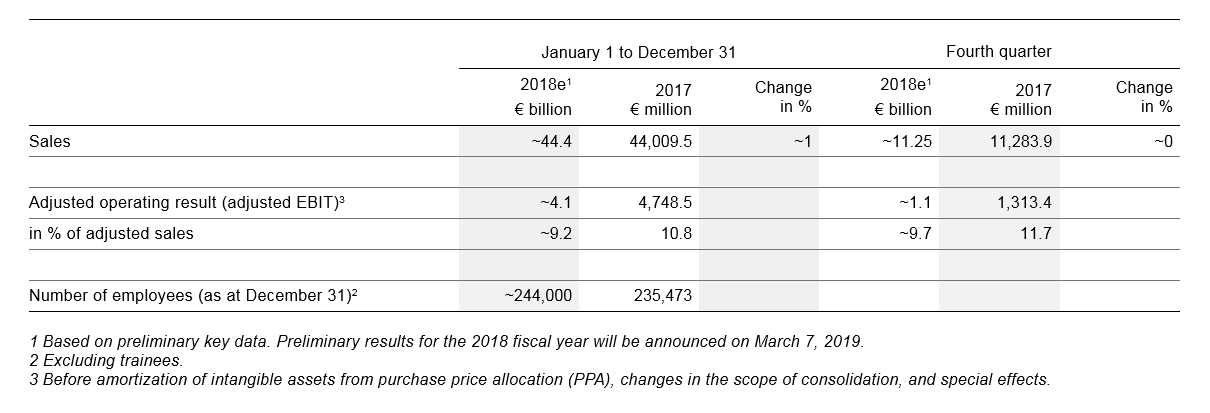

Stable operating performance in fourth quarter as expected Annual sales rise to around €44.4 billion (organic growth at about 3 percent) Adjusted EBIT for the year: around €4.1 billion (margin at about 9.2 percent) Free cash flow was higher than expected at about €1.8 billion 2019 outlook: Consolidated sales of about €45 to €47 billion at… Continue reading Continental Achieves Annual Targets

Tag: Financial Results

Auto parts supplier: Continental expects falling margins

Continental AG Automotive supplier Continental expects shrinking margins. (Photo: AP) MunichThe auto supplier Continental is preparing for increased pressure on its margins in the new year. The company from Hanover expects only an adjusted return on earnings before interest and taxes (EBIT margin) of between eight and nine percent for 2019, such as Conti announced… Continue reading Auto parts supplier: Continental expects falling margins

China car sales hit reverse for first time since 1990s

BEIJING/SHANGHAI (Reuters) – Car makers in China will face more fierce competition this year, after a tough 2018 when the world’s biggest auto market contracted for the first time in more than two decades, the country’s top auto industry association said on Monday. FILE PHOTO: Newly manufactured cars are seen at the automobile terminal in… Continue reading China car sales hit reverse for first time since 1990s

Latest in Ford-VW buzz: Hackett says VW might make Fords in Europe – Detroit Free Press

Detroit Free Press staff Published 9:19 p.m. ET Jan. 13, 2019 | Updated 9:50 p.m. ET Jan. 13, 2019 CLOSE Analysts note that the car companies recently initiated talks about small partnerships, but each may be motivated to think big because of their limited product lines and limited regional scope. Wochit One of the big stories at… Continue reading Latest in Ford-VW buzz: Hackett says VW might make Fords in Europe – Detroit Free Press

Ford’s CEO says a ‘big surprise’ is coming next year with electric vehicles

Ford CEO Jim Hackett on restructuring, going electric and China's slowdown

2 Hours Ago | 10:00

Ford Motor is gearing up to launch new electric cars as soon as next year, CEO Jim Hackett told CNBC on Sunday.

Ford has previously announced its plans to invest $11 billion in electric vehicles by 2022 and produce 40 hybrid and fully electric cars, in a plan to revive its slowing business. However, the company's chief told CNBC that drivers should be prepared for 'a big surprise' from Ford.

“We talked about a huge investment in electric vehicles. We have 16 models that are in design and development. We have a pretty big surprise coming next year,” Hackett told CNBC's Phil LeBeau on the sidelines of the Detroit Auto Show, which kicks off this week.

During the first nine months in 2018, Ford's profit dropped a whooping 27 percent from the same period in 2017. Shares of Ford, which tumbled 39 percent in 2018, are hunkered under $10 a share for the first time since 2012.

“Some of the pain in the margins additionally [is] because the vehicles are old. We have on average the oldest fleet in the industry and we are going to have average the newest fleet. 75 percent of the portfolio is being turned over,” the CEO said.

The company is also in the middle of a massive restructuring with an aim to slash costs by $14 billion over the next five years. Ford recently announced plans to cut thousands of jobs in Europe as well as discontinuing some unprofitable lines there.

Yet in the face of a skeptical market Hackett defended Ford's moves to right its ship. He told CNBC that investors “needed to be a little patient with some of the long-lived problems that haven't been addressed that I'm going to represent. In less than 19 months, I've addressed every one of them.”

Many companies have expressed concerns about American brands potentially falling out of favor in China. For example, tech giant Apple cut its forecast in January, sounding alarms that an economic slowdown will weigh on its business. However, Hackett is not so worried.

“China's optimism is still high with us,” he told CNBC. “The brand is one of the highest-ranking brands in the country. Even at the highest levels of the government they see it as a family-owned business that middle America loves. The Chinese want to relate to American businesses like that,” Hackett added.

Seamless EV Charging Is Catching On In North America

NORTH AMERICAN CHARGING NETWORKS MOVE TO ENABLE SEAMLESS ROAMING FOR EV CHARGING Electric vehicles are often compared to mobile phones. Among other similarities, both devices depend on a stack of interdependent hardware, software and services, and both need to be plugged in and charged after use, normally in the evening. *This article comes to us courtesy of EVANNEX (which… Continue reading Seamless EV Charging Is Catching On In North America

Ford’s Self-Driving Unit CEO: Here’s Where We’re Taking Autonomous – TheStreet Tech

Over the last several years, Ford (F) has gotten serious about investing in autonomous driving. The auto giant has committed to investing $4 billion through 2023 in an autonomous driving subsidiary, a figure that includes a $1 billion investment in self-driving startup Argo AI. It has been testing out self-driving cars in Miami, and has plans to… Continue reading Ford’s Self-Driving Unit CEO: Here’s Where We’re Taking Autonomous – TheStreet Tech

The Tesla Story Through The Eyes Of Tesla Shorts & Obsessive Critics

Electric Cars

Electric Car Benefits

Electric Car Sales

Solar Energy Rocks

RSS

Advertise

Privacy Policy

Cars

Published on January 4th, 2019 |

by Zachary Shahan

The Tesla Story Through The Eyes Of Tesla Shorts & Obsessive Critics

Twitter

LinkedIn

Facebook

January 4th, 2019 by Zachary Shahan

I started covering Tesla in 2012, coming to the company as someone who had been car-free for over a decade and loving it. I had previously worked to promote human-powered transport (bicycling and walking), mass transit, and sustainable development. In other words, I was not a car guy.

Nonetheless, there was much to appreciate about electric cars, the beautiful Model S Tesla had developed, and the technological innovations Elon Musk and team had employed.

Furthermore, from my previous work, I had to come to grips with one obvious fact of modern life: even many people who would benefit tremendously from bicycle commuting and would surely enjoy it (who biked for recreation, for example) would never stop driving on a daily basis. If we were going to cut emissions, we needed an electric car revolution. Tesla was clearly leading the way on that front. It was offering an award-winning electric car that demolished the gas & diesel competition in its vehicle class, the first mass-produced electric car that was completely competitive with similarly priced conventional cars.

Nevertheless, critics and skeptics were around every corner. I thought it was crazy back then, but now, after 6½ years of tremendous Tesla successes, it’s downright hilarious. So, in honor of another wicked cool quarter, here’s a view of Tesla history that you might have missed if you only read CleanTechnica:

In bold: what happened

Not bold: Tesla shorts’ & obsessive critics’ take on the news.

Tesla Model S unveiled

It’s doomed. Tesla is doomed. Tesla can’t produce the car. No one will buy it. Sales of 10,000–15,000 a year? Pfff. For whom?

Tesla Model S wins top awards from Consumer Reports, owners, and big auto magazines.

It doesn’t matter — there are panel gaps and demand is drying up. They’ve worked through interested customers and demand is falling.

Tesla Model S demand grows, Tesla creates more production capacity and sales grow.

It’s just a phase, a trend, because Tesla is a novelty with far too much hype. Anyway, that demand growth was all an illusion and is fading now. Demand is falling now. Really.

Tesla Model X approaching production.

Hahaha, no way in hell Tesla is producing that vehicle. It’s impossible to mass produce. Tesla is going to collapse trying to produce this vehicle. It’s a dead company walking.

And anyway, demand for this “SUV” is far lower than Tesla says.

Tesla struggles through first few months of Model X production.

See, we told you. This vehicles can’t be mass produced. It’s completely impossible. Tesla is dead any day, can’t produce the Model X and there’s no demand and Model S demand is falling.

Tesla gets through early hurdles and starts mass producing the Model X.

Crickets.

Tesla reaches annual production and sales of 100,000 Model S and Model X vehicles a year (combined), far more than the 30,000–35,000 the company initially forecasted for these models.

It’s all nonsensical hype. It’s just gone too far. Anyway, Tesla is going to crash financially because it can’t turn a profit and definitely can’t build this ridiculous “Gigafactory” marketing scam. (Never mind that Tesla could be making great profits — has extremely high gross margins — and isn’t doing so just because it is aiming for insanely fast growth.)

Progress keeps truckin’ on Tesla Gigafactory.

It doesn’t matter — Tesla won’t have demand for enough vehicles to make the Gigafactory sensible. It’s a giant, empty house of cards and Ponzi scheme that’s going to take Tesla down. Don’t worry — Tesla’s won’t even be here in 2016 — it’ll be out of business.

Tesla forecasts a doubling of Model S and Model X sales in 2016.

Hahaha — what are you, crazy? Who is going to want to buy all of these vehicles? Demand is going in the other direction! The Tesla fad is getting old and consumers are moving in other directions now. Building up this much production capacity is just hastening Tesla’s collapse.

Tesla unveils Model 3. Reservations surpass 100,000 before the car is even shown, and then soar after it is shown.

This is all a Ponzi scheme [this is a frequent claim] and Tesla will run out of money before it ever builds a single Model 3 for consumers. Plus, the company can’t produce the car as specced without losing money and customers aren’t going to wait till 2020 for their cars. Other automakers — real automakers — will have much better cars out before then and Tesla will still be struggling to get the Model 3 into production if the company isn’t dead by then. But yeah, it will be dead long before then.

Elon Musk indicates that the company’s official target date for start of production is July 1, 2017 — but that it’s sort of just a fake target to push suppliers to be ready and it’s more or less impossible production would start then … but suppliers need to be ready by then.

Hahaha, you’ve got to be kidding me! July 2017? More like July 2020 … or never!

It’s all a scam. The market will figure this out sooner or later.

Tesla actually starts delivering consumer vehicles in July 2017 — blowing basically everyone’s mind.

These are not real cars. It’s all a trick. Tesla’s delivering fake, hand-built cars to Tesla and SpaceX employees. Elon Musk is more like David Copperfield than an auto industry master. The company will never mass produce the Model 3. It will go bankrupt soon enough. Short the stock now!

Tesla struggles for a few quarters trying to get Model 3 production up to the targeted level. One production hiccup after another slows down the progress and essentially puts Model 3 production back on its original schedule.

Told you so. The sky is falling, and Tesla is running out of money and will self-destruct any day now. Don’t wait too long — short the stock now! See? We were right all these years.

Tesla keeps making progress increasing its Model 3 production capacity.

It’s all a scam. They’re shifting cars around from parking lot to parking lot. They have hard limits they can never pass to get to 5,000 units per week. #PaintShop

And demand is already starting to fall off. The cars aren’t even fully produced and customers will start revolting soon. Plus, Tesla could never service these cars and Superchargers are going to be completely clogged soon.

Tesla reaches 5,000 vehicle/week milestone.

#Tentgate

Elon Musk says the company will show a profit in the 3rd quarter and should be sustainably profitable from then on.

WHAT?!?!? Are you crazy? This is crazy talk. Tesla is on the verge of collapsing. There’s no way in hell this is accurate. This is a joke. This is a total scam. Elon Musk is losing his mind. All signs point to the house of cards collapsing any day. It will all be over soon, folks — hold on tight. (And don’t forget to get your anti-Tesla bets in.)

Tesla production grows, sales surge, and Tesla shows a profit in the 3rd quarter. Side note: Tesla Model 3 becomes one of the top selling cars in the country in terms of units sold and the #1 best selling car in terms of revenue. Tesla absolutely dominates the luxury car market and presumably starts sucking sales away from Honda, Toyota, and others as well.

This is all a blip. It’s an accounting trick multiplied by years of demand for the car. Demand is going to collapse now. This strong quarter of sales is the surest sign yet that Tesla is about to crash, as demand cannot be sustained and bills be due.

Tesla has record 4th quarter, massively defying the critics and achieving unprecedented growth in the auto industry. In one year, the company nearly tripled its automobile production and delivery capacity. It sold 33% more cars in the 4th quarter than in all of 2017 combined. The Tesla Model 3 becomes the best selling car in the US from an American car company and the #11 best selling car overall in all of 2018. On the back of the strong 4th quarter numbers, it turned out Tesla sold 1 out of every 5 luxury cars in the country in 2018 and the Model 3 accounted for 1 out of every 3 small & midsize luxury cars in the year.

Now it’s really clear: Tesla demand is dropping. All of the above is history and now we know for sure that Model 3 demand is drying up and Tesla will soon run out of cash as a result. The stock will drop 70% in value in 2019. Forget our previous predictions and criticisms. Forget that we have been consistently wrong for years and have claimed the sky was falling 1,000+ times and it has never yet fallen. We are right this time. Really. You will see.

Is there any wonder why people don’t take Tesla short sellers and über critics seriously?

By the way, if you would like to buy a Tesla and want the benefits that come with a referral, feel free to use my referral code — http://ts.la/tomasz7234 — or not.

About the Author

Zachary Shahan Zach is tryin' to help society help itself (and other species). He spends most of his time here on CleanTechnica as its director and chief editor. He's also the president of Important Media and the director/founder of EV Obsession and Solar Love. Zach is recognized globally as an electric vehicle, solar energy, and energy storage expert. He has presented about cleantech at conferences in India, the UAE, Ukraine, Poland, Germany, the Netherlands, the USA, and Canada.

Zach has long-term investments in TSLA, FSLR, SPWR, SEDG, & ABB — after years of covering solar and EVs, he simply has a lot of faith in these particular companies and feels like they are good cleantech companies to invest in. But he offers no professional investment advice and would rather not be responsible for you losing money, so don't jump to conclusions.

Back to Top ↑

Advertisement

Advertise with CleanTechnica to get your company in front ..

Tesla Vehicle Ramp Cycles Getting Shorter (Charts)

Electric Cars

Electric Car Benefits

Electric Car Sales

Solar Energy Rocks

RSS

Advertise

Privacy Policy

Clean Transport

Published on January 12th, 2019 |

by Zachary Shahan

Tesla Vehicle Ramp Cycles Getting Shorter (Charts)

Twitter

LinkedIn

Facebook

January 12th, 2019 by Zachary Shahan

Twitter user @ElonMuskScience created an interesting chart last year based on Tesla financial data and shared it with us.

I thought it was fascinating and worth a long story, but we never got around to diving deeply into the topic (well, I mean, since Maarten did back in May). But the time has come. Here we go!

This was the original tweet:

And here’s a newer one:

One basic point which all of the financial press seemed to ignore in 2018 is that it takes time to get a new product — especially something as complicated and costly as a car — through the production ramp and to profitability, but that doesn’t mean the whole business model is financially unsustainable. It just means that it takes time to make money on a new product.

Of course, professionals in the financial press have to know this — yet they continually ignored the point while covering Tesla and acting as though it could never make money and was essentially just a clever Ponzi scheme.

Just because Tesla was spending a lot of money on new products didn’t mean those products wouldn’t make the company a net profit eventually. That’s what we tried to explain over and over in 2018 when so much of the media was forecasting Tesla’s doom.

Anyhow, that’s the basic point you can take away from the charts above, but there’s a more interesting point highlighted by @ElonMuskScience here. That point is that the development cycle for Tesla vehicles — from initial development stages to actually making the company money — has been getting shorter and shorter.

“Ramp 1” in each of the charts represents the Tesla Model S’s path from its early stages of development to company profits. “Ramp 2” covers essentially the same cycle for the Tesla Model X, but that one comes in at 42 months instead of 51 months. (Note that both timeframes are quite short compared to normal vehicle development in the auto industry.)

The Tesla Model 3’s ramp — “Ramp 3” — showed a big reduction in the timeline, though, cutting the period down to just 24 months!

As you can see in the second chart, it also led to soaring profits. (Selling 63,000 cars a quarter at an average selling price over $50,000 = a lot of revenue.)

Of course, there’s development of the models that goes on before the ramp timeframes shown. Nonetheless, it is clear that Tesla has gotten much quicker at completing the process between showing a prototype and making money (in net) on that model.

What about going forward? The Tesla Model Y is supposed to be shown in the middle of March. It is supposed to go into production in China in 2020. And perhaps earlier in the US? Will it be approximately 2 years from the time the Model Y is shown and it is delivering a cumulative net profit for Tesla? Will it be 18 months?

We don’t actually have precise data to measure any this, as Tesla doesn’t break out costs and revenue by model in such a way. Historically, @ElonMuskScience and others have basically tracked the results based on overall company costs & revenue — as you can see above — but we won’t even have that method going forward, as Elon Musk expects the revenue from Tesla’s Model 3, Model S, and Model X will be enough to fund new product development & production ramps while maintaining a company profit.

The whole thing is pretty amazing when you step back and look at it. Tens of thousands of Tesla employees made magic happen by somehow bringing product after product to market, selling these through new sales channels for the auto industry, rising from a few hundred cars a quarter to nearly 100,000 cars a quarter in just ~6 years, and scaling up requisite manufacturing, service, supercharging, and sales networks all along the way.

You can see why so many in the auto world and financial world didn’t expect Tesla to succeed. Making it through one humongous product ramp was a challenge, making it through another one was another challenge, and making it through a super rapid and high-volume third one was yet another daunting challenge. If any of those product ramps went too badly — in terms of production or consumer demand — Tesla would have crashed into a deep crater of debt.

But it didn’t.

There were signs and historical precedence along the way to presume that Tesla would pull through. Nonetheless, Tesla had a seemingly unprecedented level of skepticism thrown its way, winning the title of most shorted company on the US stock market for much of 2018.

Now the company is employing 45,000 people and counting, and it appears to be in a very different period of its corporate life. There should be no more “bet the company” trials, as the real Elon Musk put it. The Model Y ramp, Tesla Semi ramp, and Tesla electric pickup truck ramp, while not walks in the park, should be easier to manage and fund thanks to lessons learned from the production ramps of the S-3-X model lineup. The revenue flowing into Tesla’s piggy bank from those pillar products should help as well.

That said, stay tuned — there could always be life-threatening challenges around the corner, and Tesla short sellers accounting for billions of dollars of bets against the company will be sure to notify us of any forming (or imaginary) thorns and stumbles.

To wrap up, I’ll return to comments Maarten made in 2018 in a handful of articles aiming to shed bright lights on Tesla’s present and future when so many people were focused on the darkness:

Early May: “It was my impression that the original plan for the Model 3 was self-financing through a slow ramp and incremental building of the assembly line. The number of reservations changed those plans. Tesla accelerated the development of the car and design of the production and shortened the ramp by a whole year. … I have a very strong impression that Tesla is only looking at self-financing for its future products and factories.”

Middle of May: “The long answer is in 3 fresh articles here on CleanTechnica. This first one examined the problems 450,000 Tesla Model 3 reservations created. In this second one, we have a long look at the profitability of Tesla products. We finish with the media madness about ‘Tesla Cash Burn.’ … But I think Tesla is secretly a potentially very profitable company. Or not so secretly, if you really pay attention to Tesla’s finances. …The only reason Tesla keeps reporting losses is because after launching each successful product, the next product is so much more ambitious that it can’t be financed out of the revenue streams of the company’s current products.

“To visualize this and make it easier to discuss, I have Tesla virtually split into separate companies, each providing a single product or service. Each company has its own financing, from sister companies or from the capital markets. Resources like design labs, research departments, specialized personnel, etc. are “sold” to sister companies for shares when no longer needed, mimicking the relationships between the parts of a consolidated company.”

Late May: “As usual, the rumors of Tesla’s demise are grossly exaggerated.”

Late May: “’Tesla bankwuptcy’ would perhaps be better termed ‘shorts losing their shirts.’ …

“As usual, the rumors of Tesla’s demise are grossly exaggerated. If you haven’t been fooled in the past 10 years, don’t start falling for the rumors now. ”

Indeed. Easier said now than in May of 2018. Kudos to Maarten for saying it then.

If you plan to buy a Tesla and want the benefits that come from using a referral code, feel free to use mine — http://ts.la/tomasz7234 — or not.

About the Author

Zachary Shahan Zach is tryin' to help society help itself (and other species). He spends most of his time here on CleanTechnica as its director and chief editor. He's also the president of Important Media and the director/founder of EV Obsession and Solar Love. Zach is recognized globally as an electric vehicle, solar energy, and energy storage expert. He has presented about cleantech at conferences in India, the UAE, Ukraine, Poland, Germany, the Netherlands, the USA, and Canada.

Zach has long-term investments in TSLA, FSLR, SPWR, SEDG, & ABB — after years of covering solar and EVs, he simply has a lot of faith in these particular companies and feels like they are good cleantech companies to invest in. But he offers no professional investment advice and would rather not be responsible for you losing money, so don't jump to conclusions.

Back to Top ↑

Advertisement

Advertise with CleanTechnica to get your company in front of our readers.

CleanTechnica Clothing & Cups

Top News On CleanTechnica

Join CleanTechnica Today!

Advertisement

Advertisement

Follow CleanTechnica Follow @cleantechnica

Our New Electric Car Driver Report

Read & share our new report on “electric car drivers, what they desire, and what the demand.”

The EV Safety Advantage

Read & share our free report on EV safety, “The EV Safety Advantage.”

EV Charging Guidelines for Cities

Share our free report on EV charging guidelines for cities, “Electric Vehicle Charging Infrastructure: Guidelines For Cities.”

30 Electric Car Benefits

Our Electric Vehicle Reviews

Tesla News

Cleantech Press Releases

New Research Shows That Only Two Large Petroleum Companies Have Meaningful Emission Reduction Targets

Koben Announces EVOLVE EVSF —Grid-Friendly Modular EV Store & Forward System

The New Danish Climate Plan — Together For A Greener Future

38 Anti-Cleantech Myths

Wind & Solar Prices Beat Fossils

Cost of Solar Panels Collapses

© 2018 Sustainable Enterprises Media, Inc.

Electric Cars

Electric Car Benefits

Electric Car Sales

Solar Energy Rocks

RSS

Advertise

Privacy Policy

This site uses cookies: Find out more.Okay, t..

Jaguar Land Rover car factories resume production – Coventry Telegraph

Production has resumed this week at Jaguar Land Rover’s two Midland car factories following a temporary shutdown. The Coventry car maker’s factories in Solihull and Castle Bromwich both saw shutdowns – Solihull for two weeks and Castle Bromwich for one week. Jaguar Land Rover said the Castle Bromwich shutdown was to coincide with half-term and… Continue reading Jaguar Land Rover car factories resume production – Coventry Telegraph