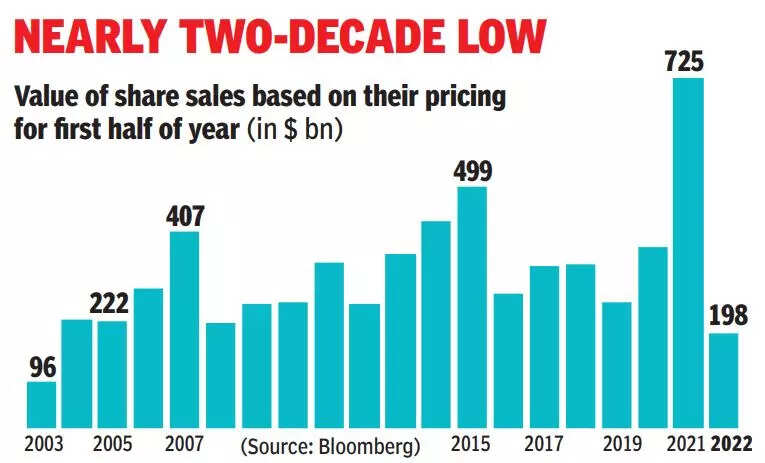

The market for share sales hasn’t been this bad in nearly two decades, with few willing to take a chance in a grim investment climate. Just $198 billion worth of initial public offerings (IPOs) and follow-on sales have been priced so far this year, a 70% drop from a year ago. That puts them on track for the lowest first-half haul since 2005, data compiled by Bloomberg show.

Right now, who can blame sellers for holding back? The alternative is the challenge of trying to find willing buyers in astock market down 20% this year as surging inflation, aggressive central bank interest rate hikes and the risk of a global recession erode sentiment.

And any lingering hopes for apickup in IPO action keep getting ground down. The Federal Reserve jacked up rates by the most since 1994 on Wednesday, and even after a bounce on Friday, the S&P 500 suffered yet another weekly loss. “Until relatively recently, there was a well-balanced expectation for high-quality IPOs to come to market in September,” said James Palmer, Bank of America’s head of EMEA equity capital markets. “But given market events over the last two weeks, that’s re-weighted the degree of hope. ”

Among those that have recently thrown in the towel are Coca-Cola, which delayed the planned IPO of a part of its stake in an African bottler, and Asian insurer FWD Group Holdings, said to have postponed a $1-billion listing in Hong Kong.

Those that have forged ahead had to temper expectations. LIC, once slated to number among the largest fund-raisings of the year, slashed the size of its IPO by about 60%. The drop in volumes has been particularly pronounced in the US, where just $47 billion of equity offerings have been priced — an 85% fall from a year ago. Cross-border listings from China, once a steady source of business for New York’s investment bankers, have also stalled amid higher regulatory scrutiny in the aftermath of Didi Global’s debacle.

A few markets have bucked the trend, most notably the Middle East. IPOs there are heading for a record first half as high oil prices and equity inflows shield the region. Energy giant Saudi Aramco is lining up a number of offerings for the second half, seeking to take advantage of elevated commodity prices.

Elsewhere, there’s no dearth of candidates waiting for the right moment. They include chip designer Arm, whose owner Softbank Group aims to list the company by next March, Thai Beverage’s brewery business, which is making its third attempt at going public, and Volkswagen’s planned share sale of Porsche. Market conditions are also creating incentives for a second-half rebound in other transactions, such as convertible bond sales and spinoffs.