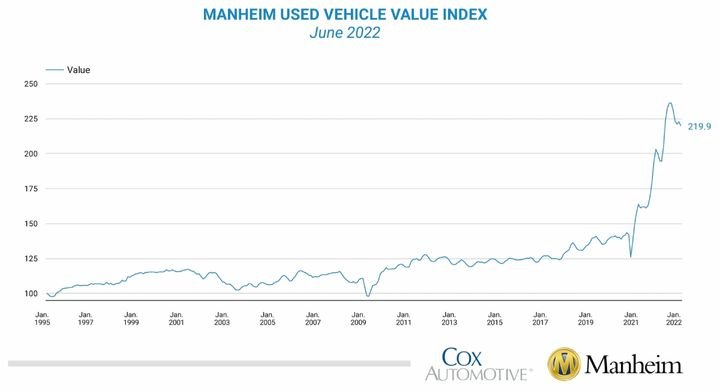

Manheim’s Used Vehicle Value Index shows a decline in wholesale used-vehicle prices this month, while the non-adjusted price change in June also decreased 1.8%.

Source: Cox Automotive

Wholesale used-vehicle prices decreased 1.3% in June from May, according to recent Cox Autotmotive analysis. The Manheim Used Vehicle Value Index declined to 219.9, up 9.7% from a year ago. The non-adjusted price change in June decreased 1.8% compared to May, leaving the unadjusted average price up 10.7% year over year.

In June, Manheim Market Report (MMR) values saw larger declines over the last two weeks than the prior two weeks. Over the last four weeks, the Three-Year-Old Index decreased a net 2.5%. Over the month of June, daily MMR Retention, which is the average difference in price relative to current MMR, averaged 98.4%, meaning market prices were slightly behind MMR values.

All major market segments saw higher seasonally adjusted prices year over year in June, except for pickups showing a 2.5% decline. Vans had the largest increase at 23.1%, with compact and sports cars maintaining seasonally adjusted year-over-year gains ahead of the overall industry. Compared to May, all major segments’ performance was down. Pickups and midsize cars lost more than 2%, followed by luxury cars and vans at 1.8% and 1.6%, respectively.

Cox estimates that used retail sales increased 5% in June from May.

Source: Cox Automotive

Compared to last year, retail used sales pace declined in June, with Cox estimating an increase of 5% in June from May. However, the Dealertrack estimates indicate that used retail sales were down 13% year over year. Compared to 2019, sales were down 11%, which was the best comp against 2019 so far this year, according to the analysis.

June’s total new-light-vehicle sales were down 13.5% year over year, with one less selling day than June 2021. By volume, June new-vehicle sales were up 1.7% from May. The June SAAR came in at 13 million, a 16% decline from last year’s 15.5 million but up 2.3% from May’s 12.7 million pace.

Combined sales into large rental, commercial, and government fleets were up over 8% year over year in June. Sales into rental were down 10% year over year, while sales into commercial fleets were up 23% and sales into government fleets were up 24%. Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be down 15.3%, leading to an estimated retail seasonally adjusted annual rate (SAAR) of 11.1 million, up 0.2 million from last month, or 1.6%, and down 8.5% from last June’s 12.1 million pace. Due to weakness in retail, fleet share rose in June to 14.5%, up from last June’s 12.7% and last month’s 13.9%.

Rental risk mileage was down, maintaining stability from last year. The average price for rental risk units sold at auction in June was up 30% year over year. Rental risk prices were up 0.9% compared to May. Average mileage for rental risk units in June (at 58,700 miles) was down 32% compared to a year ago and down 7.6% from May.

Measures of consumer sentiment decline again in June, too. The Conference Board Consumer Confidence Index declined 4.4% in June when a larger decline had been expected, but the May index was also revised down. Most of the index decline was driven by a 9.9% decline in future expectations as views of the present situation were barely changed, down 0.2% from May. Plans to purchase a vehicle in the next six months increased but remained down year over year. The confidence index has not declined as much as the sentiment index from the University of Michigan, which declined 14.4% in June to a record low. The Michigan index is more sensitive to inflationary pressures and stock market volatility as its questions focus on personal financial conditions, whereas the confidence survey focuses more on business conditions, Cox said. The Morning Consult Index of Consumer Sentiment declined 4.5% in June, but it improved modestly in the final week of the month as gas prices came down slightly.

Originally posted on Vehicle Remarketing