New Delhi: The ongoing meltdown in global stocks, particularly in high-flying tech stocks, has managed to bring the valuations of Tesla closer to Indian midcap EV stock Sona BLW Precision Forgings, also known as Sona Comstar.

With US stocks entering a bear market because of soaring inflation and higher interest rates that threaten to trigger a recession, shares of Elon Musk-led Tesla has been one of the bigger victims. Tesla shares are down 46 per cent from its all-time high in November.

Sona, on the other hand, is down about 35 per cent from its all-time high of Rs 839.15. The auto component major derives around 40 per cent of its revenues from battery electric vehicles (BEV) and hybrid vehicles.

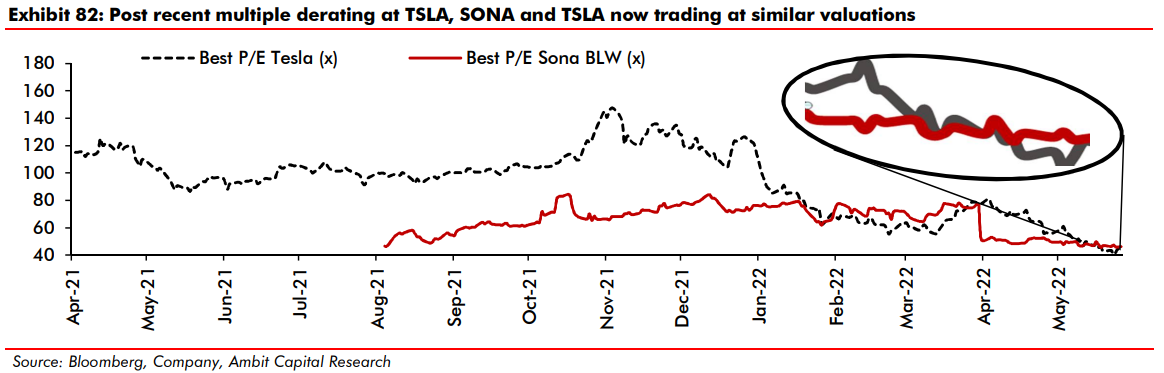

Calculations done by Ambit Capital shows that after the recent multiple derating at Tesla, both Sona and Tesla are now trading at similar valuations.

“Historically, Tesla has traded at valuations 1.5-2x that of SONA. However, in recent times, likely led by concerns on inflation and subsequent monetary tightening, Tesla’s stock has seen significant multiple derating,” Ambit’s analyst Karan Kokane said.

The brokerage, which began coverage on the stock with a sell rating, said Sona may be gold among Indian peers but it is not like Tesla in the EV ecosystem.

Pointing out that India accounts for just about 26 per cent of revenue for Sona and thus concerns on inflation in Europe and North America would also apply to Sona as well, it questioned whether Sona and Tesla should trade at similar valuations, especially given Tesla’s superior innovation capabilities, R&D spends, brand equity and overall standing in the EV world.

The brokerage has valued the midcap EV stock at Rs 543, signalling a downside potential of 17 per cent from Monday’s closing price.

“Our implied multiple of 42x FY24E earnings compares with domestic auto ancillary basket valuation of ~17x FY24E earnings and global EV peers’ ~25x CY23 consensus earnings. Auto ancillary players poised to ride the EV wave, both domestic and global, trade at premium valuations vs peer,” Ambit said.

It expects Sona to clock 34/38 per cent revenue/EBITDA CAGR in FY22-25E along with healthy mean post-tax RoCE at 20 per cent. “However, scaling up post that hinges on continued new order wins which is likely to be challenging amidst elevated competitive intensity in fast growing global EV components market and trend towards insourcing by auto OEMs globally. Amidst these challenges, present lofty valuations of ~53x are likely to moderate,” it said.

The average target price of Rs 623 on the stock, however, signals an upside potential of 14 per cent.

The auto ancillary stock was listed on stock exchanges on June 24 last year at Rs 302.4, a 4 per cent premium over its issue price of Rs 291.

Domestic brokerage ICICI Securities sees the stock at Rs 726. It said it likes Sona for its ability to identify products that would add to RoCE and growth and for its sustained efforts to extend the portfolio to large EV makers and grow with them in addition to focusing on capturing domestic e-2W opportunity.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)