SHANGHAI, China, Jan. 24, 2019 (GLOBE NEWSWIRE) — NIO Inc. (“NIO” or the “Company”) (NYSE: NIO), a pioneer in China’s premium electric vehicle market, today announced that its founder, chairman and chief executive officer, Mr. William Li, transferred an aggregate amount of 50 million ordinary shares, consisting of (i) 189,253 class A ordinary shares and (ii)… Continue reading NIO Inc. CEO Transferred 50 Million Shares to the Newly Established NIO User Trust

Tag: Financial Results

UPDATE 3-Hyundai Motor suffers first net loss in 8 years as China sales skid

SEOUL (Reuters) – South Korea’s Hyundai Motor (005380.KS) surprised the market on Thursday by posting its first quarterly net loss in at least eight years as its vehicle sales slumped in the key China market. FILE PHOTO – Hyundai Motor’s vehicles are displayed at a Hyundai Motorstudio in Goyang, South Korea May 29, 2017. REUTERS/Kim… Continue reading UPDATE 3-Hyundai Motor suffers first net loss in 8 years as China sales skid

Europcar’s Mobility Joins Smart Cities Platform

Nicolas Bailleux, who recently joined Europcar Mobility Group as head of the Mobility Lab, will oversee the partnership. Photo courtesy of Europcar. Europcar Mobility Group is forming a partnership between its Mobility Lab and Plug And Play, a long-standing incubator with roots in Silicon Valley. Europcar Mobility Group intends to leverage the Plug And Play… Continue reading Europcar’s Mobility Joins Smart Cities Platform

Hyundai Motor swings to Q4 loss as overseas sales tumble

Go to Source

Isuzu PH to Stop Local Isuzu D-Max Production – Yahoo News

“The actual number of CKDs in PH is going down,” said IPC Sales Division head Joseph Bautista. “We don’t have enough economy of scale.” Aside from the discontinued assembly, IPC has also withdrawn the Isuzu D-Max from the government’s Motor Vehicle Development Program, “with the last CKD production sometime in July this year.” Currently, the… Continue reading Isuzu PH to Stop Local Isuzu D-Max Production – Yahoo News

Fisker aims to offer $40,000 EV by 2021 – Automotive News Europe

Henrik Fisker wants the company that carries his family name to offer a high-volume, “more affordable” full-electric model that will sold globally by 2021. The former BMW and Aston Martin designer, who had a bumpy ride when his previous company, Fisker Automotive, entered the EV sector in 2011 with the Karma, is bullish about the… Continue reading Fisker aims to offer $40,000 EV by 2021 – Automotive News Europe

Ford misses profit estimates as pension and layoff costs erode earnings

Daniel Acker | Bloomberg | Getty Images

A Ford Motor Co. Explorer Hybrid sports utility vehicle (SUV) is displayed during the 2019 North American International Auto Show (NAIAS) in Detroit, Michigan, U.S., on Monday, Jan. 14, 2019.

Ford's reorganization plans showed up in its fourth-quarter earnings Wednesday as pension and layoff costs eroded the company's profit and caused it to miss earnings estimates — despite posting stronger-than-expected sales.

The Detroit automaker has been struggling overseas, and that was apparent in the fourth quarter. While Ford grew its revenue in North America by $1.7 billion, it fell in every other region across the globe. It lost market share in every major market in South America except Peru. Unfavorable exchange rates and a drop in sales volume also hurt Ford's bottom line, especially in Europe and Asia.

Ford also said it faced financial headwinds of $750 million from tariffs, another $1.1 billion from commodities costs, $750 million in unfavorable foreign exchange, and $775 million related to recalls announced last year in North America, said Ford Chief Financial Officer Bob Shanks on a conference call after the automaker released results.

Here's how the company did compared with what Wall Street expected, based on average estimates compiled by Refinitiv:

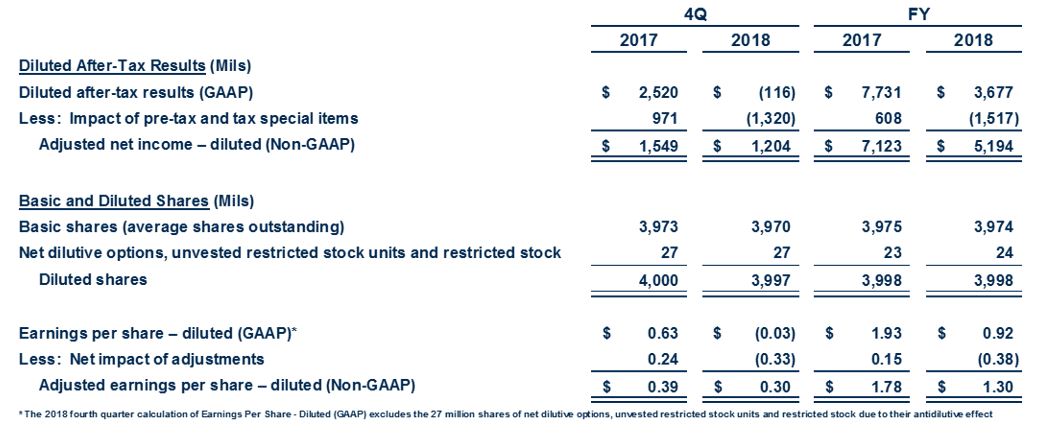

— Adjusted earnings per share of 30 cents vs. a forecast of 32 cents per share

— Automotive segment revenue: $38.7 billion vs. a forecast of $36.88 billion

Ford took a $1.18 billion charge for “special items” that were excluded from its adjusted earnings. The charges stem mostly from pension and layoff costs. On an unadjusted basis, Ford lost $116 million, or 3 cents a share, during the fourth quarter. It generated a profit of $2.52 billion, or 63 cents per share, a year earlier.

The company's total revenue was $41.8 billion during the quarter, slightly higher than its $41.3 billion in revenue during the same quarter last year.

“While 2018 was a challenging year, we put in place key building blocks to build a more resilient and competitive business model that can thrive no matter the economic environment,” Shanks said in a statement.

Despite the losses, Ford expects to be able to fully fund its business and capital needs in 2019, while keeping cash and liquidity at or above target levels, Shanks said.

On an adjusted basis, the company earned 30 cents a share, which missed analyst expectations of 32 cents per share, according to analysts surveyed by Refinitiv. It was also less than the 39 cents a share the company reported in the same quarter of 2017.

Ford's shares have been under pressure all year, tumbling by about 22 percent over the last 12 month, closing at $8.34 a share Wednesday.

The automaker is undergoing an $11 billion restructuring plan that has so far involved trimming back international operations, making investments in new mobility technologies, and realigning its portfolio around more profitable vehicles.

That strategy includes doubling down on segments where Ford has historically been strongest — trucks, utilities, and muscle cars. The automaker unveiled a refreshed version of its best-selling Explorer sport utility vehicle at the Detroit auto show and is also broadening its Mustang lineup.

Ford also said it is partnering with German automaker Volkswagen on a number of initiatives, shortly after announcing job cuts across its European operations. The first agreement the two firms signed appeared to benefit VW more than Ford, said Jeffries analyst Philippe Houchois. But it allows Ford to remain in its most profitable businesses in Europe while cutting costs and pulling out of areas where it is failing.

“The issue that Ford has had around the world is that everywhere they operate, Ford's business is a mix of good and bad,” Houchois said in an interview Tuesday. Ford's position in Europe is different from that of rival General Motors, which decided nothing in Europe was worth salvaging when it sold its operations in the region to French automaker Groupe PSA.

“For Ford it is more complicated,” Houchois said. Ford's commercial van business is significantly smaller than its F-150 pickup truck franchise, but it's probably the company's second-most profitable product and its market share in Europe is key. “So they can't just pull out of Europe. They have to find ways of being sustainable there, which is more complicated, but could have some benefit long term.”

The company is holding a conference call with CEO Jim Hackett and other executives at 5:30 p.m. ET to discuss the results.

This story is breaking news. Please check back for updates.

Pensions, one-time charges push Ford to fourth-quarter loss

DETROIT, Jan 23 (Reuters) – Ford Motor Co on Wednesday posted a fourth-quarter loss, which it attributed partly to one-time charges, including pension-related costs. The No. 2 U.S. automaker posted a loss of $116 million or 3 cents a share, down from a net profit of $2.5 billion or 63 cents a share in the… Continue reading Pensions, one-time charges push Ford to fourth-quarter loss

Ford Details Commitment to Global Redesign — Reshaping Overseas Operations and Strengthening North America

Ford reshaping company to lead the future of transportation and mobility Company strategy centers on high-growth product segments, electrified propulsion, autonomous vehicles, mobility services, operational fitness and high-performance culture Global wave of new products in fastest growing and most profitable segments, with more than 20 new Ford and Lincoln products in North America over the… Continue reading Ford Details Commitment to Global Redesign — Reshaping Overseas Operations and Strengthening North America

Ford Surpasses 1 Million Truck Sales in 2018

Ford extended its market dominance in trucks again in 2018 with more than 1.075 million F-Series sold globally Using average U.S. transaction pricing of $46,700, F-Series estimated sales revenue of $50 billion would be greater than the 2018 revenues of Fortune 500 companies including Oracle, American Express or Best Buy DEARBORN, Mich., Jan. 12, 2019… Continue reading Ford Surpasses 1 Million Truck Sales in 2018