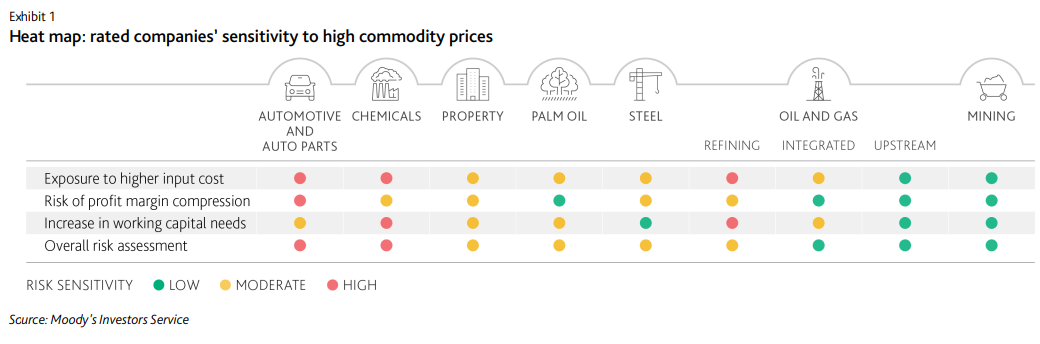

New Delhi: Rising raw material costs, declining profitability and higher working capital intensity as a result of high commodity prices are having the biggest impact on rated companies in the automotive and chemical sectors in South and Southeast Asia (SSEA), says Moody’s Investors Service in a new report.

Elevated prices of key inputs such as steel, aluminium and energy will hurt the profitability of automotive manufacturers in SSEA, particularly auto-parts suppliers, although India’s strong car demand will support carmakers’ pricing power. Meanwhile, chemical companies face higher feedstock costs and working capital requirements.

However, Moody’s said that commodity producers, such as those in mining and oil and gas sectors are the major beneficiaries of the high prices.

“High commodity price is a big risk that adds to global macroeconomic uncertainty, clouding the prospects for commodity-reliant sectors. Although commodity prices have declined in recent weeks, they continue to be above long-term averages,” Maisam Hasnain, a Moody’s Vice President and Senior Analyst, said.

Still, strong car demand in India and the ability to raise product prices will support Tata Motors Limited’s credit quality. Moreover, TML’s commodity hedges will help contain the impact on profitability.

According to the rating agency, semiconductor shortages since 2021 that have weighed on auto production will ease through year-end 2022, with better availability of these components for automotive manufacturers and auto part suppliers.

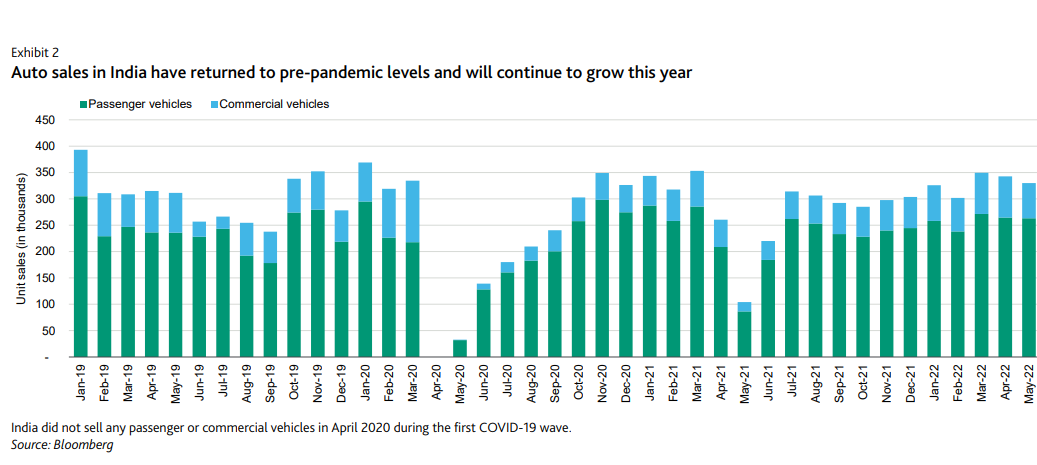

Moreover, the report noted, underlying car demand remains strong despite rising borrowing costs, as reflected by the 90-basis-point increase in the Reserve Bank of India’s benchmark repo rate in the second quarter.

Car sales in India, the world’s fourth-largest market, will climb 10% in 2022 following 27% growth in 2021. During the pandemic, consumers have shown a preference for personal vehicles over public transportation, driving demand.

Property developers, steelmakers and palm oil producers have moderate exposure to the impact of high commodity prices. For steelmakers, strong steel demand will support their earnings despite narrowing product spreads on higher input costs. Meanwhile, palm oil companies will need to increase short-term borrowings to fund higher working capital needs.

On the other hand, upstream oil and gas producers benefit directly from high product prices. Refiners, too, will lift with bumper margins, although they face higher input costs, increased working capital needs and uncertainty over their ability to pass on higher costs to customers. Likewise, record high selling prices will boost mining companies’ revenue to far exceed the increase in production costs.

Most of the miners will have sufficient liquidity to cover any increase in working capital requirements, along with planned investments.