9 November 2017

New figures released today by the Finance & Leasing Association (FLA) show that new business volumes in the point of sale (POS) consumer new car finance market fell by 11% in September, compared with the same month in 2016, while the growth in the value of new business was flat over the same period. In Q3 2017 overall, new business was up 1% by value, but fell 9% by volume.

The percentage of private new car sales financed by FLA members through the POS held steady at 86.0% in the twelve months to September.

The POS consumer used car finance market reported new business in September up 9% by value and 3% by volume, compared with the same month last year.

Commenting on the figures, Geraldine Kilkelly, Head of Research and Chief Economist at the FLA, said:

“The performance of the POS consumer new car finance market in September continued to reflect recent trends in private new car sales.

“Despite subdued consumer confidence, new business volumes in the POS consumer car finance market overall were stable in the first nine months of 2017, compared with the same period in 2016.”

Table 1: Cars bought on finance by consumers through dealerships

New business

Sep 2017

% change on prev. year

3 months to Sep 2017

% change on prev. year

12 months to Sep 2017

% change on prev. year

New cars

Value of advances (£m)

2,869

0

4,898

+1

18,358

+3

Number of cars

144,143

-11

254,167

-9

985,382

-5

Used cars

Value of advances (£m)

1,277

+9

3,849

+11

14,663

+10

Number of cars

110,000

+3

337,170

+5

1,303,848

+5

Table 2: Cars bought on finance by businesses

New business

Sep 2017

% change on prev. year

3 months to Sep 2017

% change on prev. year

12 months to Sep 2017

% change on prev. year

New cars

Number of cars

41,827

-16

119,873

-6

505,930

-1

Used cars

Number of cars

3,862

-8

16,397

+34

58,492

+34

Note to editors:

In 2016, FLA members provided £118 billion of new finance to UK businesses and households. £88 billion of this was in the form of consumer credit, over a third of total new consumer credit written in the UK in 2016. £41 billion of it supported the purchase of new and used cars, including over 86% of private new car registrations. 2. For media enquiries, please contact the FLA press office on 020 7420 9656.

Tag: Financial Results

Second charge mortgage repossessions remain low

10 May

New figures released today by the Finance & Leasing Association (FLA) show that the number of second charge mortgage repossessions in Q1 2018 was 46, up from 25 in the first quarter of 2017.

The rate of second charge mortgage repossessions (as a percentage of outstanding agreements) was 0.09% in the twelve months to March 2018.

Commenting on the figures, Fiona Hoyle, Head of Consumer and Mortgage Finance at the FLA, said:

“The increase in second charge mortgage repossessions in the first quarter of 2018 was from a low base. We expect the number of repossessions in this market to remain low in 2018 as a whole.

“As always, any customer worried about making payments should speak to their lender, because the sooner contact is made, the easier it is to find a solution.”

Table 1: The number of actual properties taken into possession by FLA second charge mortgage providers1

Time period

Number of possessions in the quarter

% change on the same quarter in the previous year

Annual total

% change on the previous year

2008 Total

2009 Total

2010 Total

2011 Total

2012 Total

2013 Total

Q1 2014

Q2 2014

Q3 2014

Q4 2014

Q1 2015

Q2 2015

Q3 2015

Q4 2015

Q1 2016

Q2 2016

Q3 2016

Q4 2016

Q1 2017

Q2 2017

Q3 2017

Q4 2017

Q1 2018

128

133

107

79

72

67

56

33

34

40

31

39

25

39

34

38

46

-43.4%

-27.3%

-25.7%

-35.8%

-43.8%

-49.6%

-47.7%

-58.2%

-52.8%

-40.3%

-44.6%

18.2%

-26.5%

-2.5%

9.7%

-2.6%

84.0%

1,612

1,467

864

827

6282

676

447

228

144

136

-9.0%

-41.1%

-4.3%

-24.1%2

7.6%2

-33.9%

-49.0%

-36.8%

-4.9%

Possession proceedings arising from FLA members’ second charge mortgage books, which have led to actual possession by the second mortgage provider.There were changes to the sample in Q1 2012 and Q1 2013 due to changes in FLA membership.Figures for 2017 have been revised since the previous issue.

Consumer finance new business holds steady in March

11 May 2018

New figures released today by the Finance & Leasing Association (FLA) show that consumer finance new business in March was at a similar level to that reported in March 2017, and grew 6% in Q1 2018 as a whole.

Credit card and personal loan new business together grew in March by 7%, compared with the same month in the previous year, while retail store and online credit new business increased by 4%. The point of sale finance sector reported a fall in new business in March of 6% compared with the same month in 2017.

Commenting on the figures, Geraldine Kilkelly, Head of Research and Chief Economist at the FLA, said:

“The latest consumer finance new business figures were in line with recent trends in the wider economy, with household spending likely to have been adversely affected by poor weather conditions. FLA consumer finance providers’ penetration of the UK new consumer credit market held steady in the twelve months to March 2018 at 35.6%.”

Table 1: New consumer credit lending

Mar 2018

% change on prev. year

3 months to Mar 2018

% change on prev. year

12 months to Mar 2018

% change on prev. year

Total FLA consumer finance (£m)

10,381

0

25,786

+6

97,820

+6

Data extracts:

Retail store and online credit (£m)

719

+4

2,022

+8

9,136

+9

Credit cards & personal loans (£m)

4,357

+7

12,664

+10

49,010

+7

Second charge mortgages (£m)

86

-10

244

0

1,023

+15

Car finance (£m)

4,849

-5

9,894

+3

34,522

+4

Note to editors:

FLA members in the consumer finance sector include banks, credit card providers, store card providers, second-charge mortgage lenders, motor finance providers, personal loan and instalment credit providers.In 2017, FLA members provided £128 billion of new finance to UK businesses and households. £96 billion of this was in the form of consumer credit representing over a third of total new consumer credit written in the UK in 2017.For media enquiries, please contact the FLA press office on 020 7420 9656.

Asset finance new business more than £3.3 billion in March

11 May 2018

New figures released today by the Finance & Leasing Association (FLA) show that asset finance new business (primarily leasing and hire purchase) fell by 5% in March, compared with the same month last year, and by 3% in Q1 2018 overall.

New finance for business equipment grew in March by 13% compared with the same month in 2017. Over the same period, the plant and machinery finance and commercial vehicle finance sectors reported falls in new business of 9% and 2% respectively.

Commenting on the figures, Geraldine Kilkelly, Head of Research and Chief Economist at the FLA, said:

“The asset finance market recorded its third highest monthly new business total in March at more than £3.3 billion. However, the latest figures reflect some of the recent slowdown in the UK economy, with new finance for agricultural and construction equipment 1% and 8% lower in March than in the same month in 2017.”

Mar 2018

% change on prev. year

3 months to Mar

2018

% change on prev. year

12 months to Mar

2018

% change on prev. year

Total FLA asset finance (£m)

3,325

-5

7,668

-3

31,459

+3

Total excluding high value (£m)

3,229

-3

7,316

-1

29,782

+3

Data Extracts:By asset:

Plant and machinery finance (£m)

654

-9

1,652

-1

6,561

+7

Commercial vehicle finance (£m)

849

-2

1,813

-4

7,412

-1

IT equipment finance (£m)

196

-24

497

-3

2,318

+2

Business equipment finance (£m)

259

+13

622

+1

2,586

+5

Car finance (£m)

1,041

-7

2,200

-3

9,357

+2

Aircraft, ships and rolling stock finance (£m)

33

-39

66

-61

448

-18

By channel:

Direct finance (£m)

1,652

+1

3,693

-1

14,940

+1

Broker-introduced finance (£m)

579

-4

1,451

+4

5,720

+8

Sales finance (£m)

998

-10

2,172

-2

9,122

+4

By product:

Finance leasing (£m)

406

-1

914

+4

3,843

+5

Operating leasing (£m)

714

-13

1,531

-11

6,534

-3

Lease/Hire purchase (£m)

1,835

+1

4,151

0

16,865

+4

Other finance (£m)

304

-19

824

-14

3,150

-6

Note to editors:

In 2017, FLA members provided £128 billion of new finance to UK businesses and households. £32 billion of finance was provided to businesses and the public sector. FLA members financed more than a third of UK investment in machinery, equipment and purchased software in the UK in 2017.For media enquiries, please contact the FLA press office on 020 7420 9656.

BMW recalls 168,000 GS motorcycles

BMW Motorrad advertises its bestseller GS with absolute reliability. Now, the last five years of travel enduro have to go to the workshops – because of a dangerous and, above all, well-known design flaw. Off to the workshop: All BMW R 1200s from the years 2013-2017 Tuesday, 04.07.2017 11:43 clock The trouble started at the… Continue reading BMW recalls 168,000 GS motorcycles

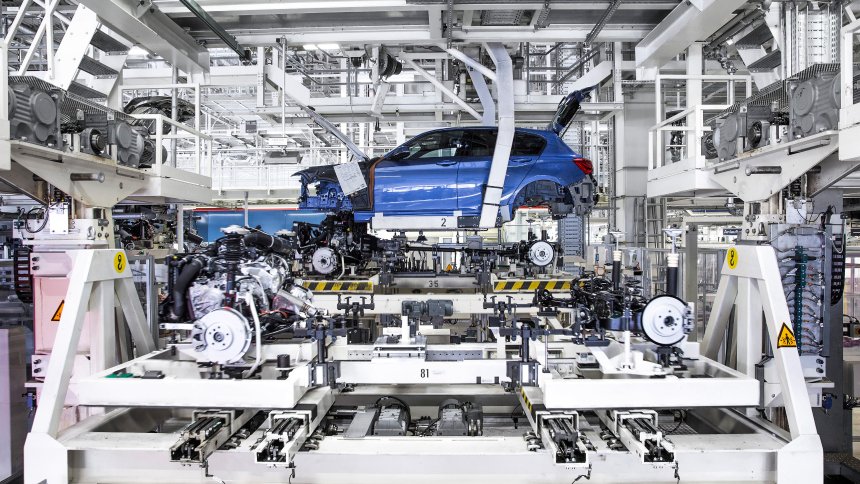

BMW and Bosch are negotiating damages

The delivery problems at the end of May are expensive for Bosch. Because BMW wants to have replaced the damage caused by the forced stop of production. It’s about millions. BMW production in Leipzig Friday, 07.07.2017 1:52 pm BMW calls for the loss of production due to lack of steering gear compensation from its supplier… Continue reading BMW and Bosch are negotiating damages

Vauxhall Astra review

Strong diesel engines and punchy petrols combine well with Astra’s composed chassis Unlike many rivals, the Vauxhall Astra is not only built in the UK, it had its chassis tuned for UK roads. In fact, Auto Express was invited on an early chassis development drive to give initial feedback that the Astra was going in… Continue reading Vauxhall Astra review

TI Automotive Acquisition Completed By Bain Capital

AUBURN HILLS, Mich. (June 30, 2015) – TI Automotive, a leading provider of automotive fluid storage, carrying and delivery systems for passenger cars and light trucks, today announced the completion of the acquisition of the company by affiliates of Bain Capital, a leading global private investment firm. Financial terms of the private transaction, which was… Continue reading TI Automotive Acquisition Completed By Bain Capital

2014 record year for Automobili Lamborghini in sales and turnover

LATEST NEWS

SUBSCRIBE TO RSS FEED

XML

MORE INFO

DOWNLOAD

MEDIA CART

MORE INFO

DOWNLOAD

MEDIA CART

ADD ALL TO MEDIA CART

DOWNLOAD ALL

of

MORE INFO

DOWNLOAD

MEDIA CART

MORE INFO

DOWNLOAD

MEDIA CART

In the fiscal year 2014 Automobili Lamborghini S.p.A. again improved its key financial figures and reached new records in terms of sales and turnover in its history of more than 50 years. Worldwide deliveries to customers increased from 2.121 to 2.530 units: a growth of 19 percent. Turnover showed an even stronger growth of 24 percent from 508 million euros to 629 million euros. The over-proportional growth in turnover is due to a continuing high demand for the Lamborghini Aventador and the very successful market introduction of the new Huracán.

“For the fourth year in row Automobili Lamborghini delivered a very satisfying performance. The record values underline the attractiveness of our model portfolio as well as the strength of our global brand, product and commercials trategy,” said Stephan Winkelmann, President and CEO of AutomobiliLamborghini S.p.A.

Production at the Sant'Agata Bolognese headquarters is already used to capacity for the current year 2015.

In order to assure its commitment to innovation and in preparation for future growth, the long-established Italian super sports car company maintains its investment in research and development and in factory premises. Despite an above average rate of investment of over 20% compared to the industry the company also made a profit in the year 2014.

Winkelmann underlined: “Today the company is driving towards the future from a very solid economic base. With our very attractive model mix, on-going anticipated investment and stable markets, we anticipate a phase of solid growth in the medium term.”

SEE MORE

SEE LESS

RELATED

Press Release (English)

Automobili Lamborghini: vendite e fatturato record nel 2014

Rekordwerte für Automobili Lamborghini in 2014 bei Absatz und Umsatz

Lamborghini Media Centre

RELATED

Press Release (English)

Automobili Lamborghini: vendite e fatturato record nel 2014

Rekordwerte für Automobili Lamborghini in 2014 bei Absatz und Umsatz

Lamborghini Media Centre

MORE FROM LATEST NEWS

SUBSCRIBE TO RSS FEED

XML

Proto, Piscopo Claim PRO Class Win With Dramatic Late Move

Proto, Piscopo Focus on Consistency, Not Championship at VIR

Lamborghini Super Trofeo North America Round 6 Recap From Road America

SEE ALL

Important awards for Audi

“ J. D. Power Report 2018: Audi Q5 has the most satisfied drivers The annual customer satisfaction studies from international market research institute J.D. Power, which have also been conducted in Germany since 2002, are well respected in the automotive sector. The Audi Q5 won the compact SUV category in the Vehicle Dependability Study, the… Continue reading Important awards for Audi