One of the heartening takeaways from the industry wholesales numbers for Q1 FY2023, released by apex body SIAM on July 13, has been the revival of demand for the Indian commercial vehicle (CV) industry. Sales and demand for the CV industry follow a cyclical pattern and after four years of growth (FY2016 to FY2019), FY2020 saw the slowdown kicking in with sales down 29% to 717,593 units.

But little did the industry know that worse was to follow as the beginning of FY2021, when the Covid-19 pandemic had enveloped the world and India. April 2020 turned out to be a unique month in the annals of India Auto Inc with zero production and zero sales. Hugely impacted by the Covid-induced country-wide lockdowns, demand slid to 568,559 units in FY2021, down 20.77% YoY, as transportation, other than for essential goods, was negligible for nearly half of the fiscal.

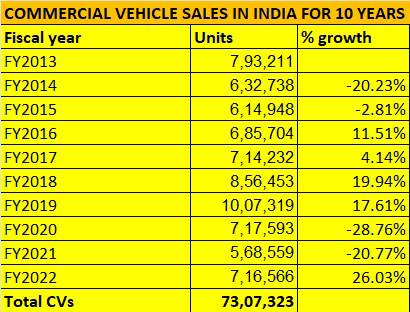

A close look at the CV industry’s sales over a 10-year period reveals five years of decline and five of growth. Coming on the back of FY2022’s 716,566 CVs sold, the latest Q1 FY2023 wholesales are an indication of a return of demand to pre-Covid days.

The wholesale numbers in the first quarter (April-June 2022) of 224,512 units (112%) and the strong performance of both the M&HCV segment (75,685 units / 159%) and LCV segment (148,827 units / 94%) reveal that CV customers are back into purchase mode as they go about replacing older vehicles and also invest in future business operations.

Combined goods carrier sales (M&HCV: 67,978 units & LCV: 137,237 units) of 205,215 units in Q1 FY2023 constitute 91% of total CV sales of224,512, the balance 9% being the 19,297 buses across both M&HCV and LCV segments.

M&HCVs: the movers and shakers

Medium and heavy commercial vehicles, which are known to be the barometer of the economy, are reflecting the improved market sentiment. There has been gradual demand recovery in M&HCVs with transporters reporting improving fleet utilisation levels, the multiplier effect of the large government spending on road construction projects across the country and also higher consumption of cement for infrastructure projects. This is reflected in the surge in demand for tippers and tractor-trailers.

As per the Q1 FY2023 CV industry wholesales data released by SIAM on July 13, demand for M&HCVs has grown by a substantial 142% YoY to 67,978 units. While Tata Motors tops with 35,241 units, followed by Ashok Leyland (21,147), it is VE Commercial Vehicles which has clocked maximum growth with 9,355 units (210%) albeit on a lower base than the two M&HCV market leaders.

LCVs: Last-mile champions

The light commercial vehicle (LCV) industry’s goods carrier sales in Q1 FY2023 are twice that of M&HCV goods carriers. The massive boom for the e-commerce industry, which is seeing a surge in online booking for scores of products from both urban India as well as Tier 1-2-3 towns, is driving sustained growth. While bigger LCVs handle the logistics deliveries across the country, smaller LCVs like pickups and mini-trucks are catering to door-to-door deliveries. Reason why Mahindra & Mahindra is the boss in this goods carrier segment.

M&M has sold a total of 57,509 units, 6,684 units more than Tata Motors. Its hugely popular Bolero range of pickups accounts for 47,462 units or 82% of the company’s LCV goods carrier sales and 34% of total industry sales. Ashok Leyland’s Dost was bought by 13,946 customers while the Toyotra Hilus, which has just entered the market, sold 433 units.

In the mini-truck segment, the Tata Ace rules supreme with 29,655 units, up 114% (Q1 FY2022: 27,124), while the Maruti Super Carry also saw demand with 10,817 units (up 166%, Q1 FY2022: 4,056). The Mahindra minitrucks accounted for 9,567 units, up 58% (Q1 FY2022: 6,042).

Growth outlook: Cautiously optimistic

The goods carrier market’s fortunes are closely aligned with the country’s GDP and from the way things are panning out and the improving macro-economic scenario, the positive sentiment will be reflected in the overall M&HCV and LCV sales numbers in the months and quarters ahead.

The massive investment and focus on road construction activity across India, resurgence of mining operations and also expected growth in agriculture will spur demand for M&HCVs. The surge in the e-commerce business had led to strong vehicle buying from logistics companies while small commercial vehicles like mini-trucks and pickups should continue to see sustained demand come their way with the last-mile delivery dynamic taking firm root in the Indian market.

There will be challenges to growth though. For instance, the Delhi government has banned the entry of M&HCVs from November 1, 2022 to February 28, 2023 to curb pollution. There is also the spend on fuel, which is one of the highest operating expenses for CV fleets. The cost of diesel, currently priced at Rs 89.62 a litre in Delhi, Rs 94.24 in Chennai, Rs 94.27 In Mumbai and Rs 92.76 in Kolkata. Any reduction in diesel prices will offer much relief to CV operators. There is also the vehicle price factor to contend with, with commodity price inflation resulting in higher input costs for OEMs.

All in all, at this stage in FY2023 when Q2 has kicked in, the market scenario seems positive and OEMs are cautiously optimistic about growth.

/analysis-sales/m&hcv-and-lcv-goods-carriers-deliver-the-goods-in-strong-q1-fy2023-92219 M&HCV and LCV goods carriers deliver the goods in strong Q1 FY2023 After two difficult years, there is a welcome return of demand for CV OEMs, particularly goods carriers as the benefits of government spend on infrastructure percolate to M&HCVs and the e-commerce boom powers LCVs. https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/ed0d2e6c-3fd0-4feb-961a-a36e892468f9.jpg