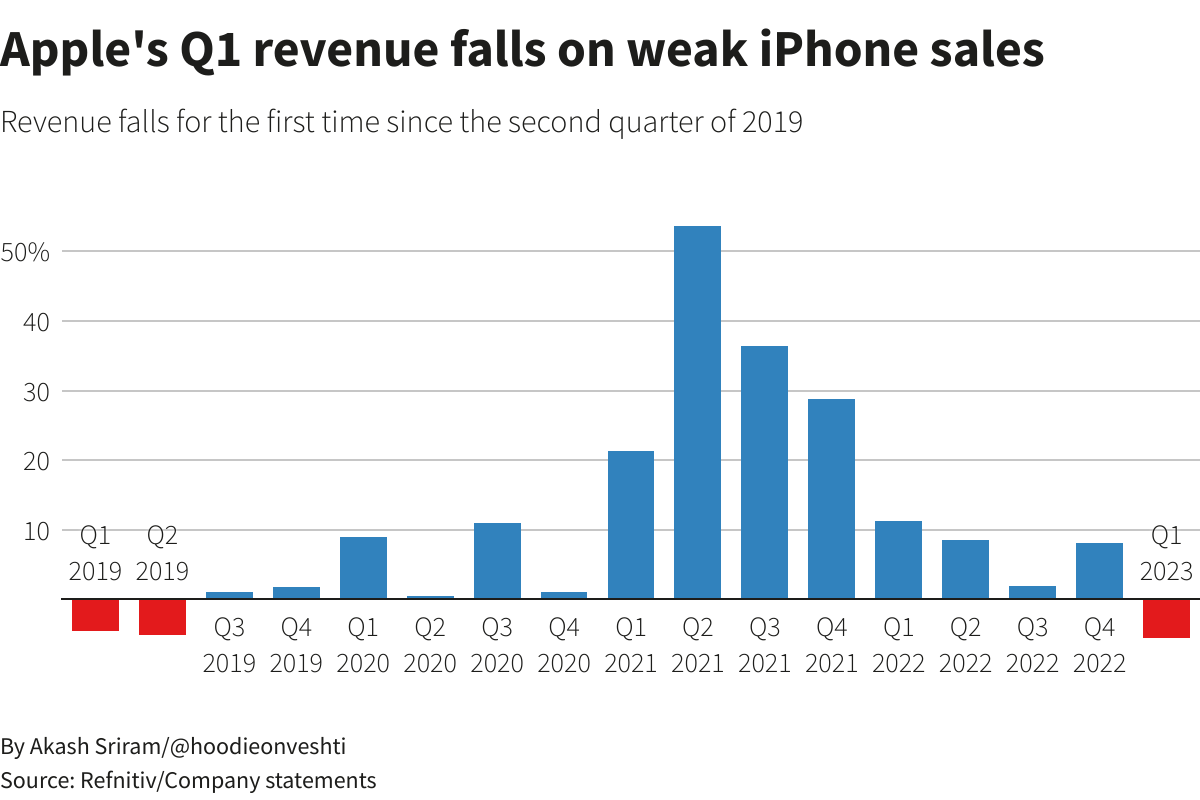

Feb 2 (Reuters) – Apple Inc (AAPL.O) on Thursday reported sales and profits that missed Wall Street expectations driven by weak iPhone sales after COVID lockdowns in China disrupted production of the company’s biggest seller. Shares of Apple fell 4% after publication of the results. Apple sales fell 5% to $117.2 billion and were down… Continue reading Apple’s weak iPhone sales drive first profit miss since 2016, article with image

Tag: Financial Results

Alphabet revenue misses estimates as ad business takes a hit, article with gallery

Feb 2 (Reuters) – Alphabet Inc (GOOGL.O) on Thursday reported lower-than-expected quarterly revenue as the Google parent’s digital ad business struggled under an economic slowdown that has choked corporate spending and triggered mass layoffs. Shares of Alphabet, which lost roughly 40% of their value in 2022, were down about 4% in after-hours trading. Revenue from… Continue reading Alphabet revenue misses estimates as ad business takes a hit, article with gallery

Qualcomm forecasts earnings a bit below expectations, shares rise, article with gallery

BANGALORE/OAKLAND Calif. Feb 2 (Reuters) – Qualcomm Inc (QCOM.O) forecast second-quarter revenue and profit below Wall Street estimates on Thursday, but the outlook was not as bleak as those from other chip makers. The stock rose 2.7% in after-hours trading. While inflation and macroeconomic uncertainty has hurt consumer electronics sales, Qualcomm has been buffered by… Continue reading Qualcomm forecasts earnings a bit below expectations, shares rise, article with gallery

Ford sales up 2% in January, boosted by record EV sales

Ford Motor Co.’s U.S. sales rose 2% year-over-year in January, boosted by record sales of its all-electric vehicles, which more than doubled over that period. The Dearborn automaker reported Thursday that it sold 146,356 new vehicles in the U.S. last month. Of those sales, the vast majority — 133,293, or 91% — came from internal… Continue reading Ford sales up 2% in January, boosted by record EV sales

BYD expects quadrupled 2022 net profit

People experience a BYD Han electric car during a media preview of the 100th Brussels Motor Show in Brussels, Belgium, Jan 13, 2023. [Photo/Xinhua] SHENZHEN — China’s leading new energy vehicle manufacturer BYD Company Limited expects to see drastic rises in both revenue growth and net profit in 2022. The company’s 2022 net profit is… Continue reading BYD expects quadrupled 2022 net profit

Global Report on Electric Vehicle Supply Equipment Market Size & Share Worth USD 210 Billion, to Record a 33.2% CAGR by 2028 | Electric Vehicle Supply Equipment Industry Trends, Segmentation, Analysis & Forecast by FnF

NEW YORK, Feb. 2, 2023 /PRNewswire/ — As per Facts and Factors study, The global electric vehicle supply equipment market is estimated to grow at a compound annual growth rate (CAGR) of 33.2%. In 2021, the global electric vehicle supply equipment market was estimated at USD 32.5 billion, and by 2028, it is predicted to… Continue reading Global Report on Electric Vehicle Supply Equipment Market Size & Share Worth USD 210 Billion, to Record a 33.2% CAGR by 2028 | Electric Vehicle Supply Equipment Industry Trends, Segmentation, Analysis & Forecast by FnF

Business Jets Market Size to Reach USD 41.89 Billion in 2030 | Emergen Research

VANCOUVER, BC, Feb. 2, 2023 /PRNewswire/ — The global business jets market size reached USD 28.73 Billion in 2021 and is expected to register a CAGR of 4.2% during the forecast period, according to latest analysis by Emergen Research. Increasing demand for sustainable aviation fuel is a major factor driving the market revenue growth. Market… Continue reading Business Jets Market Size to Reach USD 41.89 Billion in 2030 | Emergen Research

Satellite Communication System Market to Reach $61.5 Billion, Globally, by 2031 at 9.5% CAGR: Allied Market Research

Satellite communication systems have gained popularity in recent years due to their ability to provide communication services to remote and underserved areas. Additionally, increasing demand for global connectivity and growing adoption of the Internet of Things (IoT) devices have also contributed to the increased use of satellite communication systems. PORTLAND, Ore., Feb. 2, 2023 /PRNewswire/… Continue reading Satellite Communication System Market to Reach $61.5 Billion, Globally, by 2031 at 9.5% CAGR: Allied Market Research

Global Memory Device Market to Hit $376.84 Billion by 2030: Cognitive Market Research

CHICAGO, Feb. 2, 2023 /PRNewswire/ — The Global Memory Device Market size is projected to be USD 376.84 Billion by 2030 growing at a CAGR of 16.2 % from 2023 to 2030, as per a recent report by Cognitive Market Research. Major players operating in this market are trying to reach global customers by collaborating with… Continue reading Global Memory Device Market to Hit $376.84 Billion by 2030: Cognitive Market Research

Dusit Hotels and Resorts all set for Japan and Europe debut – plus more new properties slated to open in key destinations this year

Fourteen hotels and resorts are set to be added to Dusit’s portfolio this year across China, Greece, India, Japan, Kenya, Nepal, and Thailand. BANGKOK, Feb. 2, 2023 /PRNewswire/ — Dusit Hotels and Resorts under Dusit International, one of Thailand’s leading hotel and property development companies, has announced its expansion plans for 2023, including debuting its… Continue reading Dusit Hotels and Resorts all set for Japan and Europe debut – plus more new properties slated to open in key destinations this year