Chennai: The economic crisis in Sri Lanka will hit India’s auto exports to that country but, say sector experts, the good news is that exports have been shrinking for the past 3-4 years now and so the current pinch will be less painful for Indian auto companies. For one, Sri Lanka had banned vehicle imports in March 2020 due to pressure on the government’s foreign debt repayment.

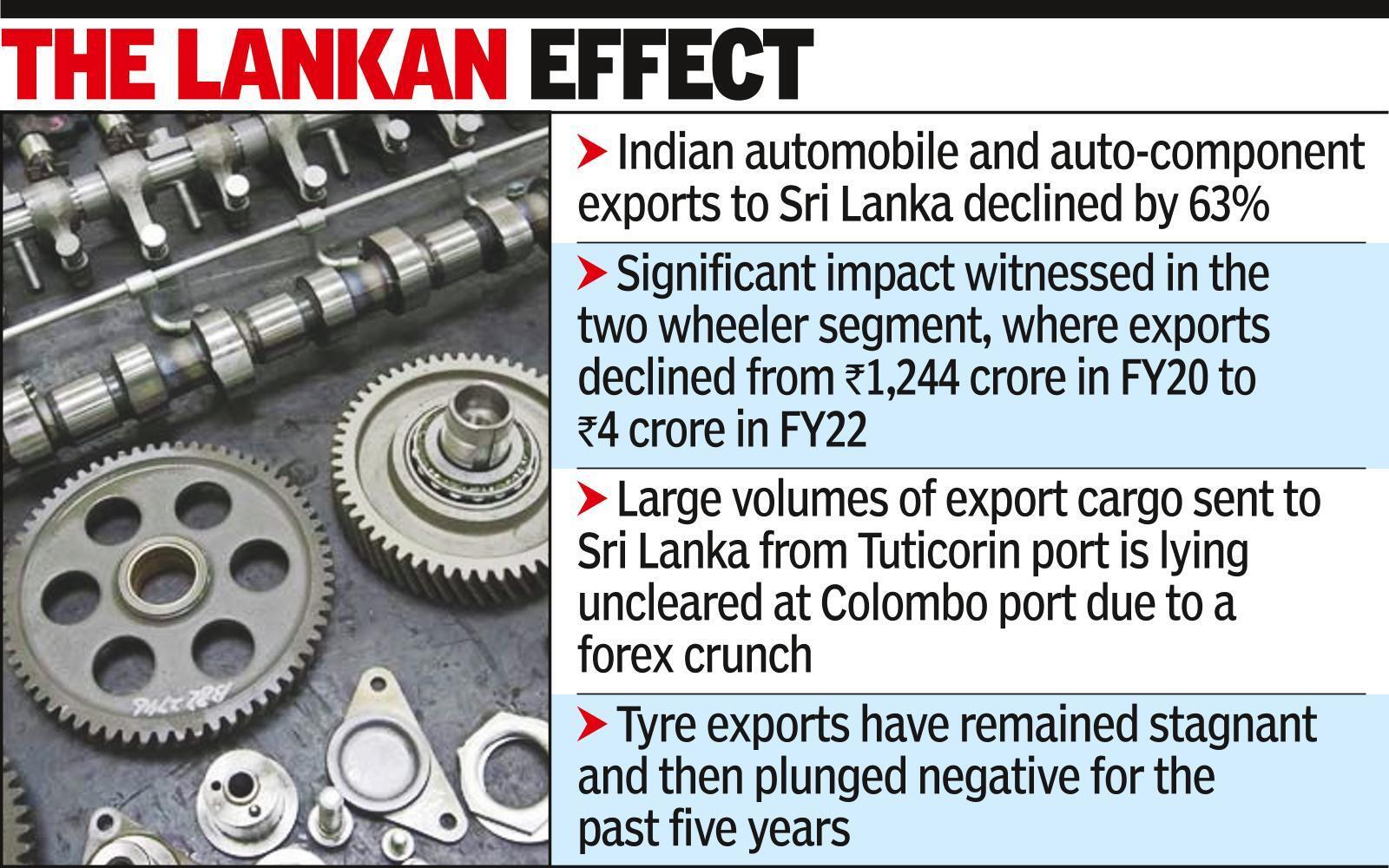

With the economic scenario worsening, the shipments were already taking a hit. Said Pushan Sharma, director, CRISIL Research: “Indian automobile (passenger vehicle, commercial vehicle and two wheeler) and auto-component exports to Sri Lanka have declined by 63% from Rs 2,377 crore in FY20 to Rs 874 crore in FY22, whereas overall auto sector exports increased by 16% from Rs 177,122 crore to Rs 205,685 crore during the same time.”

Significant impact has been witnessed in the two wheeler segment, he added, “where exports declined from Rs. 1,244 crore in FY20 to a meagre Rs Four crore in FY22”. Tuticorin is one of India’s 12 “major” ports and the second-busiest east coast container handler after Chennai. “Large volumes of export cargo sent to Sri Lanka from Tuticorin port is lying uncleared at Colombo port due to a forex crunch,” added Sharma.

Over 60% of Sri Lanka’s domestic requirements are sent from Tuticorin port. The slump in exports is a recent phenomenon and coincides with the island’s descent into economic mess. Said Shruti Saboo, associate director, India Ratings & Research: “Of the total exports of vehicles and auto components together, exports to Sri Lanka accounted for less than 1% (in terms of value).

While it used to be one of the key export destinations particularly for two-wheelers until mid-2020, it declined sharply post imposition of import ban by Sri Lankan government. Even on the passenger car side, exports to Sri Lanka reduced considerably over the last decade due to intermittent import duties being levied by their government.”

The segment where exports have gone up though are tractors, light commercial vehicles and auto components all of which have “been increasing on a YoY basis. Some of the OEMs had even set up a manufacturing or assembly base there and are currently facing issues related to sourcing of components and hence production,” added Saboo. However, being a low cost vehicle market, the overall exposure of Indian OEMs is unlikely to be significant, she clarified.

The scene is no different even for ancillary exports. Tyre exports for instance have remained stagnant and then plunged negative for the past 5 years going from Rs 110 crore in FY16-17 to nearly Rs 90 crore in FY17-18, just over Rs 91 crore in FY18-19, nearly Rs 91.5 crore in FY19-20 and nearly Rs 45 crore in FY20-21. It then recovered to Rs 100.6 crore in FY21-22 but on a very low pandemic base the year before.

According to the Society of Indian Automobile Manufacturers (SIAM), India’s exports to Sri Lanka was always dominated by the two wheeler segment. In FY19-20, the passenger vehicle and three wheeler export value stood at $40 million, whereas two wheelers stood at $176 million. “However because of import restrictions in 2020 auto exports declined significantly,” said Rajesh Menon, director-general, SIAM.

Go to Source