FILE PHOTO: A Nissan logo is pictured at Brussels Motor Show, Belgium, January 9, 2020. REUTERS/Francois Lenoir TOKYO (Reuters) – Nissan Motor Co (7201.T) is considering cutting 20,000 jobs from its global workforce, focusing on Europe and developing countries, Kyodo news reported on Friday, as the Japanese automaker struggles to recover from plunging car sales.… Continue reading UPDATE 1-Nissan considering 20,000 job cuts, mainly in Europe, developing nations -Kyodo

Category: News Site

GM will upgrade its Super Cruise technology to work on city streets

Sponsored Links GM GM’s Super Cruise, the automaker’s hands-free driving assistance feature, currently only works on highways. But according to one of its executives (as reported by Autoblog), the company is working to expand its capabilities so that it could also provide a hands-free driving experience on city streets, making it more of a rival… Continue reading GM will upgrade its Super Cruise technology to work on city streets

Renault could disappear and must adapt: French finance minister

FILE PHOTO: The logo of Renault carmaker is pictured at a dealership in Les Sorinieres, near Nantes, France, February 19, 2020. REUTERS/Stephane Mahe PARIS (Reuters) – Renault (RENA.PA) could disappear if it does not get help very soon to cope with the fallout from the coronavirus crisis, France’s Finance Minister Bruno Le Maire said on… Continue reading Renault could disappear and must adapt: French finance minister

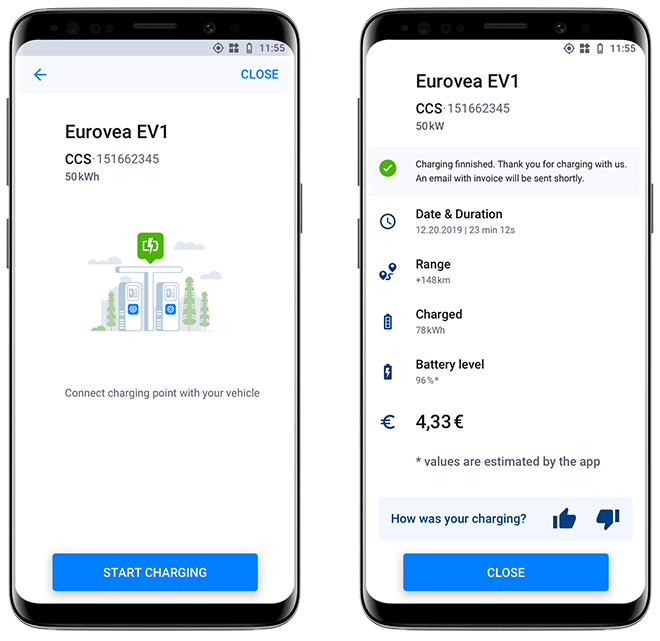

Sygic navigation solution integrates payment for charging

Slovakian mobile navigation vendor Sygic has added an EV Mode to its flagship Sygic GPS Navigation product. The new mode, which is available for free, allows users to plan routes with compatible charging points, get real-time data from charging stations, and process payments without the need for additional applications. Sygic’s EV Mode allows EV drivers… Continue reading Sygic navigation solution integrates payment for charging

Renault could disappear and needs to be able to adapt: Le Maire

FILE PHOTO: The logo of Renault carmaker is pictured at a dealership in Les Sorinieres, near Nantes, France, February 19, 2020. REUTERS/Stephane Mahe PARIS (Reuters) – France’s Finance Minister Bruno Le Maire said on Friday that Renault (RENA.PA) could disappear if it does not get help very soon to cope with the fallout from the… Continue reading Renault could disappear and needs to be able to adapt: Le Maire

Nissan considering 20,000 job cuts, mainly in Europe, developing nations: Kyodo

FILE PHOTO: A Nissan logo is pictured at Brussels Motor Show, Belgium, January 9, 2020. REUTERS/Francois Lenoir TOKYO (Reuters) – Nissan Motor Co (7201.T) is considering cutting 20,000 jobs from its global workforce, focusing on Europe and developing countries, Kyodo news reported on Friday, as the Japanese automaker struggles to recover from plunging car sales.… Continue reading Nissan considering 20,000 job cuts, mainly in Europe, developing nations: Kyodo

GM gradually restarts in Mexico as Lear Corp readies for return

MEXICO CITY (Reuters) – General Motors Co (GM.N) said on Thursday it was gradually restarting the transmission and motor lines at its Mexican facilities in Silao and Ramos Arizpe, while U.S. auto parts maker Lear Corp (LEA.N) also geared up for production. FILE PHOTO: The GM logo is seen at the General Motors Assembly Plant… Continue reading GM gradually restarts in Mexico as Lear Corp readies for return

Tesla Gigafactory Shanghai expansion is back in full swing

Construction work at Tesla Gigafactory Shanghai appears to be back in full swing as new buildings come up super quickly to produce Model Y in less than a year. As we reported earlier this week, Tao Lin, vice president of Tesla China, is saying that Tesla will ramp up Model 3 production by more than… Continue reading Tesla Gigafactory Shanghai expansion is back in full swing

‘I’ve not yet signed Renault loan’, says French finance minister

PARIS (Reuters) – France’s Finance Minister Bruno Le Maire said he has not signed off on a 5 billion euro ($5.47 billion) state-guaranteed loan to help Renault (RENA.PA) cope with the fallout from the coronavirus, and that discussions continued. FILE PHOTO: French Economy and Finance Minister Bruno Le Maire speaks during a presentation of the… Continue reading ‘I’ve not yet signed Renault loan’, says French finance minister

Carmaker McLaren clashes with bondholders over emergency financing

Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Join over 300,000 Finance professionals who already subscribe to the FT. Go to Source