Tenneco has purchased Southfield-based auto parts company Federal-Mogul from Carl C. Icahn’s Icahn Enterprises.

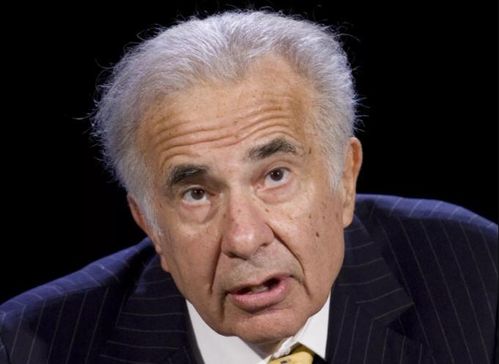

(Photo: Mark Lennihan / AP)

Tenneco Inc. plans to purchase Southfield-based auto parts company Federal-Mogul LLC for $5.4 billion. Pending regulatory approval, the merged company would split into two separate companies by the end of 2019.

Officials said Tuesday it was too early to talk about what that means for jobs for those employees based in Michigan. Federal-Mogul has technical centers in Ann Arbor and Plymouth, manufacturing facilities in Greenville and Sparta, and its headquarters in Southfield. The companies did not disclose how many employees are based in Michigan.

Tenneco plans to buy the company from Icahn Enterprises for $800 million in cash and 29.5 million shares. The Lake Forest, Illinois, auto parts maker said Tuesday that upon completion of the acquisition, Tenneco will combine business operations with Federal-Mogul, and split that combined company into two operations: There will be an aftermarket and ride-performance parts company, and a powertrain technology company, both to be traded publicly.

A representative from Federal-Mogul could not be reached for comment Tuesday. There was no indication from that company of how jobs located in Michigan would be affected by the acquisition, which is expected to close in the second half of the year. The split-up would happen in the second half of 2019.

Tenneco spokesman Bill Dawson told The Detroit News in an email that it’s too early to talk about any changes that would come as a result of the acquisition. Dawson would not comment on whether any of the six Federal-Mogul locations in Michigan would be affected by the acquisition and subsequent split, or if Federal-Mogul’s 53,000 global headcount would change.

Dawson said Tenneco and Federal-Mogul make “highly complementary” products and technologies, saying there are things Federal-Mogul makes that Tenneco does not. He also said the company expects one of the new companies following the late-2019 split will be headquartered in Metro Detroit, and the other will be headquartered in the Chicago area.

Tenneco CEO Brian Kesseler on a phone call with investors Tuesday said the deal “will bring significant synergies expected to drive shareholder value…” The company did not offer specifics.

Icahn Enterprises bought a majority stake in Federal Mogul in 2008 and took full ownership of the company last year.

Carl C. Icahn, chairman of Icahn Enterprises, said in a statement, “I am very proud of the business we have built at Federal-Mogul and agree with Tenneco regarding the tremendous value in the business combination and separation into two companies. We expect to be meaningful stockholders of Tenneco going forward and are excited about the prospects for additional value creation.”

Gregg Sherrill, executive chairman of Tenneco, said the acquisition would accelerate each company’s ability to capitalize on trends that are changing the industry: “This is a major step forward in building an even stronger position with the combination of strategically aligned companies and the subsequent separation of the businesses, realigned in such a way to unlock shareholder value.”

Tenneco stock was up 4 percent to $57.87 in trading late Tuesday afternoon.

ithibodeau@detroitnews.com

Twitter: @Ian_Thibodeau

Read or Share this story: https://detne.ws/2GPaah7