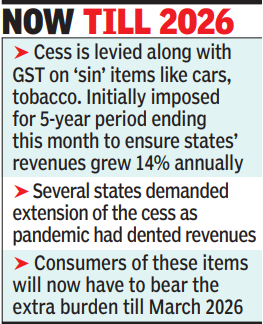

NEW DELHI: The central government has extended the validity of compensation cess levied along with the GST on luxury and “sin” goods such as cars and tobacco by nearly four years to raise funds for the additional borrowings undertaken during Covid-19 pandemic to compensate states for their “revenue loss”.

The cess is due to end on June 30 as part of the five-year formula devised by the Centre and the states to ensure that the latter’s revenue grew 14% annually. But due to the pandemic, the burden has now been passed on to consumers up to March 2026.

Extension of compensation cess comes ahead of GST council meet

The notification extending the levy of GST compensation cess for four more years comes just days ahead of next week’s crucial meeting of the GST Council amid demands from several states to extend the compensation period.

States have argued that the requirements for higher spending and lower revenue during the Covid-19 have battered their finances and compensation is required to help them overcome the stress.

“The extension of the levy of compensation cess, although expected, will continue to impose a burden on the impacted businesses, especially sectors like automotive, which need to be encouraged as it is one of the sectors that has a multiplier effect on GDP and employment,” said M S Mani, partner at consulting firm Deloitte India.

A recent study by economists at RBI had identified 10 states that are facing extreme financial stress with Punjab, Rajasthan, Kerala, Bengal and Bihar seen to be the most vulnerable.

The Centre has maintained that pandemic has resulted in an extension of the cess by another four years and providing further compensation is not feasible at the moment. “To implement the decision of the GST Council, these rules have been issued to extend the levy of the compensation cess till March 2026 to cover the shortfall for the earlier period. The issue whether states would be compensated beyond five years may get decided in upcoming GST Council meeting,” said Abhishek Jain, partner for indirect tax, KPMG in India.