NEW DELHI:India‘s current account deficit is likely to surge to a three-year high of 1.8% or USD 43.81 billion in financial year 2022, as against a surplus of 0.9% or USD 23.91 billion in FY21, said India Ratings in a report.

If the value of goods and services a country imports exceeds the value of those it exports, the country is said to be in a deficit, and the difference in the two values is CAD.

The remarkable improvement in merchandise exports, which grew a whopping 42.4% in FY22 as against a negative 7.5% in the pandemic-hit FY121 is likely to face headwinds by the clouds of uncertainty and volatility in the global economy. CAD in fiscal FY23 will be impacted due to headwinds clouding merchandise exports while higher commodity prices and weakening of the rupee will accelerate imports, noted India Ratings. Geopolitical tensions, Covid shocks in China, and inflationary pressure is likely to disrupt the supply chain further.

India Ratings expects the country’s CAD to have moderated to USD 17.3 billion (1.96% of GDP) in the fourth quarter of FY22, as against a deficit of USD 23.02 billion (2.74% of GDP) in 3QFY22 and USD 8.2 billion (1.03% of GDP) in Q4FY21 which was at a 13-quarter high.

Meanwhile, in another report, brokerage Morgan Stanley noted that India’s current account deficit (CAD) could widen to a 10-year high of 3.3% during the current financial year due to continued geopolitical tensions and surging oil prices. Morgan Stanley also pointed out that India’s forex reserves have fallen to USD 597.7 billion as of April 2022, the lowest since May 2021.

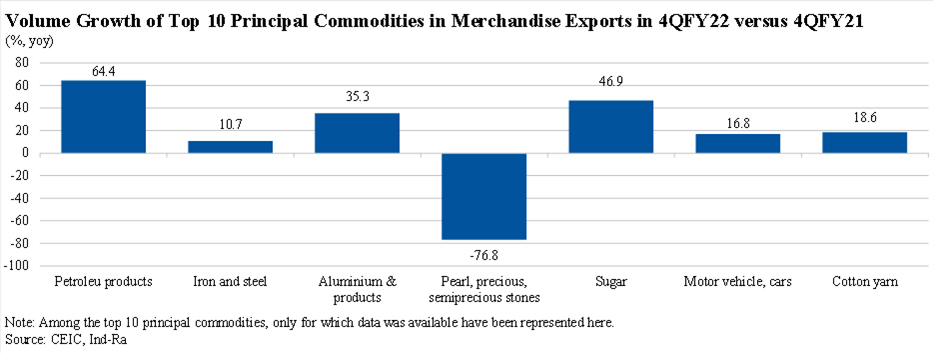

Key commodities such as petroleum products, iron & steel, aluminium & its products, pearl, precious and semi-precious stones, sugar, motor vehicles and cotton yarn contributed roughly 72.2% to the merchandise exports growth and grew in the range of 14%-158% year on year in value terms in the fourth quarter of fiscal year 2022.

Major part of the merchandise exports growth was primarily driven by prices as has been the trend in the previous few quarters.

But exports in FY23 could face significant headwinds because of the spike in commodity prices, especially crude oil after Russia invaded Ukraine, the India Rating report warned, and pointed to the lower forecast of global growth by the World Trade Organisation (WTO) which sees the global economy clipping at just about 3% in 2022, down from 4.7% forecast earlier.

The World Trade Organisation has pegged imports volume growth for India’s key exporting partners such as the US (North America) and Europe at 3.9% and 3.7%, respectively, in 2022, lower than 4.5% and 6.8%, respectively, forecasted earlier. On the other hand, India’s merchandise imports are expected to accelerate on the back of escalated commodity prices and higher rupee depreciation in FY23.

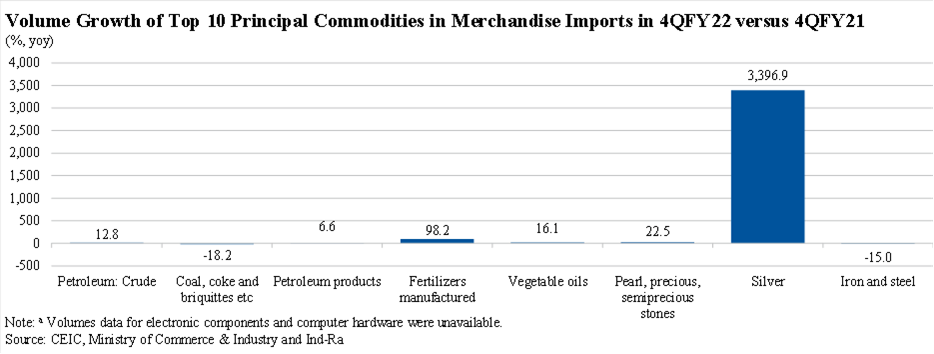

Barring coal, coke & briquettes, and iron & steel, all the other top 10 principal import commodities witnessed a positive growth of 6%-3,400%, however, value growth ranged between 24% and 4,300%.

Gold imports declined 54% yoy after a period of seven quarters as the demand for gold had fallen by the same level in 4QFY22 due to the onset of the third wave of COVID-19 during a period when there is generally a seasonal rush for gold.

What has been the price increase?

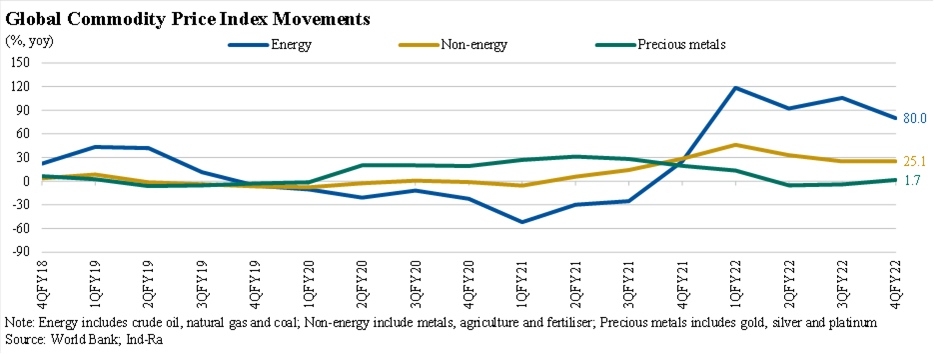

The price of energy, non-energy and precious metals increased 80% yoy, 25.1% yoy and 1.7% yoy, respectively, in 4QFY22.

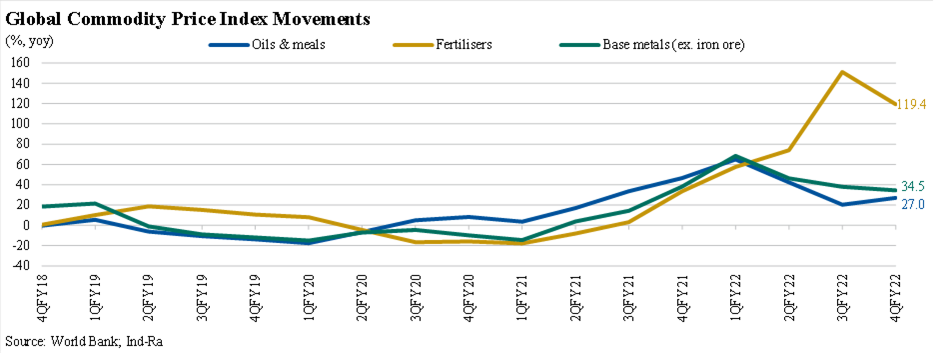

Within non-energy, the price of items such as fertilisers rose a whopping 119.4 percent, while base metals went up by 34.5 percent and oils & meals rose 27% year in year.

“Since global prices are mostly a passthrough, any surge in the global price of key items gets passed on to the domestic economy in the form of higher input costs.

Imports of petroleum crude, coal, coke & briquettes, petroleum products, fertilisers and vegetable oils grew 76.2% yoy, 104.6% yoy, 56.1% yoy, 452.6% yoy and 59.9% yoy, respectively, in value terms, pushing the wholesale inflation to 13.9% yoy in 4QFY22,” said Paras Jasrai, analyst at India Ratings.

According to the assessment by India Ratings, the Current Account Deficit has moderated to USD 17.3 billion or 1.96% of GDP in the fourth quarter of FY22 as against USD 8.2 billion or 1.03% in the year-ago period, and massively down from USD 23.02 billion or 2.74% in Q3, which was a 13-quarter high.

The agency expects merchandise exports to come in at USD 112.5 billion, growing by 17.7% in the first quarter of FY23, up 85.7% over the same quarter last fiscal.

Merchandise imports grew 44.1% during April-May 2022 to USD 120.9 billion and are expected to stand at USD 182.9 billion.

The rupee is expected to average at 77.1 against a US dollar in Q1, down 4.5% over Q1 FY22.

Notwithstanding the high base effect of Q4 of FY21, up 20.4%, merchandise exports in Q4 of FY22 grew 29.2% to a record USD 116.8 billion.

The import volumes of India’s top exporting partners such as the US and Europe increased 9.7% yoy and 8.3% yoy, respectively, in 4QFY22, explaining the high merchandise exports of India in the same period.

As a result, the overall levels scaled to a fresh high of USD 421.8 billion in FY22, over achieving FY22 merchandise exports target of USD 400 billion.

The overall annual merchandise exports grew 42.4% in FY2, clocking a double-digit growth after a span of four years. So far, the beginning of FY23 has been encouraging as merchandise exports in April-May 2022 grew 22.9% on year. However, there have been strong headwinds – expected stagflation in developed world and continued supply chain disruptions that could taper off the high double-digit growth witnessed since March 2021.