Amid rising struggles for India’s once-hot edtech market, SoftBank-backed Unacademy is undertaking drastic steps to prioritise profitability ahead of its planned IPO in two years.

In a company-wide message on Monday, shared via Slack, Unacademy co-founder and chief executive Gaurav Munjal said the company had Rs2,800 crore ($352.33 million) in the bank, but he feels the startup is “not efficient” with handling finances. To cut “unnecessary expenses”, Munjal said Unacademy will shut down its global test preparation business, implement pay cuts for founders and management, impose travel restrictions on employees and stop complimentary meals and snacks at their offices.

“We spend crores on travel for employees and educators. Sometimes it’s needed, sometimes it’s not. There are a lot of unnecessary expenses that we do. We must cut all these expenses. We have a strong core business. We must turn profitable ASAP [as soon as possible],” Munjal told his employees.

The company launched its global test preparation platform USMLE earlier this year. But now will be winding down its international operations in the coming days as it has not been able to achieve “PMF” (Profitability Mass Function), Munjal said.

This is Munjal’s second note to Unacademy employees recently. In May, he asked his employees to work under constraints and focus on profitability at all costs. “We are looking at a time where funding will dry up for at least 12-18 months. Some people are predicting that this might last 24 months,” wrote Munjal in the email then.

Munjal’s latest message to his employees has raised the alarm and solidified fears about the slowdown of the edtech industry in India. While the pandemic came as a shot in the arm for the industry, leading to many funding rounds by startups, it is now feeling the pressure after schools have reopened, in a volatile market led by inflation, the Russia-Ukraine war and stock market crashes.

Media reports suggest that investors are advising startups to cut costs and increase the runway by as much as three years, with several funding rounds being renegotiated, stalled or canned. A clutch of well-funded companies, including Byju’s Vedantu, Lido Learning and Udayy recently laid off employees to cut costs. Unacademy also fired around 1,000 employees across the group in April.

Unacademy was founded by Munjal, Hemesh Singh, and Roman Saini in 2015.

In FY21, Munjal’s gross salary was Rs1.58 crore, whereas Singh’s was Rs1.19 crore. Meanwhile, Saini’s gross salary was Rs 88 lakh during the year, according to media reports.

Unacademy’s expenses rose to Rs2,029.9 crore in FY21 and net loss rose 494% to Rs1,537.4 crore in FY21 from Rs258.6 crore in the previous year.

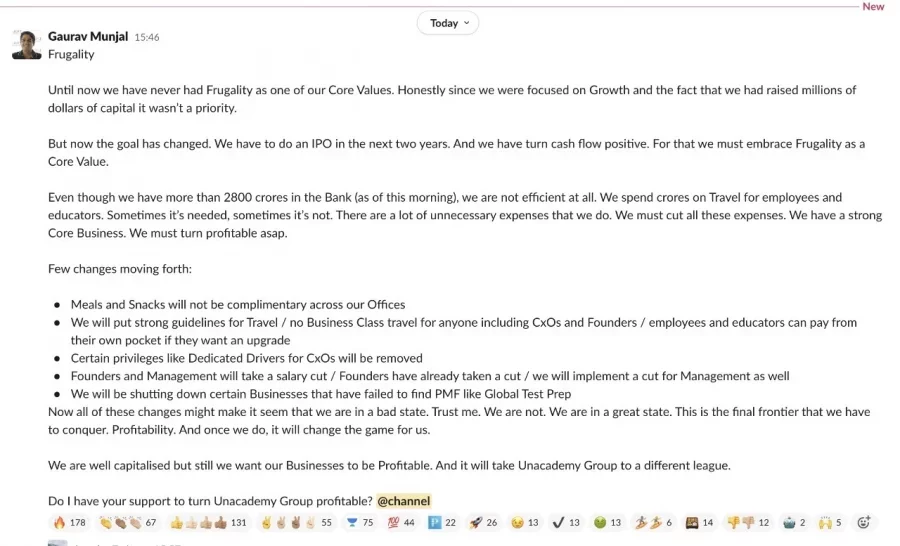

Here’s the full text of Munjal’s message to employees:

Until now we have never had frugality as one of our core values. Honestly, since we were focused on growth and the fact that we had raised millions of dollars of capital it wasn’t a priority. But now the goal has changed. We have to do an IPO in the next two years. And we have to turn cash flow positive.

For that we must embrace frugality as a core value. Even though we have more than [Rs] 2800 crores in the bank (as of this morning), we are not efficient at all. We spend crores on travel for employees and educators. Sometimes it’s needed, sometimes it’s not. There are a lot of unnecessary expenses that we do. We must cut all these expenses. We have a strong core business. We must turn profitable asap.

Few changes moving forth:

- Meals and snacks will not be complimentary across our offices.

- We will put strong guidelines for travel / no business class travel for anyone including CxOs and founders / employees and educators can pay from their own pocket if they want an upgrade.

- Certain privileges like dedicated drivers for CxOs will be removed

- Founders and management will take a salary cut / founders have already taken a cut / we will implement a cut for management as well

- We will be shutting down certain businesses that have failed to find PMF like Global Test Prep.

Now all of these changes might make it seem that we are in a bad state. Trust me. We are not. We are in a great state. This is the final frontier that we have to conquer. Profitability. And once we do, it will change the game for us.

We are well capitalised but still we want our businesses to be profitable. And it will take Unacademy Group to a different league.

Do I have your support to turn Unacademy Group profitable?