With immediate effect, potential customers can register for an exclusive special edition of the ID.3 , shown here in camouflage. Start of the new all-electric family will be in compact class Third major chapter in the history of the brand’s success ID. stands for intelligent design, identity and visionary technologies Months before its official world… Continue reading First member of the ID. family is called ID.3

Category: Automotive

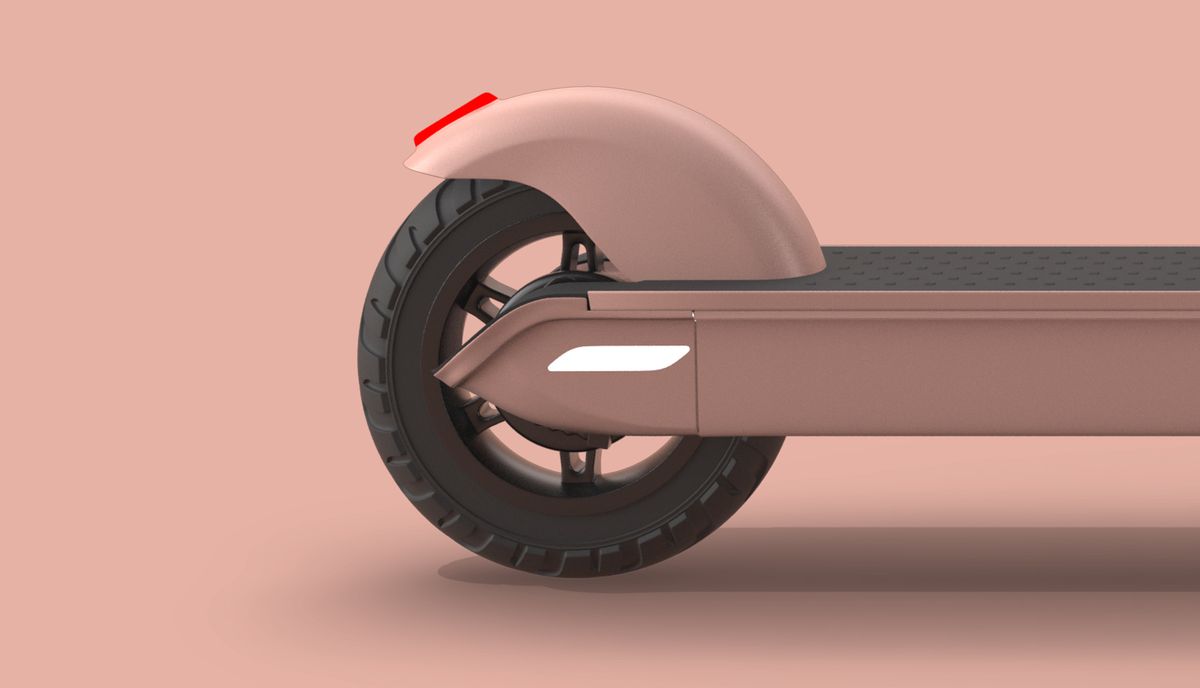

Bird has a new electric scooter: it’s durable, comes in three different colors, and you can buy it

Bird unveiled its next-generation electric scooter on Wednesday that it says will be more durable, powerful, and longer-lasting than previous versions. Dubbed Bird One, this custom e-scooter will also have a longer lifespan than past scooters — a key indicator if Bird ever hopes to become a profitable company. In a new twist, Bird will… Continue reading Bird has a new electric scooter: it’s durable, comes in three different colors, and you can buy it

Daimler Financial Services: Future topic “Mobility”

08.

May 2019

Stuttgart

Jörg Lamparter, Head of Mobility Services, to become Daimler Financial Services AG Board Member for “Digital and Mobility Solutions”, effective June 1, 2019 Benedikt Schell, currently Chief Experience Officer (CXO) on the Board of Management for Daimler Financial Services AG, moving to the position of Chairman of Mercedes-Benz Bank AG in Germany Klaus Entenmann, Chairman of Daimler Financial Services AG: “In Jörg Lamparter, we are gaining a recognized expert in digital mobility services as a new Member of the Board of Management. Within Daimler Financial Services AG, which will change its name to Daimler Mobility AG this summer, he will systematically merge the growing fields of digitization and mobility.” Stuttgart, Germany – Daimler Financial Services AG is strategically realigning key areas of its business by establishing a new division on the Board of Management. Effective June1, 2019, Jörg Lamparter is poised to become a new Member of the Daimler Fina..

Automotive Holdings backs AP Eagers’ sweetened $586 mln offer

New vehicle sales in Australia fell by about 8.9 percent in April from a year earlier, according to the Federal Chamber of Automotive Industries. Australian listed car dealer Automotive Holdings Ltd recommended a takeover proposal from larger rival AP Eagers on Wednesday after the suitor raised its indicative offer to A$836 million ($586.2 million). AP… Continue reading Automotive Holdings backs AP Eagers’ sweetened $586 mln offer

Designers at Ford are using virtual reality tools to work with colleagues remotely

FordEmployees at Ford have started to use a 3D virtual reality (VR) tool that enables them to work on designs with colleagues remotely in real time.

The technology has been developed by Gravity Sketch, in collaboration with Ford. It sees workers wear headsets and use controllers to “draw, rotate, expand and compress a 3D sketch.”

A feature in the system, called Co-Creation, allows designers around the world to work on and evaluate designs in real time while being in different offices. The Gravity Sketch platform negates the need for an initial 2D design process, allowing designers to work with a 3D model from the start.

In a statement earlier this week Michael Smith, design manager at Ford, said that the Co-Creation feature added “more voices to the conversation in a virtual environment, which results in more efficient design work that may help accelerate a vehicle program's development.”

Ford said that designers in five Ford studios around the world were experimenting with Gravity Sketch, looking at both “workflow feasibility” and capabilities relating to “real-time co-creation and collaboration.”

As technology develops, VR is starting to be used across a wide range of industries. In April 2019, for example, it was announced that Qatar Airways had partnered with Rolls-Royce to trial a VR training tool.

The technology, which uses HTC Vive equipment, has been designed to give engineers virtual refresher training with Rolls-Royce's biggest engine, the Trent XWB.

A few months earlier, in February, the British Army awarded a £1 million ($1.3 million) contract to a software developer to “explore how virtual reality can be integrated into soldier training.”

The Ministry of Defence said the pilot scheme would look to test a range of virtual reality applications. These include high resolution virtual reality headsets; avatars that can be customized to replicate facial features and body shapes; and technology that offers data capture and analysis to help soldiers “better understand their own performance.”

Here’s what Wall Street is saying about Lyft’s first report: ‘A good first step’ to profitability

Lyft President John Zimmer (R) and CEO Logan Green speak as Lyft lists on the Nasdaq at an IPO event in Los Angeles March 29, 2019.Mike Blake | ReutersDespite heavy bottom line losses, Wall Street analysts were largely optimistic on Wednesday about Lyft's first quarter earnings report, which was also the ridesharing company's first as a publicly-traded company.

“Overall, we view the 1Q update as positive as the company progresses towards its long-term goals,” Stifel said.

The first quarter results, as well as Lyft's 2019 earnings forecast, was “a good first step for the company to provide evidence toward that goal” of profitability, Credit Suisse said.

“Long term, we still see shared transportation as a market with a long runway for secular growth, potentially more rational industry competitive dynamics as maturity approaches & broader positive impacts on society,” UBS said.

JMP Securities urged investors to “take advantage of the recent pullback in shares,” the firm said, as Lyft has fallen more than 24% since its IPO.

Lyft shares were 3.6% lower in premarket trading from Tuesday's close of $59.34 a share. Its IPO price was $72.

Here's what every major Wall Street analyst said about Lyft's results.

UBS' Eric Sheridan – Buy rating, $82 price target “With its first earnings call/report, LYFT mgmt (in our opinion) laid out a positive LT vision for the industry, downplayed recent worries on competition and talked up the long term transportation oppty. In addition, we think a Q1 and upside forward commentary should also focus investors back on the potential upside. Long term, we still see shared transportation as a market with a long runway for secular growth, potentially more rational industry competitive dynamics as maturity approaches & broader positive impacts on society.”

Credit Suisse's Stephen Ju – Outperform rating, $95 price target “We note that as the potential for margin expansion (and particularly the long-term margin targets) has been a sticking point for LYFT shares among investors, we view the better-than-expected Adj. EBITDA margins reflected in the 1Q19 results, as well as the 2Q19 and 2019 guidance parameters as a good first step for the company to provide evidence toward that goal.”

Jefferies' Brent Thill – Buy rating, increased price target to $90 from $86 “Lyft delivered a clean ride out of the gate in its first qtr since the IPO, with a convincing beat and raise. Lyft showed: 1) strong momentum in rev & metrics; 2) significant progress in reducing losses; and 3) heading off a L-T concern with a partnership with Waymo. Valuation is attractive at 4.0x CY20 EV/S, and we expect stock to recover as Lyft executes and misconceptions clear.”

J.P. Morgan's Doug Anmuth –Overweight rating, increased price target to $86 from $82 “Overall, we believe Lyft's results & outlook were strong, & mgmt addressed a number of key points that we believe will bolster shares: 1) more details & confidence around leveraging insurance over time; 2) 2019 as the peak loss year; 3) core ridesharing losses improving; & 4) competition receding & ridesharing becoming increasing rational. Our 2019 & 2020 revenue estimates are increasing 3-4% & our EBITDA losses also improve notably. We continue to believe there is strong secular growth in TaaS, that Lyft's singular focus on transportation & emphasis on product innovation will driver further share gains, & that ridesharing will become profitable as the industry becomes more rational over time.”

Piper Jaffray's Michael Olson – Overweight rating, $78 price target “The company indicated that, while it continues to spend aggressively on various initiatives, the competitive pressure on rider incentives for core ridesharing has receded to some degree, which is a sign of a rational duopoly between Lyft and Uber for the time being.We believe Lyft will be both a catalyst and beneficiary of the growth of ridesharing and autonomous tech over the next 10+ years. LYFT may not be the right fit for all investors, given the company's current materially unprofitable state, but for those with a long-term view, and patience, we recommend owning shares at these levels.”

Raymond James' Justin Patterson – Outperform rating, $85 price target “We leave the quarter feeling incrementally better about Lyft's ability to win driver and customer loyalty via product innovation and service, and sustain >50% contribution profit growth into 2020E … the peak loss year is less steep than envisioned. Lyft will still generate EBITDA losses in excess of $1B this year…but that is an improvement from $1.3B previously. The incremental margin improvements demonstrated in 1Q suggest that Lyft can reduce cash burn as it exits 2019.”

Stifel's Scott Devitt – Buy rating, increased price target to $70 from $68 “The company's FY:19 revenue guide was set ~3% above our prior expectation at the midpoint. Adj. EBITDA margin for the full year is expected to be -35.4% at the midpoint, approximately 700bps better than our prior expectation. Management noted it is seeing a reduction in rider incentives across the industry and believes overall the current competitive market is rationalizing. Overall, we view the 1Q update as positive as the company progresses towards its long-term goals. We are raising our target price to $70 as a result of higher estimates.”

Canaccord Genuity's Michael Graham – Buy rating, $75 price target “Lyft delivered a textbook first public quarter, with modest upside on all key metrics, and solid guidance relative to consensus both for Q2 and 2019. Management sees the competitive landscape in key US cities becoming increasingly rational, which should be a positive signal for investors worried about the potential for near-term pressure from driver incentives and pricing. Lyft is now contribution-margin positive in nearly every market, and the core ridesharing business is showing enough operating leverage to offset even more of the 2019 investment in bikes and scooters. We continue to see Lyft offering the hallmarks of an attractive growth equity investment, including a large addressable market with an attractive duopoly structure, a strong value proposition that should get better with scale, and a business model that holds solid room for upside.”

JMP Securities' Ronald Josey – Market outperform rating, $78 price target “While acknowledging the concerns around competition, investments, and greater losses in 2019, given strong top-line growth, contribution margin expansion to ~50% in 1Q19 from 35% in 1Q18, Sales and Marketing leverage, and improving losses, we would take advantage of the recent pullback in shares; since Lyft's day 1 closing price post its IPO, shares are down 24% compared to +1.8% for the S&P 500. Importantly, with ~30-40% share of the domestic ridesharing market, a market we believe accounts for ~1% of miles driven, we believe Lyft is at scale and that its TAM could ultimately be significantly larger than the $1.2 trillion annual personal transportation market / TAAS market.

KeyBanc's Andy Hargreaves – Sector weight rating, no price target “Lyft reported solid 1Q results with better than expected rider and revenue growth. We believe Lyft is performing well and retains a strong top-line growth outlook. However, the ride-sharing market appears to be slowing and the degree of longterm profitability remains uncertain, preventing a more positive outlook on the shares.”

Atlantic Equities' James Cordwell – Underweight rating, increased price target to $52 from $50 “Q1 revenue and adjusted EBITDA were ahead and, encouragingly, management commented that promotional intensity had eased, aiding profitability. However, Q2 and FY19 revenue guidance imply a steep deceleration, and while not completely unexpected, could bring to the fore concerns regarding how much growth remains in the US ridehailing market under the current operating model … we remain Underweight given the slowing growth profile and our view that Lyft has insufficient scale to ultimately deliver attractive returns.”

Guggenheim's Jake Fuller – Neutral rating, no price target “The key debate into the release of LYFT's first quarterly results as a public company has been whether it could both sustain rapid growth in Active Riders and do so while showing improvement in unit economics. Growth in Active Riders was modestly ahead of consensus and we saw a sequential step-up in revenue/rider and contribution margin. After seeing Uber's preliminary 1Q results, we worried over the potential for mounting competition to undermine those metrics. While detail in the release and accompanying slide pack was sparse, the lack of obvious competitive pressure is encouraging.”

Three Ways Ford’s Adaptive Cruise Control Cuts Stress and Busts Traffic Jams

DUBAI, UAE, May 8, 2019 – Traffic is a key source of stress on the road. Being stuck in gridlock can result in feelings of irritation, boredom and anxiety, potentially leading to road rage and aggressive driving behaviour. Ford’s Adaptive Cruise Control (ACC)1 driver assist technology can minimise these issues by reducing the stress that drivers… Continue reading Three Ways Ford’s Adaptive Cruise Control Cuts Stress and Busts Traffic Jams

LADA – LADA Granta is the sales leader in April

close

New Granta

New Granta sedanNew Granta liftbackNew Granta hatchbackNew Granta SW

Vesta

Vesta sedanVesta CrossVesta SWVesta SW CrossVesta CNGVesta Sport

XRAY

XRAYXRAY Cross

Largus

Largus UniversalLargus Universal CNGLargus CrossLargus Cross CNGLargus wagonLargus Wagon CNG

4×4

4×4 3 door4x4 Urban4x4 5 door4x4 Urban 5 door4x4 BRONTO

close

News

Press-releases

Subscribe

RSS

Feedback

Ask question

Contacts

Company

COMPANY NEWS

PRESS-RELEASES

SUBSCRIBERSS

All news

Exhibitions, car races, sport

Innovation activity

Corporate Information

Model range

Partners

Production

Results

Social issues

07.05.19

LADA – LADA Granta is the sales leader in April

32 316 LADA cars were sold in April 2019 that is by 5.2% more versus April last year. In total 114 679 LADA cars were sold in Russia within the first four months of 2019 that is by 4.4% more vs the same period of 2018.

According to Company’s estimate, LADA market share in late April made 21.1%.

LADA Granta occupies the leading positions in April, 12 652 cars of this family found their owners, which is the highest result since the beginning of the year.

LADA Vesta took the second position of the ranking. 10 131 LADA Vesta cars were sold in April, the sales growth to the same month of last year reached 30.1%.

The LADA Largus van showed a growth among other LADA models – 829 vans are sold in April that is by 15% more vs April last year. The van, which was six times named the Car of the year in Russia in its segment, remains the most affordable commercial vehicle. Starting April, 2019 LADA offered customers even more profitable bi-fuel version of the van – the usage of the natural gas methane allows to reduce fuel consumption threefold.

Executive AVTOVAZ Vice President for sales and marketing Jan Ptacek said: “LADA market share increased in April confirming the success of new models. The state programs “The First car” and “The Family car” show the high efficiency. Prolongation of these programs will help to support the good level also in the coming period”.

Return

press-releases

subscribe

RSS

07.05.19

LADA – LADA Granta is the sales leader in April

READ MORE

30.04.19

LADA – the advertisement of LADA Granta recognized the best in Russia

READ MORE

25.04.19

LADA clients helped the fund “Gift of Life”

READ MORE

23.04.19

LADA enters the market of Mongolia

READ MORE

16.04.19

LADA – in search of new name

READ MORE

03.04.19

A meeting to discuss the prospects of CNG market development was held at AVTOVAZ

READ MORE

02.04.19

LADA is the winner of the Grand Prix of “Za rulyom”

READ MORE

05.03.19

LADA – the new Granta is the leader in February

READ MORE

04.03.19

LADA cars participate in the state programs «The First car» and «The Family car»

READ MORE

26.02.19

LADA to conquer Moscow and St. Petersburg

READ MORE

08.02.19

LADA Granta – new model will teach driving

READ MORE

05.02.19

LADA Granta became a sales leader in January

READ MORE

04.02.19

LADA Vesta – Russian bestseller became more affordable

READ MORE

04.02.19

AVTOVAZ signed agreements with St. Petersburg Polytechnic University of Peter the Great

READ MORE

01.02.19

LADA – new dealership in S.Petersburg

READ MORE

LOAD NEWS

Toyota: breaking the spiel limit

US dealers have their work cut out as carmaker’s achievements trail far behind its aspirations Go to Source

Meritor to Acquire AxleTech, Enhancing Growth Platform in Off-Highway, Defense and Aftermarket Segments

The transaction advances Meritor’s M2022 objectives to accelerate global sales and growth by leveraging the company’s core competencies to grow strategically in adjacent markets. The addition of AxleTech enhances Meritor’s growth platform, bringing a highly complementary global product portfolio across the off-highway, defense, specialty and aftermarket segments. AxleTech’s offerings include a full product line of… Continue reading Meritor to Acquire AxleTech, Enhancing Growth Platform in Off-Highway, Defense and Aftermarket Segments