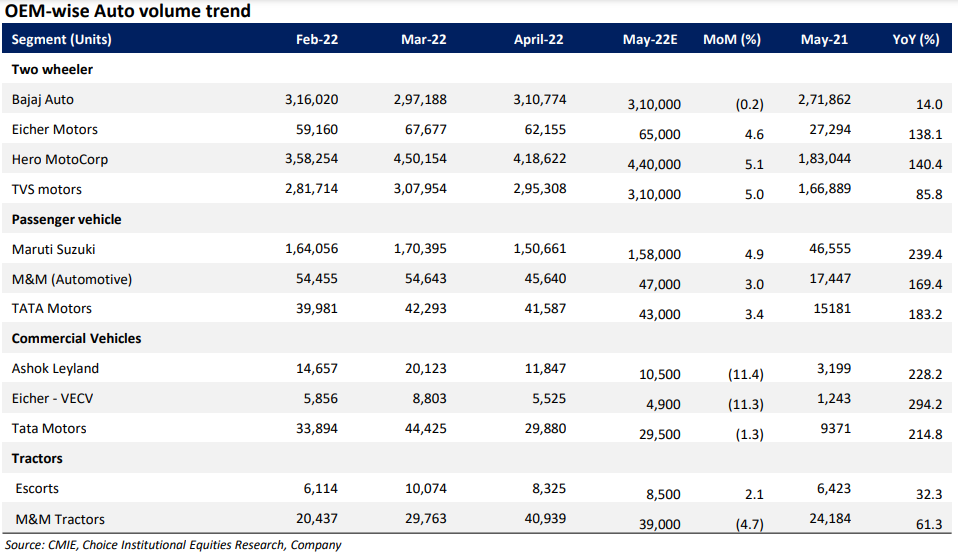

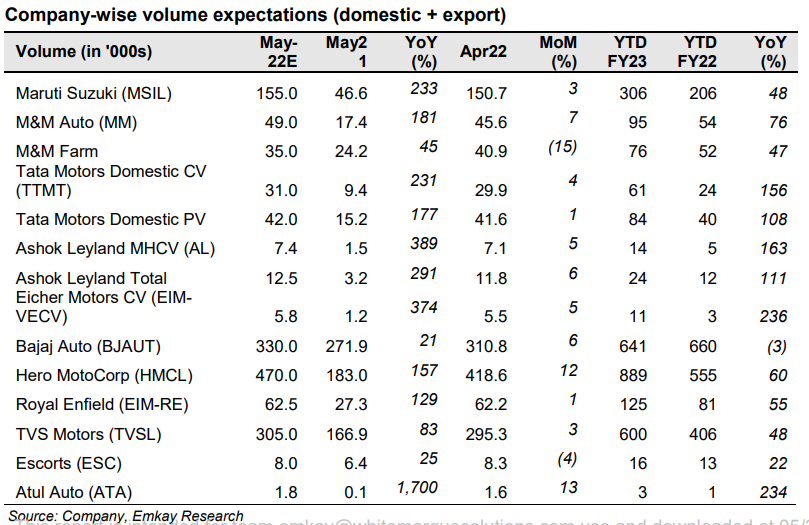

Two-wheelers: Nomura sees a 10 per cent growth in sales, while it expects volumes to improve MoM due to marriage-related demand and higher demand from customers in the salaried segment. Choice Broking sees low single-digit growth on a sequential basis.

Passenger vehicles: Preference for personal mobility and replacement demand creating healthy bookings for PVs, especially in the UV segment where we are witnessing upgrade related purchases, said Choice Broking. Nomura sees 6 per cent growth in sales. Analysts said waiting for a few models such as Nexon (5-6 months), Ertiga (6-7 months), and XUV7OO (12+ months) remains high. CNG vehicles continue to be in high demand due to better alternative fuel options and new launches, the waiting period of CNG based vehicles like Ertiga is 6-7 months and Tigor 2-3 months.

Commercial Vehicles: Emkay said CVs should remain in an uptrend on better demand for both passenger and cargo vehicles. It expects domestic CV volumes to grow by 4 per cent MoM for Tata Motors, 4 per cent for Ashok Leyland, 3 per cent for Eicher Motors and 3 per cent for M&M. Choice Broking noted that demand for HCV (Tipper, Dumper and trailer) remained high due improved utilisation and profitability of fleet operators, and government spending on infrastructure.

Tractors: Volumes are likely to decline MoM, Emkay said, expecting volumes to decline by 15 per cent for M&M and 5 per cent for Escorts.

(Disclaimer: Recommendations, suggestions, views, and opinions given by the experts are their own. These do not represent the views of Economic Times)