India’s economy is off to a strong start in the new financial year with several high-frequency indicators holding firm despite multiple headwinds, bouncing back from the tepid fourth quarter of FY22.

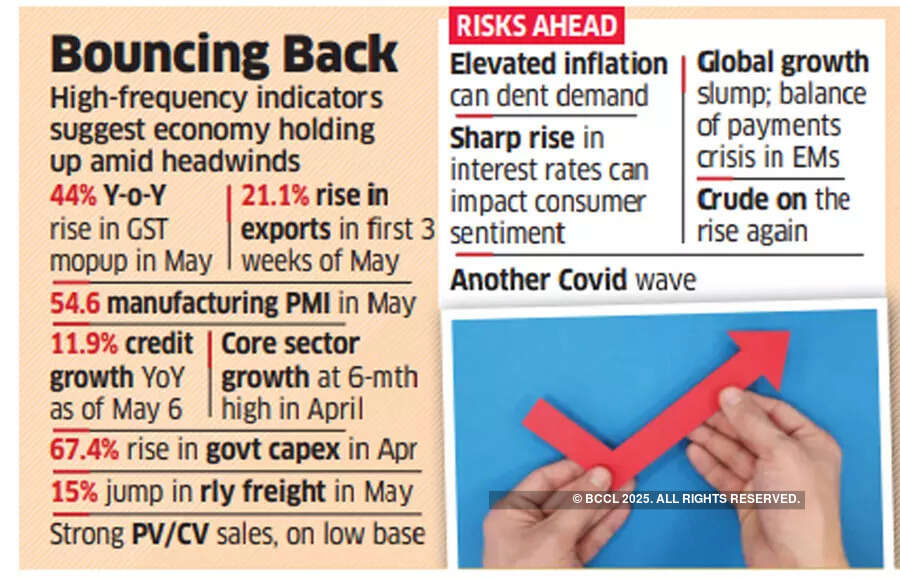

Data released June 1 showed goods and services tax (GST) collections topped ₹1.4 lakh crore for the third month running in May, while the manufacturing purchasing managers’ index (PMI) remained firmly in the growth zone at 54.6 in that month.

Automakers reported robust passenger car and commercial vehicle sales for May despite parts shortages and supply issues. Railway freight loading rose 15% in the same month to 131.7 million tonnes against 114.9 million tonnes in the year earlier. The country’s merchandise exports rose 21.1% year-on-year to $23.7 billion in the first three weeks of May.

Core sector growth hit a six-month high of 8.4% in April, data released on Tuesday showed, while credit growth was up 11.9% year-on-year as of May 6.

“The high-frequency indicators for April and May show that there is a pickup in activity,” said Sakshi Gupta, principal economist at HDFC Bank.

India’s economy grew 4.1% in the March quarter, pulled down by the Omicron wave of the pandemic and high commodity and crude prices.

Geopolitical Challenges

Economists expect double-digit growth in the June quarter, propelled by the low base of last year. FY23 growth is seen at a healthy 7-8% compared with 8.7% in FY22, helped by the low base of 6.6% contraction in FY21.

“As of today, the indicators show growth of the economy and no scope for a downgrade, but inflation can come in the way of spending at a later stage,” said Madan Sabnavis, chief economist at Bank of Baroda.

The economy could, however, hit a rough patch given the various threats it faces.

Inflation is elevated and monetary tightening is underway to control the price rise. Crude prices are advancing again with Brent at $118 a barrel and commodity prices remain elevated.

Global growth is slowing in response to monetary tightening and many countries are facing a capital exodus or balance of payments crisis.

Easing of Covid restrictions in China should ease supply issues going ahead.

“We are cautiously optimistic based on the available high-frequency indicators. However, there is a niggling concern, as we may not have the complete picture on the consumer side because there is no timely indicator for consumer non-durables,” said ICRA chief economist Aditi Nayar.

The rating agency expects India’s GDP to grow 12-13% in the June quarter of FY23 and 7.2% in the full fiscal.

“We mark down our estimate for India’s FY23 GDP growth to 7% from 7.3%, with downside risk, earlier,” QuantEco Research said, citing external risks in the form of geopolitical uncertainty and the accompanying terms of trade shock that have worsened in the past month.

According to HDFC Bank’s Gupta, rising cost pressures can curb bullishness.