LIGHT COMMERCIAL VEHICLES

In May, registrations of light commercial vehicles registered a sharp drop again, with a reduction of 32.4% and a total of 10,446 units. In the accumulated of the year, a total of 56,857 units is added, which represents a decrease of 35.4%. Regarding the channels, they all suffered significant setbacks, with the renter being the one with the greatest drop, with 46.8% in the sixth month.

INDUSTRIAL AND BUSES

The registrations of industrial vehicles, buses, coaches and minibuses managed to increase their sales in June with a growth of 23.6% and 2,104 units sold. For the total of the year, 12,547 units are accumulated, 8% more. On the industrial side, most segments grew, highlighting heavy industrial vehicles over 16 tons, with an increase of 30.8%. As soon as the buses achieve a growth of 5.3% in the last month.

DECLARATIONS

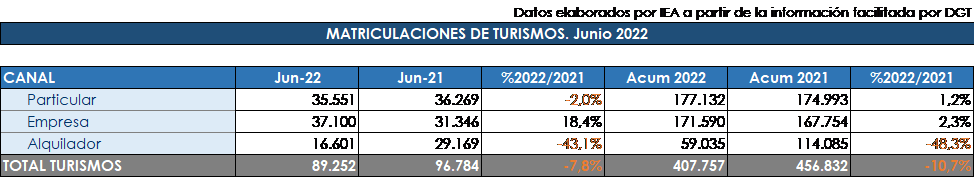

Aránzazu Mur, director of ANFAC’s economy and logistics area, explained that “the market is still unable to stabilize. Sales to individuals, which in the previous month had achieved a rebound, fell back slightly due to economic uncertainty and the microchip crisis that conditions production, both in Spain and in Europe, and delays the arrival of vehicles to the points of sale. Similarly, the rise in fuel prices and the increase in inflation are factors that are marking demand and that will surely affect the rate of recovery in sales in the coming months. In this context, the positive aspect is provided by industrial vehicles and buses, which consolidate positive figures in the year. Taking into account this context and the accumulated trend in the first half, the forecasts indicate closing around 800,000 passenger cars sold this year. A figure below the previous year and very far from the natural rhythm of the national market, over 1.3 million annual registrations”.

Raúl Morales, communication director of FACONAUTO, indicated that “vehicle sales in the first half show a stabilization because we began to repeat figures similar to those of 2021 thanks to the fact that the orders that were made in the last quarter of last year and in the first of this are turning into enrollments. This, which may seem positive, is not good news because it means that we are still a long way from the 2019 figures and that an insufficient market is becoming chronic to foster a real recovery in the sector. The data for the first half of the year are also not a good foundation to face the second half of the year, in an economic context of great uncertainty plagued by situations that have a direct impact on family economies, consumer confidence and, of course, on the automobile, as they are the escalation of the CPI or the price of fuels”.

According to GANVAM’s communication director, Tania Puche, she highlighted “the decline in purchases by individuals after last month’s growth. This fall occurs at a time when the purchasing power of families is affected by the runaway rise in inflation -at its highest level in 37 years- and the rise in the Euribor after the change in direction of monetary policy to cushion the economic impact of the pandemic and the war in Ukraine. In addition, although there has been a slight improvement in the supply of materials, there are not enough vehicles to meet the demand of rental companies, which continues to weigh on the market. Given this context, forecasts suggest that the year will close for the third year in a row below 900,000 units”.