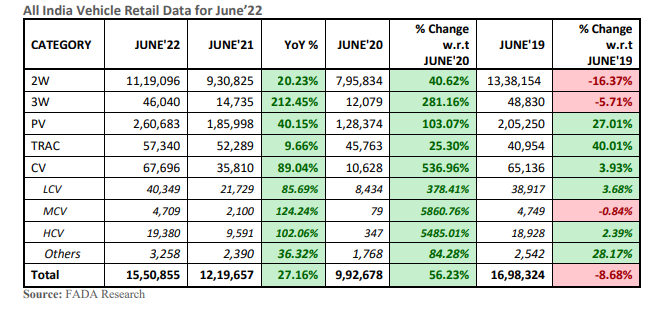

New Delhi: Passenger vehicle registrations saw year-on-year growth of 40% to 2,60,683 units in June 2022, owing to ease in semiconductor availability, says the data shared by Federation of Automobile Dealers Associations (FADA) on Tuesday. The segment registered sales of 1,85,998 units in June 2021.

Retail sales of two wheelers also increased year-on-year by 20% to 11,19,096 units in June 2022, as against 9,30,825 units in June last year.

According to the dealers’ lobby body report, total vehicle registrations at regional transport offices (RTOs), which are proxy for sales, stood at 15,50,855 in June this year, up from 12,19,657 units in June last year, thereby marking a growth of 27%.

On a year-on-year comparison, all the segments were in green.

Vinkesh Gulati, President, FADA said, “Auto Retail for the month of June’22 continued to show its positive run when compared YoY with June’21, a month which continued to face the brunt of covid. When compared to June’19, a pre-covid month, overall sales were down by -9%.”

“Apart from PV and Tractors which were already above pre-covid level for the last few months and grew by 27% and 40%, CV for the first time showed a growth of 4% thus indicating recovery slowly creeping in for this segment. While 3W narrowed its de-growth and was at down by -6%, it’s the 2W segment which still remains the biggest cause of concern and is not picking as per expectation. The same was down by -16%,” he said.

“Poor market sentiment especially in rural India, high cost of ownership, inflationary pressure and June generally being a lean month due to rains kept 2W sales at low speed. In the 3W category, a major shift has happened in the electric category. Apart from this, permit issues and frequent price increase remained the biggest dampeners,” Gulati added.

According to the FADA President, the PV segment continued to see robust growth. An increase in wholesale sales clearly shows that semiconductor availability is now getting easier. Waiting periods, especially in the compact SUV and SUV segment, continued to remain high. New vehicle launches are seeing robust booking thus reflecting a healthy demand pipeline. The CV segment showed strength for the first time as it grew by 4% when compared to June’19, a precovid month. Bus segment along with LCVs are showing good traction.

The highest year-on-year growth was observed for the three wheelers segment which marked an uptick to 46,040 units in June 2022, as compared to 14,735 units in June 2021.

The dealers’ body informed that by the end of June this year, the average inventory for Passenger Vehicles ranged from 15- 20 days and for Two Wheelers it was from 20- 23 days.

Overall Q1’22 (April- June 2022) grew by 64% when compared to Q1’21 (April-June 2021) which saw intermittent lockdowns, but went down by -8% when compared to Q1’19. Only PV and Tractor were in green for the entire quarter.

About the near term outlook, FADA said that the Russia – Ukraine crisis has increased inflationary pressure world over the RBI Governor during the recent Monetary Policy meeting has also flagged high inflation as a major cause of concern. In the past few months, prices of almost all essential items have moved northwards, thereby putting pressure on the common man’s household budget and thus reducing his disposable income. Additionally, the high fuel prices have had a spillover effect on transportation and made it expensive. This will have a negative effect on entry level PV as well as the 2W segment which are generally dominated by first time buyers. On the other hand, ease in availability of semiconductors will see increased supply especially in the PV segment and thus reduce waiting periods.

“If Rural India stabilizes, Auto retail will enter the festive season on a good note,” FADA said.

Also Read: