BEIJING, April 19, 2023 /PRNewswire/ — The Yellow River Culture Forum opened in Dongying in east China’s Shandong on Tuesday. Based on the theme of “Promoting Yellow River Culture and Telling Yellow River Stories,” guests and representatives from China and overseas conducted a series of exchanges and discussions on these two topics. Continue Reading image_1… Continue reading CGTN: Yellow River Culture Forum zeroes in on cradle of Chinese civilization

Category: News Type

German Handelsblatt: Electric mobility: software, margin, price: these are the problems of the new VW ID.7006726

Premiere of the ID.7 in Berlin With the new model, the group wants to score internationally. (Photo: Reuters) Eight a.m. in New York, 2 p.m. in Berlin, 8 p.m. in Shanghai: On Monday, Volkswagen presented its first all-electric ID.7 sedan in three simultaneous time zones. The setting alone makes it clear: with their latest model,… Continue reading German Handelsblatt: Electric mobility: software, margin, price: these are the problems of the new VW ID.7006726

German Handelsblatt: Electric mobility: software, margin, price: these are the problems of the new VW ID.7006726

Premiere of the ID.7 in Berlin With the new model, the group wants to score internationally. (Photo: Reuters) Eight a.m. in New York, 2 p.m. in Berlin, 8 p.m. in Shanghai: On Monday, Volkswagen presented its first all-electric ID.7 sedan in three simultaneous time zones. The setting alone makes it clear: with their latest model,… Continue reading German Handelsblatt: Electric mobility: software, margin, price: these are the problems of the new VW ID.7006726

Italy hopes for EU concession on biofuels

What is included in my trial? During your trial you will have complete digital access to FT.com with everything in both of our Standard Digital and Premium Digital packages. Standard Digital includes access to a wealth of global news, analysis and expert opinion. Premium Digital includes access to our premier business column, Lex, as well… Continue reading Italy hopes for EU concession on biofuels

UK’s HVS unveils 40-tonne hydrogen truck with 600km range

Zero-emission, hydrogen-powered commercial vehicle innovator, Hydrogen Vehicle Systems (HVS) has unveiled a clean-sheet-designed hydrogen-electric Heavy Goods Vehicle (HGV). Showcasing its game-changing hydrogen powertrain in the form of a 40-tonne HGV technology demonstrator underlines the company’s objective of being the first indigenous UK-designed and developed hydrogen-electric HGV on the market. The Glasgow-based company, which focuses on… Continue reading UK’s HVS unveils 40-tonne hydrogen truck with 600km range

UK’s HVS unveils 40-tonne hydrogen truck with 600km range

Zero-emission, hydrogen-powered commercial vehicle innovator, Hydrogen Vehicle Systems (HVS) has unveiled a clean-sheet-designed hydrogen-electric Heavy Goods Vehicle (HGV). Showcasing its game-changing hydrogen powertrain in the form of a 40-tonne HGV technology demonstrator underlines the company’s objective of being the first indigenous UK-designed and developed hydrogen-electric HGV on the market. The Glasgow-based company, which focuses on… Continue reading UK’s HVS unveils 40-tonne hydrogen truck with 600km range

E-vehicle maker body asks for resolution of Fame II to salvage ‘EV revolution’

E-vehicle maker body asks for resolution of Fame II to salvage ‘EV revolution’ The Society for Indian Electrical Vehicle Manufacturers (SMEV) has made a fresh petition to the Parliamentary Standing Committees on Industry and Estimates in which it warns that electric vehicle (EV) adoption has slowed down due to the financial stress in the industry.… Continue reading E-vehicle maker body asks for resolution of Fame II to salvage ‘EV revolution’

Nissan reveals Pathfinder concept SUV for Chinese market

Nissan today took the covers off the Pathfinder concept SUV developed for the Chinese market at Auto Shanghai 2023. Yesterday, the company had revealed the all-electric Arizon concept SUV, created by a Chinese team leveraging Nissan’s global EV expertise. Nissan, which has been a longstanding player in the SUV market in China, is clearly focussing… Continue reading Nissan reveals Pathfinder concept SUV for Chinese market

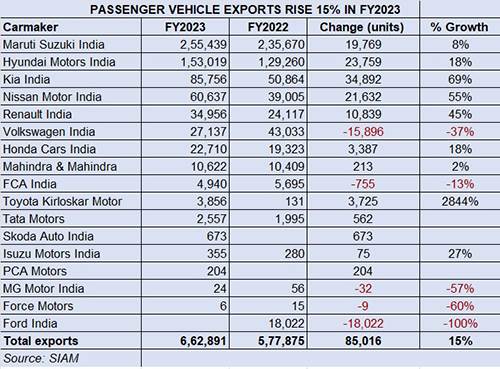

Car and SUV exports cross 6.37 million units in 10 years, Maruti Suzuki tops in FY2023

Car and SUV exports cross 6.37 million units in 10 years, Maruti Suzuki tops in FY2023 If the domestic market sales of a record 3.89 million passenger vehicles (up 35%) in FY2023 brought smiles to India Auto Inc, then the export performance of 662,891 units (up 15%) shipped overseas is also good news. That’s because… Continue reading Car and SUV exports cross 6.37 million units in 10 years, Maruti Suzuki tops in FY2023

@BMW: POSTCARD STORY. THE MINI COOPER S 3-DOOR.002648

The stylish “Moonwalk Grey” exterior color harmonizes perfectly with the impressively designed roof in red multitone. This exclusivity is further emphasized by the combination with the exterior mirror flaps in red. The sporty appearance of the MINI Cooper S 3-door is supported by the 18 ” rims Pulse Spoke 2-tone, which are a special eye-catcher… Continue reading @BMW: POSTCARD STORY. THE MINI COOPER S 3-DOOR.002648