FILE PHOTO: The logo of German carmaker Volkswagen is seen at the Volkswagen (VW) automobile manufacturing plant in Puebla near Mexico City September 23, 2015. REUTERS/Imelda Medina BERLIN (Reuters) – Volkswagen has ended its partnership with self-driving car software firm Aurora, two days after the Silicon Valley start-up said it would build autonomous platforms for… Continue reading UPDATE 1-End of the road for Volkswagen’s self-driving Aurora deal

Tag: Autonomous

Volkswagen concludes partnership with self-driving start-up Aurora, in talks with Ford

Julian Stratenschulte | picture alliance | Getty ImagesVolkswagen has ended its relationship with Amazon-backed self-driving start-up Aurora, and is now considering partnerships with Ford and competitor Argo AI, CNBC has confirmed.

Three people familiar with the matter first told the Financial Times that after a trial run that lasted a few months, the German automaker declined to renew the 2018 contract with Aurora. A new deal with Ford, however, could be reached by summer, according to the FT.

“The activities under our partnership have been concluded,” a Volkswagen spokesperson told CNBC.

Volkswagen previously sought to acquire Aurora following General Motor's acquisition of Cruise and Ford's $1 billion commitment to Argo AI.

Aurora on Monday announced a partnership with Fiat Chrysler to develop self-driving vehicles for corporate clients. The start-up also raised more than $530 million in an Amazon-led funding round in February, valuing the company at more than $2.5 billion.

Ford did not immediately respond to CNBC's request for comment.

Aurora will continue to use the VW e-Golf in development of its driverless vehicle systems, the company confirmed. Aurora also characterized the end of the partnership as amicable, and said there was potential to work together again down the line.

“Volkswagen Group has been a wonderful partner to Aurora since the early days of development of the Aurora Driver. As the Driver matures and our platform grows in strength, we continue to work with a growing array of partners who complement our expertise and expand the reach of our product,” an Aurora spokesperson told CNBC.

Volkswagen and Ford announced plans in January to partner up on the development of light commercial vehicles, and said they were considering other projects. Volkswagen has also committed over $50 billion to develop more than 50 pure battery-electric vehicles by 2025, to be sold through brands like Porsche and Audi.

Volkswagen breaks with self-driving start-up Aurora

Carmaker set to enter a partnership with Ford’s autonomous unit Argo AI Go to Source

End of the road for Volkswagen’s self-driving Aurora deal

BERLIN, June 11 (Reuters) – Volkswagen has ended its partnership with self-driving car software firm Aurora, two days after the Silicon Valley start-up said it would build autonomous platforms for commercial vehicles with Fiat Chrysler . “The activities under our partnership have been concluded,” a VW spokesman said in a statement on Tuesday following an… Continue reading End of the road for Volkswagen’s self-driving Aurora deal

Over 1,400 self-driving vehicles are now in testing by 80+ companies across the U.S.

In a talk at the Uber Elevate summit in Washington, D.C., today, U.S. Department of Transportation Secretary Elaine Chao shared a total overall figure for ongoing testing of autonomous vehicles on U.S roads: Over 1,400 self-driving cars, trucks and other vehicles are currently in testing by over 80 companies across 36 US states, plus DC… Continue reading Over 1,400 self-driving vehicles are now in testing by 80+ companies across the U.S.

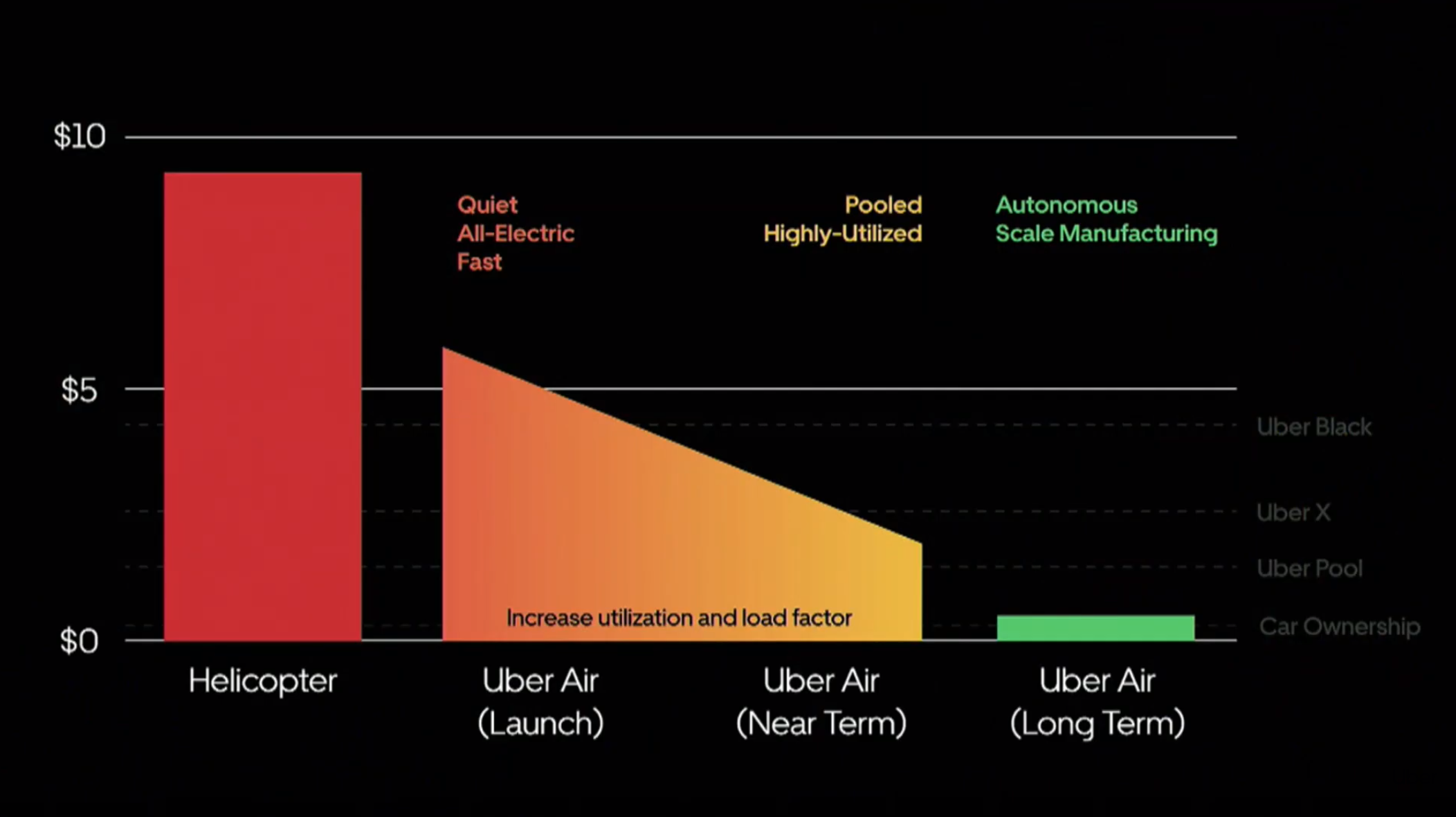

Uber envisions Uber Air will one day be cheaper than owning a car

Uber has big dreams for Uber Air, the flying taxi service it’s wanting to launch in 2023. At the third annual Uber Elevate, head of Elevate Eric Allison said the company expects Uber Air to be cheaper than driving a car. It surely won’t be that way on day one, but once Uber deploys fully… Continue reading Uber envisions Uber Air will one day be cheaper than owning a car

Ford denies it is in the self-driving slow lane

TEL AVIV (Reuters) – Ford Motor Co may be taking a cautious approach to its autonomous driving program, but its chairman rejected claims that the U.S. automaker was falling behind its peers. FILE PHOTO: The Ford logo is seen on a vehicle at the New York Auto Show in the Manhattan borough of New York… Continue reading Ford denies it is in the self-driving slow lane

The GM-backed robo-taxi startup Cruise Automation is reportedly struggling to refine its self-driving car technology

The autonomous-driving startup Cruise Automation, which was acquired by General Motors in 2016, is facing technological issues as it seeks to launch an autonomous ride-hailing service by the end of this year, The Information’s Amir Efrati reported on Friday.Among the issues reportedly experienced by Cruise vehicles are near-accidents, according to The Information; getting stuck in the middle of a trip, taking 80% longer to complete a trip than a human driver would, and erratic braking and steering.Cruise had reportedly set a goal of lowering that rate to once every 1,000 miles by the end of 2018.

Fiat Chrysler blames the French government as it withdraws its offer to buy Renault

VIDEO5:4005:40Kevin O'Leary explains what the Fiat-Renault deal collapse means for investorsSquawk BoxFiat Chrysler has withdrawn an offer for a merger-of-equals with Groupe Renault, and people close to the negotiations between the two companies are pointing the finger at what they described as meddling by the French government.

The sudden move was announced in a statement released by the Italian-American automaker shortly after midnight European time that said that, while Fiat Chrysler management remained “firmly convinced” of the rationale behind the proposed merger, “it has become clear that the political conditions in France do not currently exist for such a combination to proceed successfully.”

Fiat Chrysler's decision to withdraw the proposal came suddenly: The two companies, less than three hours earlier, were preparing to issue a joint statement that said the merger plans were going to move ahead after receiving approval from the Renault board, according to a senior-level source closely briefed on the talks between the two companies.

“We went in different directions very rapidly,” that person explained to CNBC. “It turned on a dime.”

Renault shares slid more than 6% by around 10 am ET, while Fiat was little changed.

Fiat Chrysler made its original merger proposal on May 27 following months of discussions between the two companies. They had initially started discussing more limited measures, including the joint development of new product platforms, CNBC previously reported. But, as the contacts escalated, it became apparent to top managers — including FCA CEO Mike Manley and his Renault counterpart Jean-Dominique Senard — that they had an opportunity to take the ultimate step and combine forces.

There was relatively little overlap in product lines and each company had strengths that could compensate for the other's weaknesses, many analysts said after studying the proposal. Fiat Chrysler, for one, had the powerful Jeep and Ram brands, while Renault is a leader in the development of autonomous and electrified vehicles.

The French automaker's board quickly expressed initial interest in the merger proposal, something analysts said was of little surprise since they had been talking to one another for months. It was widely expected to give more formal approval on Tuesday, according to industry observers, but the initial board meeting went by without a resolution, extending into Wednesday.

From the start, several potential obstacles emerged. That included Renault's long-standing alliance with Japanese automakers Nissan and Mitsubishi. The relationship has been strained since former Renault-Nissan-Mitsubishi Alliance chief Carlos Ghosn was arrested last November on financial corruption charges, with a number of observers questioning whether that was actually the result of Nissan's desire to gain more control in the three-way partnership.

There have been some concerns about the merger raised by the Japanese, an auto industry veteran with lengthy ties to Chrysler, Nissan and Renault said by email, but that was not likely to scuttle the deal.

If anything, said the person closely briefed on the negotiations who spoke with CNBC, Nissan had expressed interest in the deal and the potential benefits to the Japanese automaker. In its original merger proposal, Fiat Chrysler outlined 5 billion euros in potential synergies, 1 billion of that set to accrue to Nissan and Mitsubishi.

'Cumulative demands and pressures'Instead, Fiat Chrysler's proposal began to break down as a result of “cumulative demands and pressures” from the French government, said the insider briefed on the talks. That began just hours after the original proposal was announced, with France's finance minister laying out three key demands, including the need to preserve all of the Renault jobs and plants in France.

That expanded to include demands covering the location of the merged company's headquarters and the make up of its board, the insider explained, adding that “the final one” came late Friday at the extended Renault board meeting.

After several efforts to wrap things up, the French CGT Union voted “no” on the merger plan, according to Reuters. Nissan, which some had expected also would give a thumbs down, instead abstained. All other directors gave the proposal their approval, but for the government representatives who demanded that a final decision be delayed for another week as they flew to Tokyo for further consultation with Nissan.

“There was a clear, growing realization that this is not an environment in which the proposal can come together,” the Fiat Chrysler source said, noting the irony that there remains “a very cordial relationship” between the two companies, and, in particular, between CEOs Manley and Senard. Renault's 66-year-old chief executive is now finding himself “in a very difficult position,” said the industry veteran who has been linked to several of the carmakers.

Senard was pushed into the post by the French government — which holds a 15% stake in the automaker — after former Renault CEO Ghosn tendered his resignation, but now finds himself on the outs as a strong supporter of the merger proposal.

“It's unfortunate this proposal failed so quickly,” said Karl Brauer, an analyst with Kelley Blue Book, “though it's better than having it drag on for weeks or months and then fail.

What will happen next is uncertain, the Fiat Chrysler insider said one should “never say never,” and it is possible that clearer heads could prevail, though it is unlikely the merger proposal would quickly be revived.

Fiat Chrysler could also look at other merger possibilities — news reports earlier this year suggested the company might want to tie up with the other major French automaker, PSA. CEO Manley, meanwhile, said he was more than willing to continue operating independently during a media round table at the North American International Auto Show in Detroit last January.

China Merchants Capital-backed LiDAR startup Innoviz closes Series C at $170m

Innoviz Technologies, the Israel-based company that develops cutting-edge LiDAR (Light Detection and Ranging) technology, has closed its Series C funding round with an additional $38 million to bring the total series funding to $170 million. In March, the tech firm announced that it has raised $132 million in the Series C round, with Chinese investment… Continue reading China Merchants Capital-backed LiDAR startup Innoviz closes Series C at $170m