Jaguar Land Rover Automotive plc today reported pre-tax profits of £192 million for the three months to 31 December 2017, as major investment in new models and challenging trading conditions in key markets offset a solid rise in unit sales.

Tag: People

Porsche plans to invest more than six billion euro in electromobility by 2022

Doubling investment in the future: Porsche has been putting together an unprecedented future development plan. By 2022, the sports car manufacturer will invest more than six billion euro in electromobility, focusing on both plug-in hybrids and purely electric vehicles.

Nissan and Dongfeng will invest almost 7,700 million in their joint venture in China until 2022

The joint venture between Nissan Motor and Dongfeng Group in China, called Dongfeng Motor, has presented its medium-term strategic plan, which envisages an investment of 300,000 million yuan (7,692 million euros at the current rate) over the next five years.

China Digest: Gay dating app Blued, new energy vehicle firm SKIO secure funding

Chinese technology companies continue to secure funding from venture capital and private equity firms. The latest recipients are gay dating app Blued and new energy vehicle firm SKIO Matrix. Blued secures $100m in Series D Beijing-headquartered Blued, one of the world’s largest social network and dating apps for the LGBT community, has closed its Series… Continue reading China Digest: Gay dating app Blued, new energy vehicle firm SKIO secure funding

UK new car registrations decline in January

UK new car market declines in January – down -6.3%, as 163,615 cars leave showrooms. Demand for petrol and alternatively fuelled vehicles rises, but fails to offset fall in new diesel registrations. SUVs only vehicle segment to show growth, with 6.6% uplift leading to record market share. The UK new car market declined in the… Continue reading UK new car registrations decline in January

Ford CEO Jim Hackett on the future of computing, cities, and self-driving cars

In May 2017, Ford announced that it had replaced its CEO, Mark Fields, who had been with the company since 1989, with Jim Hackett. Despite being on Ford’s board since 2013, Hackett was probably best known for leading Steelcase, the large office-furniture company, for decades and turning around its fortunes, as well as for working… Continue reading Ford CEO Jim Hackett on the future of computing, cities, and self-driving cars

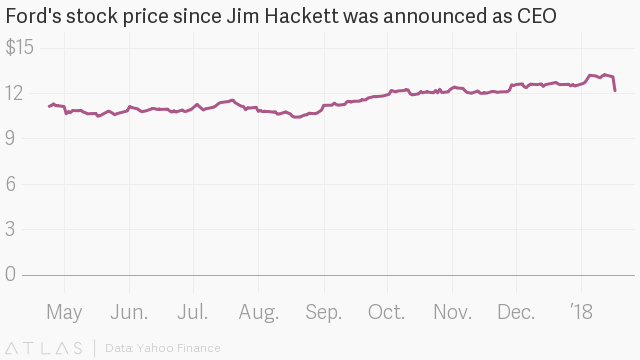

Wall Street sours on Hackett’s Ford

DETROIT — To hear Wall Street tell it, Ford Motor Co. is in dire straits. Ford shares last week fell under $11, lower than when Jim Hackett became CEO last May, despite big gains for the broader market in those eight months. Ford’s earnings outlook for the year dimmed in light of lower-than-expected 2017 results.… Continue reading Wall Street sours on Hackett’s Ford

Mahindra First Choice Wheels Raises $15 Million valuing the company at $265 Million

Mahindra First Choice Wheels Raises $15 Million valuing the company at $265 Million – Funds are primary infusion into the company to fund growth over the next 18 months– Existing investors participating in this round– Over the last five years, monthly revenue growth for the company at 3.5% with annual growth rate of over 50%–… Continue reading Mahindra First Choice Wheels Raises $15 Million valuing the company at $265 Million

Mahindra to Unleash the ‘Future of Mobility’ at the Auto Expo 2018

Mahindra to Unleash the ‘Future of Mobility’ at the Auto Expo 2018 Future Of Mobility based on three pillars – Clean, Connected & Convenient To showcase 6 new electric vehicles, including 2 futuristic concepts To exhibit a first of its kind electric mobility platform and a future electric architecture Set to display a global aspirational… Continue reading Mahindra to Unleash the ‘Future of Mobility’ at the Auto Expo 2018

Asset finance market records seventh consecutive year of growth

9 February 2018

New figures released today by the Finance & Leasing Association (FLA) show that asset finance new business (primarily leasing and hire purchase) grew by 5% in 2017 – the seventh consecutive year of growth. New business in December 2017 increased by 4% compared with the same month in 2016.

The plant and machinery finance and commercial vehicle finance sectors reported new business up in 2017 by 12% and 1% respectively, compared with 2016, while new finance for business equipment was up by 7% over the same period.

Commenting on the figures, Geraldine Kilkelly, Head of Research and Chief Economist at the FLA, said:

“The asset finance industry reported a record level of new business of almost £32 billion in 2017, despite challenging economic conditions and subdued business investment growth.

“The latest figures also reveal that asset finance is a vital source of funding for SMEs when investing in business equipment and machinery. Of the total asset finance new business in 2017, £18.6 billion went to SMEs – 12% higher than in 2016.”

Dec 2017

% change on prev. year

3 months to Dec

2017

% change on prev. year

12 months to Dec

2017

% change on prev. year

Total FLA asset finance (£m)

2,632

+4

7,861

+5

31,769

+5

Total excluding high value (£m)

2,483

-1

7,695

+5

30,752

+6

Data Extracts:

By asset:

Plant and machinery finance (£m)

512

+1

1,515

+5

6,617

+12

Commercial vehicle finance (£m)

572

-14

1,934

-1

7,480

+1

IT equipment finance (£m)

293

+19

726

+14

2,285

+2

Business equipment finance (£m)

227

+6

624

+6

2,581

+7

Car finance (£m)

629

-2

2,243

+4

9,531

+5

Aircraft, ships and rolling stock finance (£m)

36

-41

60

-50

549

+20

By channel:

Direct finance (£m)

1,153

-7

3,746

0

15,477

+4

Broker-introduced finance (£m)

579

+24

1,620

+21

5,839

+14

Sales finance (£m)

752

-8

2,329

+4

9,436

+7

By product:

Finance leasing (£m)

403

+1

1,022

+5

3,809

+6

Operating leasing (£m)

511

-12

1,624

-4

6,755

0

Lease/Hire purchase (£m)

1,225

+1

4,162

+5

16,924

+8

Other finance (£m)

493

+45

1,053

+19

4,281

+5

Note to editors:

In 2017, FLA members provided £128 billion of new finance to UK businesses and households. £32 billion of finance was provided to businesses and the public sector. FLA members financed more than a third of UK investment in machinery, equipment and purchased software in the UK in 2017.For media enquiries, please contact the FLA press office on 020 7420 9656.