The additional tax would yield Rs 141 crore, according to calculation of the administration. The amount or percentage of incentives against the purchase of EVs is declared by the administration in its draft policy. They will be available for both four-wheeler and two-wheeler electric vehicle.

“The EV policy is set to roll out in the coming days. It is proposed the cess amount be directly sent to the science and technology department of the administration instead of routing it through finance department or the Centre. If this happens, the process of releasing incentives will be speedy and timely,” a senior official said.

Sources in the administration said the authority has chosen to levy cess as sale of liquor and registration of fuel vehicles are high in numbers. “Since both these departments generate a good amount of money, it has been decided to impose cess. The move will also discourage people from buying fuel vehicles,” sources added.

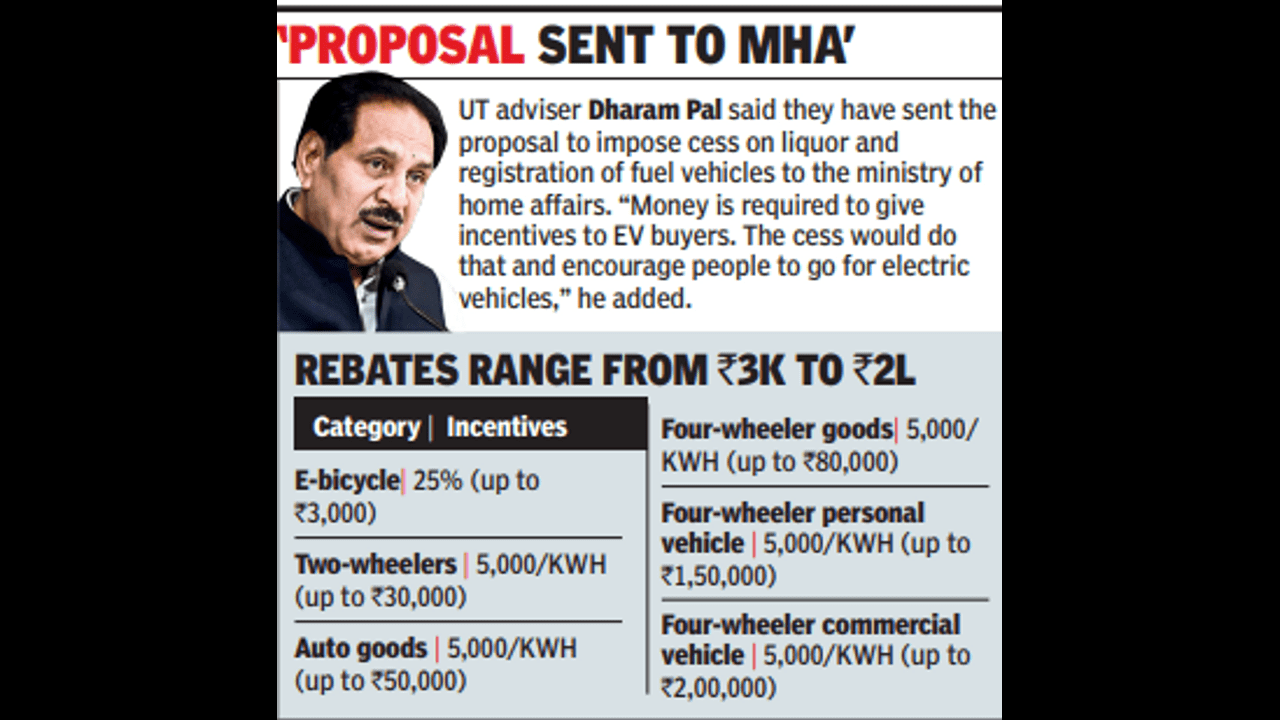

The administration recently set a Rs 5 crore provisional budget for the department of science and technology to disburse incentives to EV buyers according to its policy. Incentives range from Rs 3,000 to Rs 2 lakhs for e-bicycles to e-commercial vehicles. The administration in its policy has also mentioned of giving scrapping charges to people who want to dispose of their fuel vehicles.