Media playback is unsupported on your device Tesla shares have sunk after US regulators took legal action against founder Elon Musk for alleged securities fraud. On Thursday the Securities and Exchange Commission filed a lawsuit over a claim made last month by Mr Musk that he had funding to take the company private. The billionaire… Continue reading Tesla shares sink on fraud investigation

Tag: Electric vehicles

Tesla shares plunge as Wall Street throws in towel, saying Musk departure could cost stock $130

Bobby Yip | Reuters

Elon Musk

Wall Street is buzzing over SEC's civil action against Tesla CEO Elon Musk, predicting significant negative ramifications for the electric car market due to the action.

Shares of the automaker were down 12 percent in Friday's premarket session.

The Securities and Exchange Commission sued Musk on Thursday, alleging for fraud. The complaint says Musk issued “false and misleading” statements and failed to properly notify regulators of material company events. Musk called the SEC's allegations “unjustified” and said he “never compromised” his integrity.

Barclays believes if Musk is forced to leave because of the SEC action, it will be weigh on Tesla's stock.

“The SEC civil action may lead to Musk's exit from Tesla (either permanently or temporarily) and the Musk premium in the shares dissipating,” analyst Brian Johnson said in a note to clients Friday. “Tesla shares have ~$130 of Musk premium for future success that might dissipate.”

Tesla's stock closed at $307.52 Thursday.

Johnson reiterated his underweight rating and $210 price target for Tesla shares.

One Wall Street firm is concerned the controversy about the lawsuit will hurt demand for Tesla's cars.

“We see the potential for negative sentiment to impact demand and employee morale,” Morgan Stanley analyst Adam Jonas said in an investor note. “In our view, this is particularly a risk if the situation is not resolved relatively quickly.”

Jonas reiterated his equal-weight rating and $291 price target for Tesla shares.

J.P. Morgan also thinks the news will affect the company's ability to raise financing.

“We are concerned that decreased confidence in Tesla on the part of investors may impact the company's ability to raise capital on amenable terms,” analyst Ryan Brinkman said in a note to clients Friday.

Brinkman reaffirmed his underweight rating and $195 Dec. 2018 price target for the company's shares.

Citigroup also downgraded the stock to a sell rating from neutral.

“There's little question that Mr. Musk's departure would likely cause harm to Tesla's brand, stakeholder confidence and fundraising,” the note said. “If Mr. Musk ends up staying on, the reputational harm from this might still prevent the stock from immediately returning to 'normal.'”

Disclaimer

eMotorWerks JuiceNet Used As 30 MW “Virtual Battery”

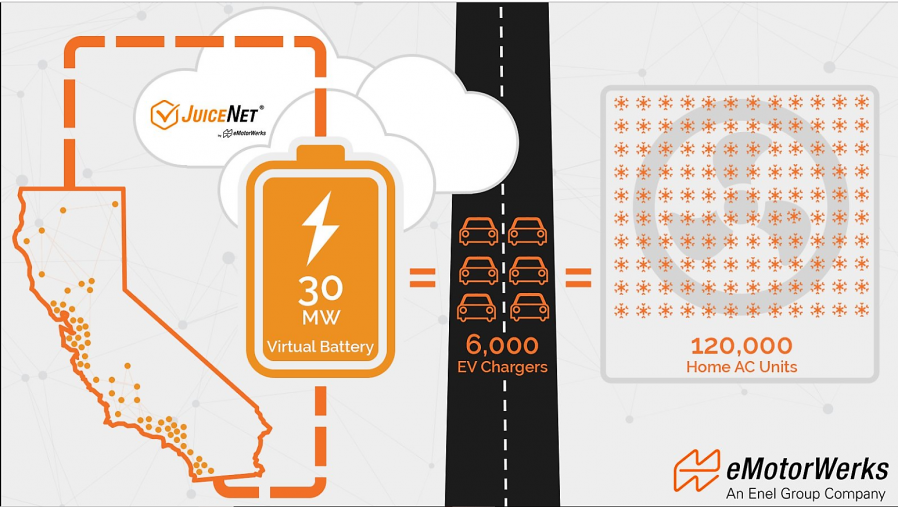

Electric cars are going to crash the grid, right? If everybody gets an EV we’ll have to build 100 more powerplants and it will cause our electric rates to triple, right? Not so fast. More Charger Info Over 6,000 eMotorWerks residential JuiceBox and other JuiceNet-enabled chargers installed in California now make up a 30MW “virtual… Continue reading eMotorWerks JuiceNet Used As 30 MW “Virtual Battery”

Lyft unveils second annual diversity report

Lyft has released its second annual diversity report outlining the gender and racial breakdown of its 4,000-person workforce. At a glance, little has changed from last year’s report, which was the first time the $15 billion ride-hailing company disclosed its diversity stats. Forty percent of Lyft’s workforce is female, a slight decrease from last year’s 42 percent,… Continue reading Lyft unveils second annual diversity report

Free2Move launches its carsharing service in Wuhan

The Yiweixiang Free2Move Carsharing service is being launched today in Wuhan with a fleet of 300 electric vehicles. The fleet will expand to 3,000 vehicles in 2019. The joint venture Fengbiao Company operates the service. Groupe PSA (50%), Dongfeng Electric Vehicle Co., Ltd (30%) and Wuhan Electric Vehicle Demonstration Co., Ltd (20%) hold the JV.… Continue reading Free2Move launches its carsharing service in Wuhan

Dealers reluctant to buy electric vehicles at auction

Dealers continue to be reluctant to buy electric cars at auction because of unfamiliarity with the technology and fears over the charging infrastructure. That’s the view of Glass’s which carried out research into dealers and how they view pure electric cars. Jayson Whittington, Glass’s chief car editor, said: “There still appears to be a reluctance… Continue reading Dealers reluctant to buy electric vehicles at auction

Toyota Considers Hydrogen-Based Mobility Partnership Between Railways and Automobiles

Toyota Motor Corporation (Toyota) and the East Japan Railway Company (JR East) have signed a basic agreement for a comprehensive business partnership, centred on a hydrogen based mobility partnership between railways and automobiles. The partnership is aimed at helping realise sustainable, low-carbon societies in the face of global warming and energy diversification. The agreement is… Continue reading Toyota Considers Hydrogen-Based Mobility Partnership Between Railways and Automobiles

New book tells the fascinating story of Shai Agassi and Better Place

Does anybody remember Better Place? It seems quite a few people do, especially in Israel. Shai Agassi is one of many brilliant businessmen to come from the country that many know as Silicon Wadi or the Start-Up Nation, but according to Brian Blum, the author of the new book Totaled, “Agassi was, and remains one… Continue reading New book tells the fascinating story of Shai Agassi and Better Place

Updated BMW i3 gets greater range

BMW’s i division has upgraded the electric-powered i3 with a new battery that is claimed to extend its range by almost 30 per cent under everyday driving conditions. The new 120Ah lithium-ion unit replaces the 94Ah battery used by the existing i3 and brings a 9.2kWh increase in energy capacity for the quirky five-door hatchback, at… Continue reading Updated BMW i3 gets greater range

Tesla shares drop as much as 13% after SEC charges CEO Elon Musk with fraud

Musk could still be an important piece of Tesla, he just couldn't run the thing: Stewart

6 Hours Ago | 11:59

Shares of Tesla dropped sharply in after-hours trading Thursday after court documents showed the Securities and Exchange Commission is suing Elon Musk for fraud.

Sources close to the company told CNBC the company was also expecting to be sued, though Tesla was not named as a defendant in the complaint.

Tesla's stock dropped as much as 13 percent, to around $268, down from $307.52 as of the close.

Musk, the company's CEO, tweeted last month he was thinking about taking Tesla private, noting: “Funding secured.”

The Aug. 7 tweet sent Tesla shares flying, and they closed 11 percent higher on the day.

After sending the tweet, Musk claimed he had been in talks with the Saudi Arabian sovereign wealth fund and was confident he'd have the funding to take the company private at $420 a share. Tesla abandoned its plans to go private later in August.

“The SEC is looking at it very seriously. The stock is going to be under pressure while this gets resolved, and obviously these things take time. The SEC obviously has fired the first shot,” said Art Hogan, chief market strategist at B. Riley FBR. “It sounds like the company's first communication was to defend.”

Tesla since Aug. 7

Source: FactSet

In its complaint, the SEC said Musk knew he “had not agreed upon any terms for a going-private transaction with the Fund or any other funding source,” adding Musk had “had no further substantive communications with representatives of the Fund beyond their 30 to 45 minute meeting on July 31.”

Regardless, the stock has been a roller-coaster ride for investors ever since the infamous Aug. 7 tweet. Since popping that day, the stock has dropped 19 percent through Thursday's close.

Colin Rusch, an analyst at Oppenheimer with a buy rating and a $385 price target on Tesla, told CNBC's “Closing Bell” the stock, and the company, can recover from this.

“The potential for this platform is generating an awful lot of cash flow,” Rusch said. If “they implement some fiscal discipline around growth and increment operating margins, we do think there is still an awful lot of capital that is still very bullish on this name and will continue to buy the name even with this sort of overhang.”

— CNBC's

Patti Domm

contributed to this report.

WATCH: Munster thinks there's a 25% chance Musk remains Tesla CEO

I think there's a 25% chance Musk remains Tesla CEO: Munster

6 Hours Ago | 09:06