SEATTLE, Dec. 21, 2021 /PRNewswire/ — According to Coherent Market Insights, The global automotive cloud market is estimated to account for 6,673.0 Mn in terms of value by the end of 2027. The automotive cloud is an open infrastructure for data from cars and the automotive supply chain. It provides access to information from different sources,… Continue reading Automotive Cloud Market to surpass US$ 6,673.0 Mn by end of 2027, Says Coherent Market Insights

Tag: Toyota

MotorBiscuit Announces Its 2021 Vehicle Award Winners

ASHEVILLE, N.C., Dec. 21, 2021 /PRNewswire/ — MotorBiscuit (motorbiscuit.com), an automotive media brand of Endgame360, has named the winners of the inaugural MotorBiscuit Vehicle Awards. MotorBiscuit staff and senior automotive journalists tested dozens of vehicles in 2021, reviewing and rating over 40 SUVs, cars, trucks, and minivans first-hand. Each vehicle review included thoughtful assessment of the styling,… Continue reading MotorBiscuit Announces Its 2021 Vehicle Award Winners

EV Roundup: TM’s Big Electrification Bet & NIO Day Event Take Center Stage

Last week, Japan-based auto biggie Toyota TM announced an extensive electrification drive in a bid to secure a solid footing in the red-hot EV space. China’s key EV player NIO Inc. NIO grabbed attention with its much-awaited annual NIO Day Event held in Suzhou in China on Dec 18, 2021, to shape the future of… Continue reading EV Roundup: TM’s Big Electrification Bet & NIO Day Event Take Center Stage

CBAK Energy Enters into Agreement with AZAPA R&D China for Developing Customized Battery Pack

DALIAN, China, Dec. 21, 2021 /PRNewswire/ — CBAK Energy Technology, Inc. (NASDAQ: CBAT) (“CBAK Energy,” or the “Company”), a leading lithium-ion battery manufacturer and electric energy solution provider in China, today announced that its wholly-owned subsidiary CBAK New Energy (Nanjing) Co., Ltd. (“CBAK Nanjing”) has entered into an agreement with AZAPA R&D China (“AZAPA”) to develop… Continue reading CBAK Energy Enters into Agreement with AZAPA R&D China for Developing Customized Battery Pack

Toyota to start car hardware, software update service in Japan

A Toyota logo is displayed at the 89th Geneva International Motor Show in Geneva, Switzerland March 5, 2019. REUTERS/Pierre Albouy Register now for FREE unlimited access to Reuters.com Register TOKYO, Dec 21 (Reuters) – Toyota Motor Corp (7203.T) said on Tuesday it will launch a service next year offering customisation and updates for cars as… Continue reading Toyota to start car hardware, software update service in Japan

@Hyundai: WRC 2021: Good Job, Hyundai Motorsport

At the 2021 WRC season, Hyundai Motorsport GmbH finished their rally second overall in the Manufacturer’s category, and failed to become the third consecutive champion; however, second place is not a defeat, so there is no need to be sad. Only when you acknowledge your hard work and effort and applaud yourself can you get… Continue reading @Hyundai: WRC 2021: Good Job, Hyundai Motorsport

EPA announces strictest fuel efficiency standards ever, reversing Trump-era rollback

On Monday, the Biden administration finalized new fuel efficiency standards designed to limit greenhouse gas emissions put out by passenger vehicles. By 2026, the Environmental Protection Agency will require that automaker fleets travel an average of about 55 miles per gallon, up from the 37 miles per gallon standard they’re held to as of this… Continue reading EPA announces strictest fuel efficiency standards ever, reversing Trump-era rollback

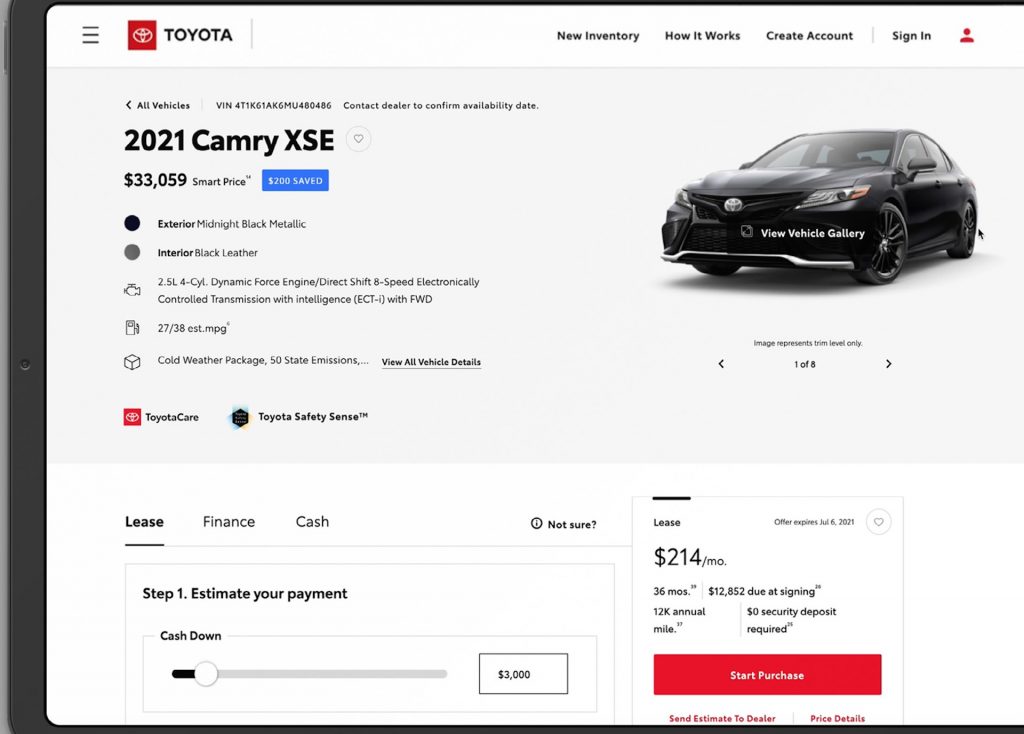

@Toyota: SmartPath is Now Toyota Dealers’ Online System of Choice

More Toyota dealers now rely on SmartPath to provide customers a more convenient and flexible digital retail experience than any of the alternatives offered by third-party companies. If that trend continues, the system promises to further differentiate Toyota in the marketplace. SmartPath, Toyota Motor North America’s (TMNA) digital retail solution — which allows customers to… Continue reading @Toyota: SmartPath is Now Toyota Dealers’ Online System of Choice

Mitsubishi Motors North America Appoints Daniel Ball Vice President, Aftersales

In this role, Ball will be responsible for overseeing parts and service operations for MMNA in the United States, including the Company’s parts distribution operations and warehouses. Specifically, he will be in charge of developing and implementing strategies and programs that enable Mitsubishi Motors and its dealer partners to provide a strong level of customer satisfaction… Continue reading Mitsubishi Motors North America Appoints Daniel Ball Vice President, Aftersales

Bangalore chamber of industry & commerce plans India-Japan summit in February 2022

BCIC, early this year, set up an office in Tokyo to promote mutual business interests and promote tourism and share good practices. Bangalore chamber of industry & commerce (BCIC) plans to hold an India-Japan summit in February next year as part of its efforts to promote Karnataka as an investment destination from Japanese investors. BCIC,… Continue reading Bangalore chamber of industry & commerce plans India-Japan summit in February 2022