NEW DELHI: The rupee’s slide may have some implication for inflation management. But overall, the macroeconomic fundamentals of the economy remain robust to deal with short-term shocks. For now, the most crucial impact would be on inflation as the country imports nearly 80% of its crude oil needs. This would mean that imports would become costlier and travel through the value chain to raise input costs.

While retail inflation has shown some signs of moderation in recent weeks, the rupee depreciation may impact the overall inflation situation. Slowing of commodity prices may also help cushion the impact. “It compounds inflation problem by raising cost of imports and partially mutes the impact of duty cuts on imports,” said Crisil’s chief economist D K Joshi. He added rupee’s depreciation raises debt servicing costs for companies as 44% of overseas commercial borrowings are unhedged.

While exports would depend on the global demand situation rather than the rupee’s depreciation, the trade deficit is only seen to be correcting it- self at a modest pace. The trade deficit widened to $25. 6 billion in June, led by surging crude oil & coal imports, and piling pressure on the rupee. The volatility in exchange rate also has implications for policymakers as opposition parties will step up attacks on the government for the soaring inflation and a weak currency. “Short phases of sharp depreciation can be tolerated. But continued weakening of the rupee can accentuate macro problems. Past episodes of currency volatility also tell us that the rupee can bounce back when underlying conditions stabilise,” said Joshi.

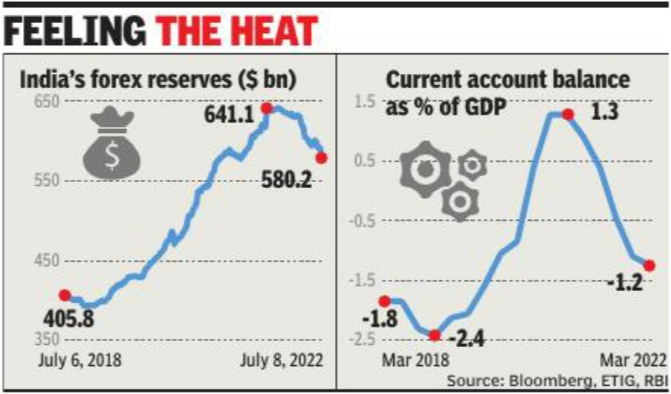

The Centre and the RBI have both reiterated that the economic recovery is holding up against global headwinds. The RBI and the government have taken several measures to increase dollar inflows. The rupee’s slide also has implications on forex reserves. According to a finance ministry report, to meet the financing needs of a widening CAD and rising FPI outflows, forex reserves — in the six months since January — have declined by $34 billion. The RBI has spent more than $40 billion during the current fiscal defending the rupee.