The city of Unterschleißheim plans to introduce an autonomous electric bus in the city. The city Unterschleissheim in the north of Munich is especially known for the BMW location. Because BMW there bundles his ambitions regarding autonomous driving. Since it seems logical that the city wants to have to do with the technology. Autonomous E-Bus… Continue reading Unterschleißheim applies for Autonomous E-Bus

Category: News Site

The Stunning One-Year Turnaround of GM’s German Castoff

Terms of Service Violation Your usage has been flagged as a violation of our terms of service. For inquiries related to this message please contact support. For sales inquiries, please visit http://www.bloomberg.com/professional/request-demo If you believe this to be in error, please confirm below that you are not a robot by clicking “I’m not a robot”… Continue reading The Stunning One-Year Turnaround of GM’s German Castoff

Fiat Chrysler's top ranks in limbo after Marchionne's death

Original Article

Kia Motors to launch vehicle in India next year

{{if trimcom}}{{:trimcom}}{{else}}{{:comment.substr(0,500)}}{{/if}} {{if comment.length > 500}} … Read More {{/if}} Startup delivers groceries in self-driving cars Toyota to invest Rs 3500 crore in Uber for self-driving cars Rare Ferrari 250 GTO sells for record Rs 334 crore at auction Go to Source

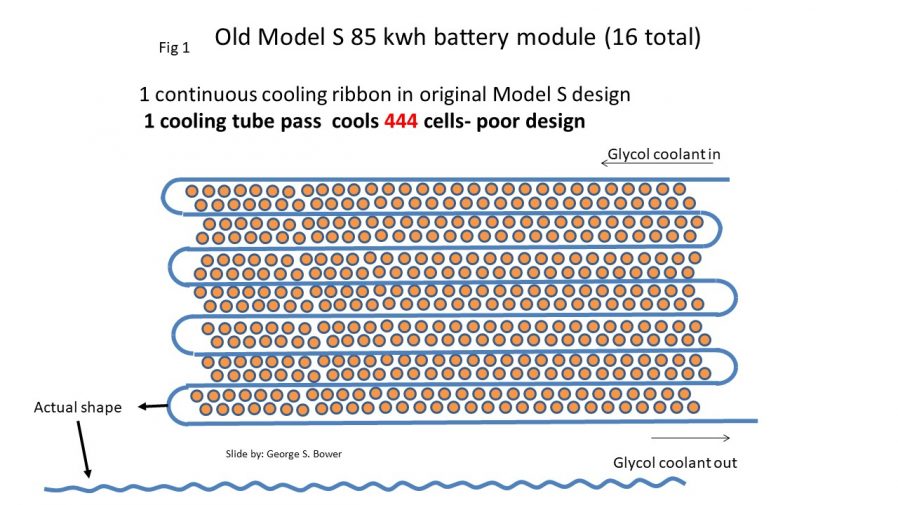

Tesla Model 3 Battery Can Transfer Twice The Heat Of Model S P100D

Track Data backs up our detailed Thermal Analysis In a previous article, we explained in words why the Tesla Model 3 battery cooling was much improved. To summarize that article, the main reasons are better heat transfer between the cells and the cooling tube (because the cells are now glued directly to the cooling tube),… Continue reading Tesla Model 3 Battery Can Transfer Twice The Heat Of Model S P100D

Elon Musk suspected sabotage when Tesla factory robots stopped working earlier this month

Joshua Lott | Getty Images

Engineer and tech entrepreneur Elon Musk of The Boring Company talks about constructing a high speed transit tunnel at Block 37 during a news conference on June 14, 2018 in Chicago, Illinois.

Elon Musk was up early on Saturday. He departed Los Angeles, where he runs SpaceX, his private rocket venture, and flew north in his white Gulfstream jet. Stopping in Silicon Valley, he picked up two engineers from Tesla, his electric-car company. They flew on to Reno, Nev., where they spent the day at Tesla's battery plant, the Gigafactory.

It might have been just another workday for Mr. Musk — a multistate jaunt to personally fix a drive-unit production line. But this was no ordinary morning. He was a brief night's sleep removed from one of his most consequential decisions: scrapping his plan to take Tesla private.

It was an abrupt about-face, and it capped a tumultuous two and a half weeks that began with a single tweet and wound up roiling markets, setting off regulatory alarms and raising questions about his judgment. Even by Mr. Musk's standards — this is a C.E.O. who believes Tesla is under attack by saboteurs, has a personal life playing out in the gossip blogs and is prone to fiery outbursts on Twitter — it has been a time of high intrigue.

“The reason Elon seems to attract drama is that he is so transparent, so open, in a way that can come back to bite him,” said Kimbal Musk, Mr. Musk's younger brother and a Tesla board member. “He doesn't know how to do it differently. It's just who he is.”

Mr. Musk, a brilliant but erratic billionaire, is the animating force behind Tesla, responsible for everything from its push into renewable energy to the design of the air vents in its newest electric car. His singular role gives him extraordinary influence over the fate of Tesla, its more than 40,000 employees and its investors.

Associates, including several people inside the company interviewed over the past week, portray him as a workaholic who zeroes in on the smallest details. His deep involvement suggests that the company can't do without him. Yet these days, it's not always clear that he knows what's best for Tesla.

More from The New York Times:

Google Attacked by Trump With Claim It Is Burying Conservative News

Silicon Valley Takes a (Careful) Step Toward Autonomous Flying

In a Shift in Driverless Strategy, Uber Deepens Its Partnership With Toyota

Even before taking Tesla investors on a roller-coaster ride, Mr. Musk was increasingly unpredictable, marketing flamethrowers online and dispatching a submarine to assist in a rescue in Thailand, then calling a critic of the gesture a pedophile. In an interview this month with The New York Times, Mr. Musk said he was physically exhausted and emotionally drained, causing some to question his fitness for the job.

Mr. Musk's personal life is no less chaotic. He was dating Grimes, the Canadian pop musician, but the two stopped following each other on social media last week, leading gossip blogs to speculate they had broken up. That followed a bizarre run-in with the rapper Azealia Banks, who intimated that Mr. Musk had written his going-private tweet while on acid. (He denied it.) Amid the fallout, he took to Twitter, posting cryptic messages about love and quoting T. S. Eliot.

And at the office, he is hardly a typical chief executive. Racing to resolve critical production issues, he can often be found on the factory floor, working to fix robots. At night, he sometimes sleeps under his desk. All the while, he has been confronting an exodus of senior employees, preparing to be interviewed by the Securities and Exchange Commission, and was working with Goldman Sachs and Saudi Arabia's sovereign wealth fund to take Tesla private — until he wasn't.

Some board members have been dismayed at Mr. Musk's behavior, according to people familiar with the directors' thinking, but no active search is underway for a replacement — although there have been fitful efforts to find a top lieutenant.

James Anderson, the head of the asset management firm Baillie Gifford, Tesla's biggest shareholder after Mr. Musk, said he still had faith in the 47-year-old chief executive, calling him a “visionary leader” who had unmatched technical expertise and remained “obsessive about the details.”

Yet Mr. Anderson said he had grown increasingly worried about Mr. Musk, believing that his volatile personal life and intense work ethic were taking a steep toll. “He is so demanding, so driven by the imperative to do something good for the world,” Mr. Anderson said. “You could always see something like this happening.”

'We feel like we are at war'

At 6:30 a.m. on Aug. 18, three robots in the paint shop at the Tesla factory in Fremont, Calif., started malfunctioning. The incident forced a production halt on the Model 3, the key to the company's future.

Made aware of the stoppage, Mr. Musk went to the factory and worked into the night. The problem was resolved, but Tesla reached a troubling conclusion: The robots had been infected with malware in an act of industrial sabotage. And though they could not prove it, executives suspected they knew the culprit: a rogue employee, working at the behest of short-sellers.

Tesla is among the most shorted stocks, meaning that hedge funds are betting against it and quick to note a missed production goal or cash shortfall. David Einhorn, the billionaire founder of Greenlight Capital, is in that camp. In a letter to investors last month detailing his argument, Mr. Einhorn wrote, “Elon Musk appears erratic and desperate.”

Mr. Musk believes that the short-sellers spread misinformation about the company, and perhaps much worse. In June, Mr. Musk accused an employee of sabotage that had slowed Model 3 production, and suggested short-sellers might be to blame.

Kimbal Musk, reflecting on the battles with short-sellers, said, “We feel like we are at war.”

Plenty of other companies face the wrath of short-sellers. The issue at Tesla seems to be that for Mr. Musk — who talks earnestly about weaning the world off fossil fuels with Tesla, and colonizing the solar system with SpaceX — these attacks are not just the cost of doing business. They are malicious and misguided efforts to derail his efforts to help humanity.

“Tesla is his baby,” said Deepak Ahuja, Tesla's chief financial officer. “He takes it extremely personally.”

But with Tesla now staying public, Mr. Musk will have to continue to contend with those who doubt his vision and are rooting for Tesla to fail.

The most difficult time

When Mr. Musk ceremonially unveiled the Model 3 last summer, he billed it as the first mass-market electric vehicle, and predicted monthly production of 20,000 by year's end. But in the final three months of 2017, just 2,425 were completed.

The delays were a result of what Mr. Musk called “manufacturing hell,” an inferno that has preoccupied him for much of the past year. “This has been the most difficult time for Tesla,” said JB Straubel, the company's chief technical officer. “We knew this was going to be the case, but it's been even harder than any of us expected.”

Some of the wounds were self-inflicted.

In preparing the assembly lines, Mr. Musk became convinced that the process should be close to fully automated, using robots rather than humans whenever possible. Doing so, he believed, could make cars move through the factory at one meter per second, 10 to 20 times the speed of existing lines.

So Tesla built a factory with hundreds of robots, many programmed to perform tasks that humans could easily do. One robot, which Mr. Musk nicknamed the “flufferbot,” was designed to simply place a sound-dampening piece of fiberglass atop the battery pack.

But the flufferbot never really worked. It would fail to pick up the fiberglass, or put it in the wrong place, frequently delaying production. It was eventually replaced by factory workers.

Mr. Musk has accepted responsibility for some of these missteps, occasionally with humor. In late June, he wore a T-shirt depicting a robot that passes butter. It was an inside joke, lampooning the notion of technology for technology's sake.

After the debacle, Mr. Musk tweeted: “Excessive automation at Tesla was a mistake. To be precise, my mistake. Humans are underrated.”

As the challenges have mounted, Mr. Musk has thrown himself into his work, spending hours each week walking factory floors, trying to diagnose and fix various problems on the assembly line.

“He demands personal accountability from the people that are closest to the machines,” Mr. Straubel said. “This freaks people out. They are worried that they wi..

‘I hate them’: Locals reportedly frustrated with Alphabet’s self-driving cars

Early rider use the Waymo driverless vehicles to get to school.

Alphabet's self-driving cars are annoying their neighbors in Chandler, Arizona.

More than a dozen locals who work near Waymo's office gave The Information the same unequivocal assessment of the cars, which reportedly struggle to cross a T-intersection there: “I hate them.”

One woman said that she almost hit one of the company's minivans because it suddenly stopped while trying to make a right turn, while another man said that he gets so frustrated waiting for the cars to cross the intersection that he has illegally driven around them.

The anecdotes highlight how challenging it can be for self-driving cars, which are programmed to drive conservatively, to master situations that human drivers can handle with relative ease, like merging or finding a gap in traffic to make a turn.

Waymo has been testing its vehicles in the Phoenix suburbs for little more than a year and is widely seen as the furthest along in the self-driving car space, but its safety drivers have to take control of the vehicles regularly, people with direct knowledge of the issues tell The Information.

A Waymo spokesperson says that its cars are “continually learning” and that “safety remains its highest priority” during testing. The spokesperson also said that Waymo is using feedback from its early rider program to improve its technology, though it declined to comment specifically on the intersection complaints mentioned in The Information story. The company has previously said that it plans to launch a commercial self-driving taxi service before the end of the year, but that its service will still include a Waymo employee in each car as a “chaperone.”

The potential for self-driving cars is so powerful because they eliminate aspects of human error and unpredictability that make driving dangerous, like speeding, texting, drinking or blowing through stop signs. However, as they start coexisting on roads alongside human drivers, that very unpredictability can confuse the cars, which may stop abruptly, endangering or aggravating people.

Waymo and other self-driving car companies will continue to try to work out software kinks and expand their regions of operation, but experts are divided on when self-driving cars will actually become mainstream.

As Waymo's CEO said in June during a talk at a National Governors Association meeting: the time period to make automated vehicles widespread “will be longer than you think.”

Read The Information story here.

Clarification: This piece previously referred to the Waymo employee who will be in the car when it launches its taxi service as a “safety driver.”

Behind the scenes at Waymo's top-secret testing site

10:02 AM ET Tue, 31 Oct 2017 | 02:08

A Little Secret GM Isn’t Telling Us About Improving The Bolt EV Battery

4 H BY GEORGE BOWER What’s one of the biggest complaints about the Chevrolet Bolt EV (besides the seats)? Slow Charging. Remember the song “I can’t Drive 55”? It’s about the same thing when it comes to charging speed. Why won’t GM make the Bolt EV charge faster? Related Articles: Our resident heat transfer expert… Continue reading A Little Secret GM Isn’t Telling Us About Improving The Bolt EV Battery

UPDATE 1-Chinese EV maker Nio expects to raise $1.32 bln in IPO

(Reuters) – Chinese electric vehicle start-up Nio Inc [NIO.N], backed by Chinese tech heavyweight Tencent Holdings Ltd (0700.HK), on Tuesday said it expects to raise up to $1.32 billion in its initial public offering. The logo of electric car startup NIO is seen at a new NIO House “brand-experience” store, in Beijing, China November 25,… Continue reading UPDATE 1-Chinese EV maker Nio expects to raise $1.32 bln in IPO

Subaru to build tech center in suburban Detroit, hire 100 workers

Original Article