Asian plastic makers have been eagerly anticipating a post-lockdown pick-up in Chinese consumption, but weak consumer demand and high inventories mean it could be a long time coming.

Petrochemicals has been the hardest hit segment of the oil market this year. Covid-19 restrictions in manufacturing giant China decimated demand over April and May, while the invasion of Ukraine upended fuel flows and raised costs for naphtha, a major feedstock.

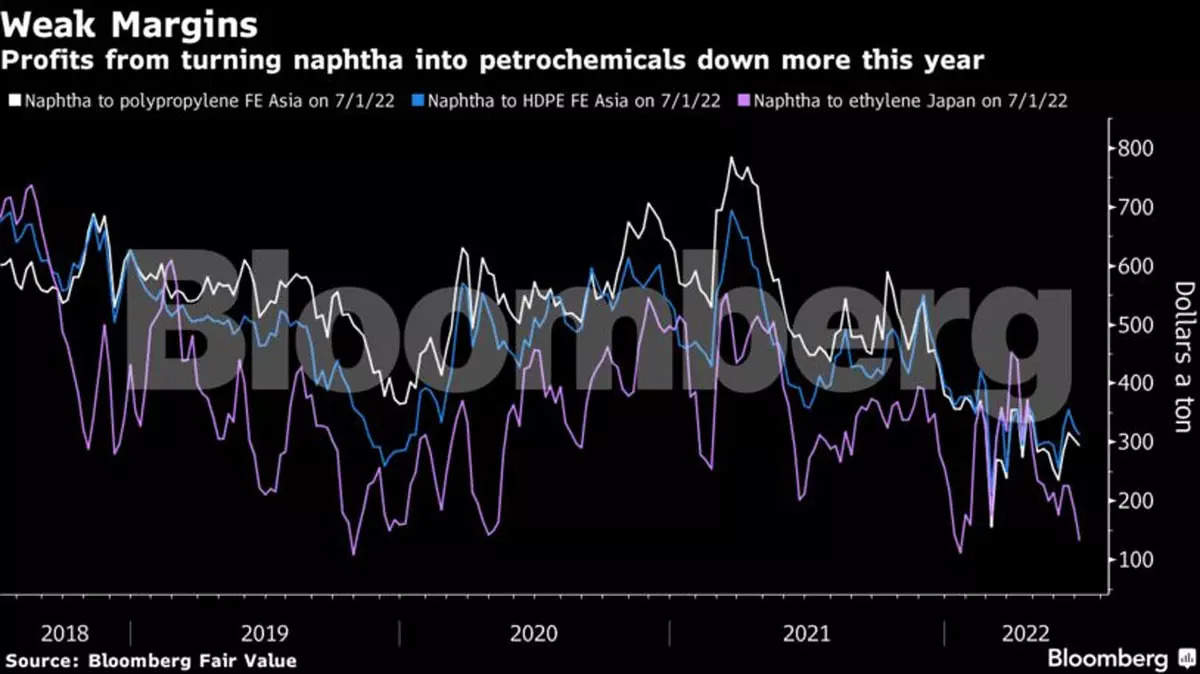

Producers of the building blocks used to make everything from car interiors to packaging and cables have seen margins fall further this year. Profits from turning naphtha into ethylene, a petrochemical that’s the base for many plastic products, have dropped to $133 a ton from above $450 in early April. China accounts for about 40% of global petrochemicals demand, according to S&P Global Commodity Insights, so the fortunes of big producers like LG Chem Ltd. and Formosa Petrochemical Corp. are closely tied to what’s happening there. While lockdowns have eased, there are signs that Chinese consumer confidence will take longer to recover amid price gains and a very gradual economic rebound.

China accounts for about 40% of global petrochemicals demand, according to S&P Global Commodity Insights, so the fortunes of big producers like LG Chem Ltd. and Formosa Petrochemical Corp. are closely tied to what’s happening there. While lockdowns have eased, there are signs that Chinese consumer confidence will take longer to recover amid price gains and a very gradual economic rebound.

“Durable plastics for domestic white goods and for automotive applications have yet to see a strong demand recovery,” said Larry Tan, vice president for chemical consulting in Asia at S&P Global. Inflationary pressures in China are “causing consumers to be more cautious on spending on bigger-ticket items,” although domestic sentiment is slowly improving, he said.

Higher shipping costs and disruptions to supply chains are also complicating the global plastics trade, making it tougher for Asian producers to offset sluggish local demand by exporting to Europe.

Chinese petrochemical plants have increased operating rates over the last few weeks, but they’re still only running at 85% of capacity, compared with 100% normally, according to Kelly Cui, a consultant at Wood Mackenzie Ltd. Stockpiles are also high, she said.

There are some optimistic signs for plastics producers, however. Benchmark North Asian naphtha prices have fallen by around 30% since spiking in early March after the Russian invasion of Ukraine, although are still high on a historical basis. Some of their products — such as xylene, toluene, benzene and MTBE — that can be blended with gasoline are also seeing strong demand.

And Chinese household spending should also start to improve. Goldman Sachs Group Inc. sees it increasing 4.5% in the second half from a year earlier, compared with a 1.5% contraction last quarter.

However, Beijing’s Covid Zero policy means the risk of more lockdowns hasn’t gone away, said Wood Mackenzie’s Cui. Consumption is slowly on the mend, but it could take until September, usually the peak-demand period for polyolefins — a key petrochemical segment — to see a firmer turnaround, she said.