Closing summary

Time for a quick recap.

The economic outlook has “deteriorated materially”, the Bank of England has warned, as pressures including the Russian invasion of Ukraine hit households and families.

In its latest Financial Stability Report, the BoE said:

The Russian invasion of Ukraine could cause more disruption to global energy and food markets. There are also risks from abroad that could indirectly affect the UK.

Risks for borrowers with higher levels of debt will be greater if prices increase faster than expected, growth is weaker than expected or it becomes harder to borrow. In the past we have highlighted that lending to businesses with higher debt burdens, including in the US, could be a particular risk to the UK financial system.

The BoE was confident, though, that UK banks have capacity to weather global uncertainty; they must set aside more capital to weather the economic storm.

In the cost of living squeeze …

The boss of Sainsbury’s warned that the pressure on households will “only intensify” through the rest of this year, as the supermarket pledged to invest £500m in attempting to keep prices low.

Pet food brands Whiskas, Dreamies and Pedigree are caught up in a row over price rises between supplier Mars and supermarket chain Tesco.

Supplies of some of the brands are running low in stores and online in the supermarket chain’s second falling-out with a major supplier in a fortnight.

Single mothers warned that soaring bills have hit their finances – and explained why one-off payments aren’t enough, in our latest special report on the crisis.

The children’s commissioner for England has called on the government to develop urgent plans to tackle child poverty, amid the cost of living crisis that is hitting the most vulnerable in society hardest.

The European gas crisis has intensified after one of Norway’s biggest operators was forced to shut three oil and gas fields after workers went on strike.

UK gas prices reached three-month highs on Tuesday as the energy company Equinor said that the fields on Norway’s continental shelf, which produce the equivalent of 89,000 barrels of oil a day, would suspend production.

Norway’s Gassco, the state-owned pipeline operator, told the Financial Times on Tuesday that “in a worst-case scenario, deliveries to the UK could stop totally”.

Rising worries about a European recession hit stock markets, as the euro slumped to a two-decade low.

The pound has fallen to its lowest since the start of the pandemic, shedding almost two cents to as low as $1.192.

Shares tumbled in London and across Europe as the jump in natural gas prices intensified the strain on the European economy.

Oil also tumbled as recession fears mounted, with Brent crude diving 6% to below $107 per barrel, the lowest since mid-May.

Mining stocks, oil producers and airlines are among the big fallers in London, where the FTSE 100 share index had lost 182 points or 2.5% in afternoon trading. Anglo American and Glencore shed 7%, while BP and Shell fell 6%.

Germany’s DAX index, and France’s CAC, are both down around 2.4%.

British Airways is to cancel more than 1,000 additional flights this summer from Heathrow and Gatwick as staff shortages continue to affect its operations.

Floating windfarms could be built off the coasts of Cornwall and Pembrokeshire after the Queen’s property manager identified a clutch of sites in the Celtic Sea that could host them.

Sales of new cars in the UK fell by almost a quarter last month, the worst June since 1996, as global chip shortages hammered the industry.

Royal Mail managers across the UK are poised to take industrial action in the next two weeks in a dispute over jobs and pay.

Unite, the union that represents the workers, said 2,400 managers would work to rule between 15 and 19 July, followed by strike action between 20 and 22 July over Royal Mail’s plan to cut 700 jobs and slash pay by up to £7,000.

The logistics firm DHL is to expand in the UK in response to the growth in home deliveries, setting up new depots and enlarging others, which will create more than 4,000 jobs.

We’ll be back tomorrow….GW

Pound falls to lowest since March 2020 against US dollar

The pound has now hit a two-year low against the US dollar, dropping to just $1.192.

Recession concerns, risk-off sentiment and today’s gloomy outlook from the Bank of England are taking their toll on sterling, explains Victoria Scholar, head of investment at Interactive Investor.

Cable was under pressure during the month of June with many analysts becoming increasingly bearish on the pound as we enter the second half of the year.

Headwinds from a UK economic slowdown, rising interest rates and rampant inflation are expected to take their toll on the British currency as the descending trendline looks set to extend itself.

The pound-dollar exchange rate is now below psychological support at $1.20 which has now become the major near-term resistance level to watch with weakness exacerbated by strong demand for the greenback.

$GBPUSD under pressure today breaking below psychological support at $1.20 pic.twitter.com/76cEctubcM

— Victoria Scholar (@VictoriaS_ii) July 5, 2022

Norway strikes threaten to cut off gas supplies to UK within days

Norway has warned that gas exports to the UK could be shut off this weekend if the offshore workers’ strike escalates.

Norway’s Gassco, the state-owned pipeline operator, told the Financial Times on Tuesday that “in a worst-case scenario, deliveries to the UK could stop totally”, with striking workers planning to extend the shutdowns this Saturday to a key distribution hub that supplies the UK.

More here: Norway strikes threaten to cut off gas supplies to UK within days

As reported earlier, Equinor, Norway’s state-backed energy company, had already shut down three oil and gas fields.

The strikes began on Monday evening over pay claims to compensate for rising inflation, pushing gas prices to their highest level since early in the Ukaine war.

Some encouraging news in the gloom – new orders for US-manufactured goods increased more than expected in May.

US factory orders rose 1.6% in May, after advancing 0.7% in April, the Commerce Department reports.

US factory orders didn’t get the recession memo, at least not yet. Orders for manufactured goods rose more than expected in May… pic.twitter.com/6pHEWqpLse

— James Picerno (@jpicerno) July 5, 2022

Recession fears have pummelled the oil price too, with Brent crude sinking by 6% to below $107 per barrel.

As Stephen Innes of SPI Asset Management put it:

Oil is still struggling to break out from its current recessionary malaise as the market pivots away from inflation to economic despair.

Stocks have fallen heavily in New York too, where trading has resumed after Monday’s Independence Day holiday.

The S&P 500 index has dropped 2% so far, having already shed more than 20% since the start of January in its worst start to a year since 1970.

Stocks opened sharply in the red after a long holiday weekend over fears a deeper economic downturn continue to persist

The Dow Jones fell over 500 points at opening bell or about 1.6%. Tech-heavy Nasdaq dipped 200 points or 1.7% while S&P 500 dropped by more than 1.9% pic.twitter.com/iEvIiU9w70

— Mona Salama (@MonaSalama_) July 5, 2022

Britain’s Foreign Office says it was now advising against all but essential travel to Sri Lanka due to the impact of the country’s economic crisis.

It says:

“Sri Lanka is experiencing a severe economic crisis which has led to shortages of basic necessities including medicines, cooking gas, fuel and food.”

Sri Lanka’s energy minister warned on Monday that fuel supplies will run out in a few days, forcing nationwide school closures and prolonged power cuts, as the worst economic crisis in its history continues.

Inflation in Sri Lanka has soared over 50%, while depleted foreign exchange reserves have made it harder to pay for imports.

Sri Lanka defaulted in May, as shortages of food, fuel and medicines and rolling power blackouts led to nationwide protests and a plunging currency.

The pound has also sunk against the US dollar, to a three-week low, on concerns that the economic outlook is darkening.

Sterling has dopped by almost 1.5 cents to $1.1963, toward’s June’s two-year low, as fears of a recession drove investors into the safety of the dollar.

Raffi Boyadjian of XM says today’s spike in natural gas prices has dented optimism:

Recession worries took a bit of a backseat at the start of July as the selloff paused for breath, but the panic crept back in on Tuesday as a fresh surge in natural gas prices upset the uneasy calm.

Shares in Europe reversed earlier gains, mirroring US futures, which also floundered after a positive start and are now pointing to modest losses when traders return from the Independence Day holiday.

Germany is sticking to its plan to prioritize private households in the case of a gas emergency, Economy Minister Robert Habeck said today (Reuters reports).

Habeck presented a revised law giving the government powers to bail out utilities struggling from rising gas prices.

Habeck said the gas market situation was tense and he could not say yet whether more stabilization measures would be needed but added that the government wants to prevent a domino effect in the gas market.

⚠️ GERMAN ECONOMY MINISTER: STICKING TO PLAN THAT PRIVATE HOUSEHOLDS WILL BE PRIORITIZED IN CASE OF GAS EMERGENCY

– Reuters via @PiQSuite – https://t.co/6vj5FWMV9H

— PiQ (@PriapusIQ) July 5, 2022

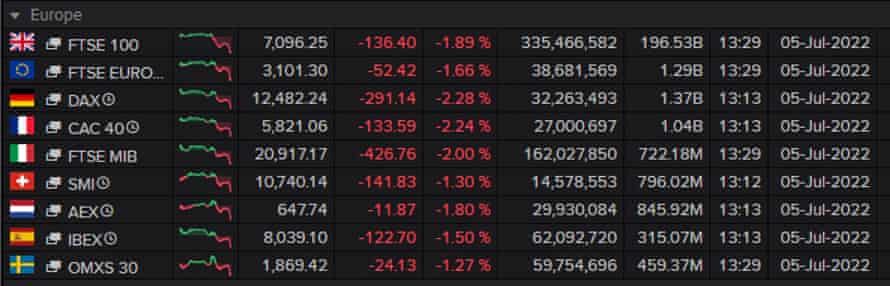

European stock markets have sunk deeper into the red, as fears of an economic downturn grip investors again.

Britain’s FTSE 100 has now sunk by 1.9%, or 137 points, to 7096 points, the lowest in ove a week.

Engineering firm Rolls-Royce are the top faller, down 6%, followed by advertising giant WPP (-6.2%) copper producer Antofagasta (-6.1%), mining giant Anglo American (-6%) and betting group Entain (-5.5%).

France’s CAC and Germany’s DAX are both down over 2%, as the surge in gas prices and slowdown in business growth reported today fan economic worries.

The surge in gas prices helped to drive the euro sank to a two-decade low versus the dollar today.

The euro is now down almost 1.5 cents at $1.0286, on growing worries that energy shortages will drive Europe into recession.

Jordan Rochester, a currencies analyst at Nomura, explains:

“Everyone is gearing up for Nord Stream to be turned off and Russia has already signaled they will use that as a weapon. So this is really hitting the competitiveness of German manufacturing.”