The Climate Policy Initiation (CPI India) on Wednesday released an update on India’s first-ever effort to track green investment flows, which are falling far short of the country’s current need for its ambitious climate targets.According to the new report, ‘Landscape of Green Finance in India’, the tracked green finance in 2019-2020 was Rs 309,000 crore… Continue reading India needs to quadruple climate finance: Study

Tag: Mobility

Ola plans mass market scooter

A three-month dip in monthly numbers on the trot has pushed Ola to rejig its strategy and eye the mass market with its second offering that it plans to introduce on Independence day and targeted “at the fast-growing Rs 80,000 to 95,000 price range”, a highly placed company official has said. Ola’s CEO Bhavish Aggarwal… Continue reading Ola plans mass market scooter

@BMW: BMW Group backs sustainable packaging in its logistics002192

+++ Increase in proportion of recycled material in packaging +++ Nikolaides, Head of Logistics: “We are leveraging various options to save carbon emissions and raw materials.” +++ Other pilot projects underway +++ Munich. The BMW Group has implemented several projects in its packaging logistics to further save resources. With these projects, the Group aims… Continue reading @BMW: BMW Group backs sustainable packaging in its logistics002192

Trimble RTX Integrity Validates Positioning Data Accuracy to Support Safety-Critical Applications

Providing Even More Reliable Measurements for Users of Trimble CenterPoint RTX Fast Networks in North America and Europe SUNNYVALE, Calif., Aug. 11, 2022 /PRNewswire/ — Trimble (NASDAQ: TRMB) introduced today data integrity monitoring for its precise point positioning (PPP) correction service, CenterPoint® RTX Fast. The Trimble RTX Integrity™ monitoring system is an innovative, patented solution, built… Continue reading Trimble RTX Integrity Validates Positioning Data Accuracy to Support Safety-Critical Applications

Gogoro Releases Second Quarter 2022 Financial Results

TAIPEI, Taiwan, Aug. 11, 2022 /PRNewswire/ — Gogoro Inc. (Nasdaq: GGR), a global technology leader in battery swapping ecosystems that enable sustainable mobility solutions for cities, today released its financial results for its second quarter ended June 30, 2022. Second Quarter Highlights Revenue of $90.7 million, up 5.3% year-over-year despite the impact of COVID and… Continue reading Gogoro Releases Second Quarter 2022 Financial Results

MAINE’S EASTERN TRAIL SELECTED AS ONE OF THE NATION’S BEST RAIL-TRAILS

The popular Maine trail to join elite group as 36th inductee in Rails-to-Trails Conservancy’s national Rail-Trail Hall of Fame WASHINGTON, Aug. 11, 2022 /PRNewswire/ — Rails-to-Trails Conservancy (RTC), the nation’s largest trails organization, today announced that Maine’s Eastern Trail would join its Rail-Trail Hall of Fame—an exemplary group of rail-trails nationwide celebrated for the social, economic… Continue reading MAINE’S EASTERN TRAIL SELECTED AS ONE OF THE NATION’S BEST RAIL-TRAILS

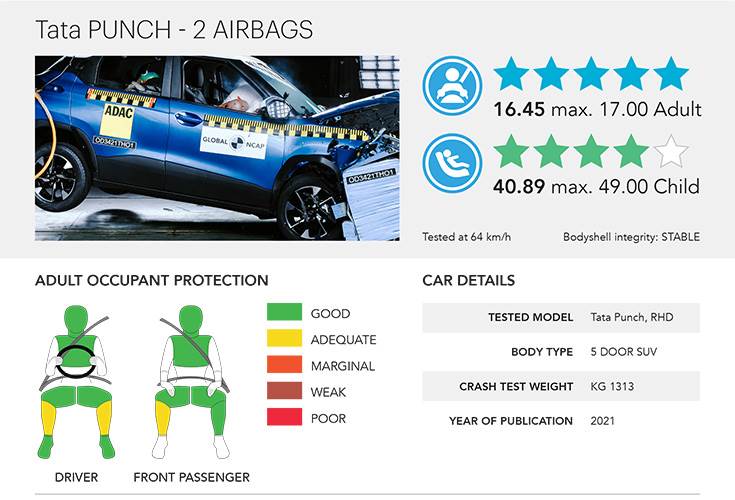

Tata Punch punches past 100,000 sales in just 10 months

Tata Motors today rolled out the 100,000th unit of the Tata Punch compact SUV from its manufacturing facility in Pune. July 2022 was a record month for the carmaker which recorded its best-ever monthly sales: 47,505 units, up 57% year on year. The Punch compact SUV contributed 23% to the total with 11,007 units. With this kind… Continue reading Tata Punch punches past 100,000 sales in just 10 months

MAHLE and Siemens join forces to accelerate wireless charging tech for EVs

MAHLE, the technology group, and Siemens have signed a declaration of intent for cooperation in the area of wireless charging systems for electric vehicles. In the future, both companies will jointly develop and test complete infrastructure and automotive engineering systems. One of the areas of focus will be on promoting technological standards for inductive charging… Continue reading MAHLE and Siemens join forces to accelerate wireless charging tech for EVs

Solar E-Bike Market to Reach $6.01 Billion, Globally, by 2040 at 13.7% CAGR: Allied Market Research

Factors such as favorable government regulations and policies to encourage the use of solar e-bikes, surge in fuel costs, and increase in interest in cycling as a fitness & recreational activity is anticipated to boost the growth of the solar e-bike market growth PORTLAND, Ore., Aug. 11, 2022 /PRNewswire/ — Allied Market Research published a report,… Continue reading Solar E-Bike Market to Reach $6.01 Billion, Globally, by 2040 at 13.7% CAGR: Allied Market Research

UFODrive Expands EV Rental Business to the U.S.

As UFODrive plans further expansion in North America, it has partnered with Inspiration Fleet, an EV-only fleet management company, to accelerate the transition to electric vehicles. Photo: UFODrive UFODrive announced the launch of its first U.S. city on August 4, starting with San Francisco. The electric vehicle rental has seen rapid growth in 20 cities across Europe already. Now, Bay area… Continue reading UFODrive Expands EV Rental Business to the U.S.