This week brought back some of our favorite tech deals we’ve seen all year. A four pack of Apple’s AirTags is back on sale for $89, while the Apple TV 4K has dropped to $130. While neither of those are all-time lows, they’re very close and great deals on a couple of the most popular… Continue reading The 2021 Apple TV 4K drops to $130, plus the rest of the week’s best tech deals

Category: News Type

Volkswagen CEO Herbert Diess to be replaced by Porsche chief in major shake-up

In a major shake-up, Volkswagen CEO Herbert Diess is stepping down as head of the world’s second-largest automaker and will be replaced by Porsche chief Oliver Blume, the company announced Friday. Blume will replace Diess in his role as chairman of the board of management on September 1st, the company announced. In a statement, Hans… Continue reading Volkswagen CEO Herbert Diess to be replaced by Porsche chief in major shake-up

Grupo Antolin has installed a photovoltaic system in Aragusa

This sustainable facility is added to other photovoltaic projects in Germany, India and Spain -including the headquarters-. The installation provides 1200 kW of rated power and is expected to produce 1,626,000 KW a year. Thanks to renewable energy consumption both from acquiring origin-certified green energy or promoting self consumption, Antolin goes ahead with its plans… Continue reading Grupo Antolin has installed a photovoltaic system in Aragusa

Autonomous driving without a steering wheel: USA and China

There are new efforts worldwide to initiate autonomous driving without a steering wheel and pedals. Examples are Ford, GM and Baidu. Autonomous vehicles must be recognizable in order to be spotted. One thinks of markings, Mark or special colors and lights. But another identifying feature in the future will be the lack of one steering… Continue reading Autonomous driving without a steering wheel: USA and China

The Worldwide In-vehicle Infotainment Industry is Expected to Reach $48.6 Billion by 2030

DUBLIN, July 22, 2022 /PRNewswire/ — The “In-vehicle Infotainment Market Share, Size, Trends, Industry Analysis Report, By Component, By Installation, By Location, By Vehicle, By Region, Segment Forecast, 2022 – 2030” report has been added to ResearchAndMarkets.com’s offering. The global In-vehicle Infotainment market size is expected to reach USD 48.62 billion by 2030. The report gives… Continue reading The Worldwide In-vehicle Infotainment Industry is Expected to Reach $48.6 Billion by 2030

Make Safety a Priority When Staying in a Vacation Rental Home

WASHINGTON, July 22, 2022 /PRNewswire/ — As Americans travel this summer, the U.S. Consumer Product Safety Commission (CPSC) wants to remind consumers to check for safety features when staying at a vacation rental home. Before signing the rental agreement, consumers should verify that the property has smoke and carbon monoxide alarms and at least one… Continue reading Make Safety a Priority When Staying in a Vacation Rental Home

China’s Digitized Container Duckbill Speeds Up, Faster and Smarter

The startup will use the fresh funds to support the ongoing research and development of digitalization in container land transportation, business expansion to more ports across China, and optimization of service, the statement reported. A latecomer, but a quick grower Founded in 2017 and headquartered in large-port megacity Shanghai, Duckbill is an innovator in the… Continue reading China’s Digitized Container Duckbill Speeds Up, Faster and Smarter

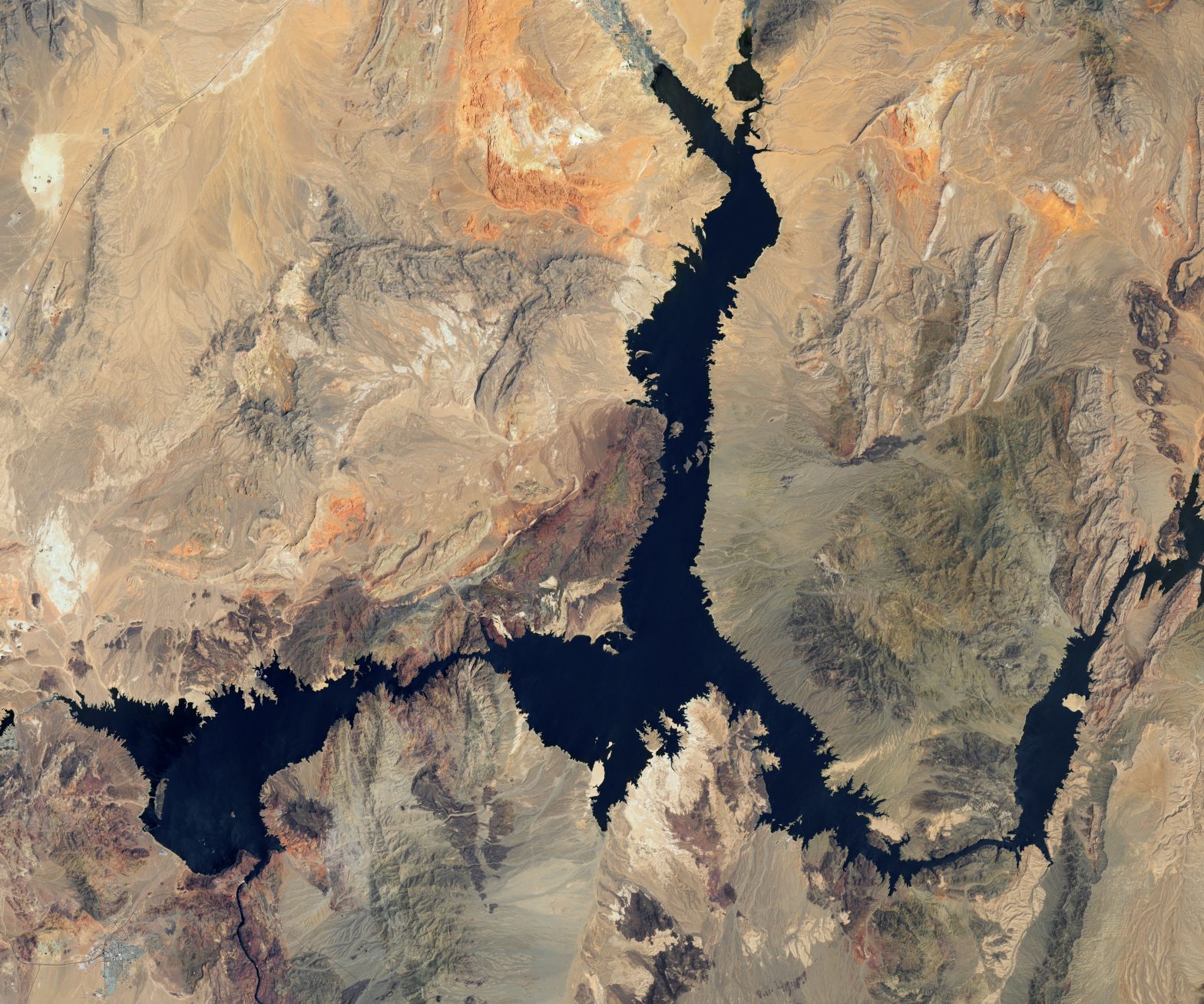

What record-low water levels at the Hoover Dam reservoir look like from space

The US’s largest water reservoir, Lake Mead at the Hoover Dam, is in very, very bad shape. How bad is it? New satellite images from NASA show just how much the reservoir’s footprint has shrunk over the past two decades — and the difference between July 2000 and July 2022 is stark. Water levels at… Continue reading What record-low water levels at the Hoover Dam reservoir look like from space

Thai digital lender SCB Abacus raises $20m Series BThe Series B round brought its total funding to around $41m.

Thai alternative digital lending platform SCB Abacus, a spinoff of financial services conglomerate SCBX, has closed a $20 million Series B funding round from undisclosed investors. The firm said in a statement that the Series B round brought its total funding to 1.5 billion baht ($41 million), becoming the most funded digital lending platform in… Continue reading Thai digital lender SCB Abacus raises $20m Series BThe Series B round brought its total funding to around $41m.

China Evergrande CEO, CFO step down following probe into property services unit

China Evergrande Group said on Friday that its chief executive officer and finance head have stepped down after initial findings of a probe into Evergrande Property Services found loans secured by the unit were redirected back to the group. The indebted company’s property-services unit was investigating how 13.4 billion yuan ($1.99 billion) of its deposits… Continue reading China Evergrande CEO, CFO step down following probe into property services unit