James O'Neal attaches a fender in the body shop at GM's Chevrolet Silverado and GMC Sierra pickup truck plant in Fort Wayne, Indiana, July 25, 2018.John Gress | ReutersGeneral Motors will trim production of the Chevrolet Equinox SUV at two North American car plants, a move that follows cuts announced by Ford, Honda and other manufacturers.

Automakers are facing what is only the second down market since the end of the Great Recession and the record sales that followed. How far down demand will go this time is a matter of debate, with analysts and planners warning that could depend on how the Trump administration handles disputes with China and other trade partners.

Industry officials, including General Motors CEO Mary Barra, say they learned critical lessons during the last recession and hope to be more proactive this time around, adjusting production early to stay in line with market demand while avoiding the sort of budget-busting incentives that devastated industry balance sheets a decade ago.

GM's latest cutback primarily targets the Equinox but also impacts two other SUVs, the GMC Terrain and Chevrolet Trax, and heightens concerns that the increasingly crowded list of new utility vehicles coming to market will create additional headaches for the industry.

GM plans to drop one of the three crews working at its San Luis Potosi plant in Mexico, spokesman Dan Flores confirmed in a telephone interview with CNBC. The factory produces the Equinox, GMC Terrain and Chevrolet Trax SUVs, all of which will see production cut. In addition, a factory in Ingersoll, Ontario that solely produces the Equinox will be idled for one week during late September.

The automaker is “focused on profitable sales and (we) want to do things that make good business sense. We're committed to running the business in a responsible manner,” Flores said. That echoes comments CEO Barra has made on several occasions that GM won't repeat a key mistake made in the run-up to the Great Recession. Rather than trimming production to meet demand, it relied on increasingly hefty incentives that ultimately ran up its losses and contributed to its eventual bankruptcy.

Ford echoed that approach in a statement, citing “long-standing practice of matching production with consumer demand” for its decision to curb operations at its Oakville, Ontario plant next month. The factory produces four SUVs — the Ford Flex, Ford Edge, Lincoln MKT and Lincoln Nautilus models. About 200 workers will be idled, and Ford cautioned further cuts could follow.

Honda, meanwhile, confirmed this week it has reduced production of its Accord and Civic models at its Marysville, Ohio plant. Nissan trimmed output in Canton, Mississippi, as well as its operations in Mexico in recent months, while also offering voluntary buyouts to an unspecified number of U.S. employees.

The second-largest Japanese automaker last month announced plans to cut production worldwide by 10% over the next three years, while eliminating 12,500 jobs. CEO Hiroto Saikawa told reporters during a news conference that “our situation right now is extremely severe.” A U.S. spokesman said Nissan has already made the necessary adjustments in the U.S., but several analysts said further cutbacks could be needed, pointing to the 8.3% decline in its sales for the first seven months of 2019.

Across the industry, the biggest cuts have focused on the passenger car side of the market. GM, for one, announced last November plans to close three North American assembly plants, while dropping an array of sedans including the Chevrolet Cruze and Impala, as well as the Cadillac CT6. The automaker's plant in Lordstown, Ohio has already been shuttered but one in Detroit is now scheduled to operate through at least early 2019.

The United Auto Workers Union has said the fate of the two U.S. plants will be a critical topic during contract talks with GM that began last month. During meetings on Capitol Hill last December, CEO Barra said the automaker has no plans to reverse its decision, however, and has already lined up a tentative buyer for the Lordstown factory.

What concerns industry observers is that there are signs demand for SUVs may be leveling off in some market segments, something signaled by recent cuts such as those of the four Ford utility vehicles.

Complicating matters, “While people are talking about fabulous SUV sales, the market is getting saturated with them and inventories are building while incentives are growing,” said Michelle Krebs, executive analyst with Autotrader.com.

Industry planners have been aggressively trying to manage inventories of unsold cars as sales have slowed this year. The numbers are now climbing up the high side of normal, ending July at a U.S. market average of around 67 days of stock, Krebs noted, up three days from May. The norm is closer to 60 days supply.

Traditionally, they've relied on incentives to hold down inventories and the numbers are rising. The average giveback in July was $3,911 per vehicle, according to research by Cox Automotive, a 4% year-over-year climb. On some pickups, meanwhile, the numbers have reached $10,000 or more.

But “this is an industry that remembers quite vividly what happened a decade ago,” said Stephanie Brinley, principal analyst with IHS Markit. Leading into the Great Recession, they kept ratcheting up the givebacks “to keep their plants running and production up. But they found there was a point where that eroded profitability to a point that couldn't be sustained.”

The challenge now, said Brinley, is to be “proactive,” and use production cuts to keep sales and inventories in balance, rather than waiting to be “reactive.”

Several industry executives, talking on background, said a key concern is what ongoing trade disputes could mean for the U.S. economy and, in particular, the auto market — a concern highlighted by the sharp downturn on Wall Street after the latest moves by the Trump administration and China.

There are other factors that could cause trouble. New car prices have reached record levels, at an average of around $33,000 for July, reported J.D. Power and Associates. Coming in $1,400 more than a year ago, that threatens to drive some potential buyers out of the market, Power said, at a time when there's a bubble of “nearly new” off-lease vehicles now flooding the market. Meanwhile, automotive interest rates have spiked to around 6%, according to data from tracking service Edmunds.

Barring an economic meltdown, analysts like David Andrea, a principal at Plante Moran, don't see more complete plant shutdowns in the works.

“Manufacturers are showing increased discipline going into the softening of the market,” he said, “but you'll see a lot more of these temporary reductions to keep inventories and incentives in check.”

Tag: Honda

Honda Celebrates 25 Years of Odyssey with 25th Anniversary Accessory Package and 10-Speed Automatic Transmission for All Trims

Searching for your content…

No results found. Please change your search terms and try again.

Honda’s new tactic for attracting first-time car buyers: esports

Original Article

PSA, Dongfeng to drop two China auto plants, halve workforce

Underperforming vehicles will be dropped as the Peugeot and Citroen lineups are streamlined around more profitable models, mirroring the European turnaround strategy now powering record margins in PSA’s home markets. BEIJING/PARIS: Peugeot maker PSA Group and partner Dongfeng Group have agreed to cut thousands of jobs in China and drop two of their four shared… Continue reading PSA, Dongfeng to drop two China auto plants, halve workforce

Exclusive: PSA, Dongfeng to drop two China auto plants, halve workforce – document

BEIJING/PARIS (Reuters) – Peugeot maker PSA Group (PEUP.PA) and partner Dongfeng Group (0489.HK) have agreed to cut thousands of jobs in China and drop two of their four shared assembly plants, according to a document seen by Reuters, in a last-ditch bid to curb mounting losses as the world’s largest auto market loses steam. FILE… Continue reading Exclusive: PSA, Dongfeng to drop two China auto plants, halve workforce – document

Musashi Seimitsu and KeraCel to develop 3D printed solid-state batteries for motorcycles

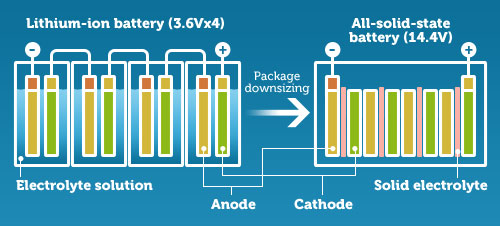

Musashi Seimitsu Industry, a Japanese automobile parts manufacturer, and advanced battery technology specialist KeraCel have formed a strategic partnership to accelerate the development of 3D printed solid-state batteries. As part of this partnership, Musashi has made an investment in KeraCel to advance its 3D printed batteries toward high volume production. Together, the partners will focus primarily on… Continue reading Musashi Seimitsu and KeraCel to develop 3D printed solid-state batteries for motorcycles

Honda to recall 222,674 Accord vehicles in China

FILE PHOTO: A staff member cleans a Honda’s Accord sedan at the booth of Guangzhou Automobile Group during the Auto China 2016 auto show in Beijing, China, April 26, 2016. REUTERS/Kim Kyung-Hoon/File Photo BEIJING (Reuters) – Honda Motor Co Ltd’s (7267.T) venture with Guangzhou Automobile Group Co Ltd (601238.SS) will recall 222,674 Accord sedans in… Continue reading Honda to recall 222,674 Accord vehicles in China

Honda pulls back Clarity PHEV outside California

As East Coast states try to catch California in plug-in car sales, they've lost another arrow in their quiver.

Honda switched from offering big incentives on Clarity Plug-In Hybrids in Northeastern States to shipping its entire U.S. allotment to California, according to a Honda spokeswoman.

“California is the largest market for plug-in hybrid vehicles. In order to meet customer demand, we are currently prioritizing supply of the Clarity Plug-in Hybrid in California, rather than allocating units for dealer inventory in other markets.” Honda spokeswoman Jessica Pawl told Green Car Reports in an email.

That poses a challenge—at least for now—for the nine Northeastern states that have signed on to follow California's emissions standards and plug-in vehicle mandate. Among those states are Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, and Vermont.

While nearly 8 percent of cars sold last year in California were electric or plug-in, barely 1 percent of those sold in those Northeastern states were, and most of those were Teslas.

2018 Honda Clarity PHEV Plugged into L1 in Corte Madera, Calif.

Even with generous incentives, Honda was unable to move enough Clarity PHEVs in the Northeast to make it worthwhile to sell the cars there.

California's ability to set its own emissions standards, which those other states follow, is coming under attack from the EPA and the NHTSA under the Trump administration. A new proposed fuel-economy rule that could freeze fuel-efficiency standards through 2026 was sent to President Trump for review last week, according to a report in The Washington Post.

The new rule is expected to be released after Labor Day, and it's no longer clear whether it may retain some more-modest annual fuel economy increases. The new rule also proposes to rescind the right California has had since 1970 under the Clean Air Act to set its own standards that other states can follow.

If that EPA waiver gets pulled the number of EVs available in the Northeast may become a moot point, but California and 16 other states (plus Washington D.C.) have already launched a lawsuit against the proposal.

Inside EVs forum users tracked Clarity VIN numbers and first noticed no new VINs were showing up outside of California. When Honda first announced the Clarity, the company said the Plug-in Hybrid would be available nationwide, and it was in 2018.

Pawl says dealers in any state can still order a Clarity PHEV.

NHTSA vs Tesla, Honda Clarity PHEV, EV sales, electric conversions: Today’s Car News

The NHTSA sent Tesla another letter asking it stop using misleading safety claims for the Model 3. Honda focuses sales of the Clarity Plug-in Hybrid in California. New forecasts peg 2037 as the year EV sales will overtake gasoline worldwide. And readers are still in favor of electric-car conversions in our latest Twitter poll. All this and more on Green Car Reports.

For the second time, the NHTSA told Tesla to stop making claims regarding its cars' performance in NHTSA crash tests, this time regarding the Model 3. Now the agency said it has forwarded its complaint to the Federal Trade Commission to investigate unfair and deceptive trade practices.

Honda confirms that it is focusing new sales of its Clarity Plug-in Hybrid in California, because it says that's where the buyers are.

A new report from normally EV-optimistic Bloomberg NEF forecasts that electric car sales will surpass those of gas cars worldwide in 2037, but it will take many more years for them to become the majority of cars on the road.

In response to our Twitter poll last week, readers said EV conversions of older cars are still relevant today, even in the face of new long-range models that are available from many major automakers.

After announcing last week that new 2020 Kia Optima Hybrid and Plug-in Hybrid will come standard with automatic emergency braking, the company recalled more than 11,000 2019 Optimas for a defect in the system.

Finally, add Bugatti to the ranks of boutique supercar-makers considering building an electric SUV. Out of four potential follow-ups to the Chiron, Automobile Magazine reports that the electric SUV is the leader.

_______________________________________

Follow Green Car Reports on Facebook and Twitter

Honda drivers can now get Amazon parcels delivered to the trunk of their car

HondaHonda drivers in the U.S. who use the auto firm's “cloud-based connected car system” can now get their Amazon parcels delivered to the trunk of their car.

In a statement earlier this week, Honda said that drivers with a subscription to the HondaLink Remote Services system and a compatible vehicle would be able to use the Key by Amazon app to select an “in-car” delivery option.

On the day of delivery, users of the service must park within two blocks of a selected delivery address. When it's confirmed that the car is in range of the address, a delivery driver will use its GPS location to determine the exact position.

The driver will then scan the package before sending a request for the vehicle to be unlocked so it can be dropped off. The vehicle is then re-locked and the customer is sent a notification to confirm the delivery was made and that their vehicle is secured. Customers need an Amazon Prime subscription to use the service, which is currently available in a select number of cities and surrounding areas.

Honda is the latest car company to utilize the system. Others include GMC and Volvo. The cars have to be 2015 models or newer and need connected service systems.

More broadly, innovation is transforming the way goods and services are delivered. Earlier this month, U.K. supermarket Waitrose announced it would be expanding the trial of its “While You're Away” delivery service.

Yale smart-lock technology gives Waitrose delivery drivers access to a customer's home. The customer sets a temporary access code for their lock, which is sent to Waitrose through a secure app.

This code is in turn sent to a driver's device for the time slot the customer has booked their delivery for and deleted when the delivery is made.

The driver packs refrigerated and frozen goods away and leaves other items on the kitchen counter, or wherever the customer has asked them to be left. A chest-cam worn by the driver records the delivery, with customers able to view the video upon request.