As the market quickly transitions to electric vehicles (EVs), competition in the Indian luxury car market is fast intensifying in the zero-emission vehicle space.

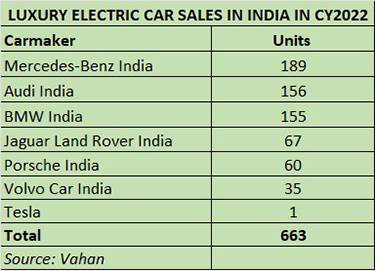

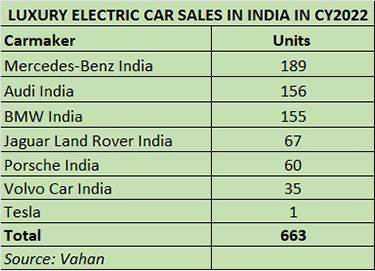

As per the Vahan Data for 2022, approximately 663 electric luxury cars valued at around US$ 100 million (Rs 824 crore) were registered at the luxury end of the market last year. What has emerged is a neck-and-neck race for supremacy between Mercedes-Benz, BMW and Audi with just 20-40 units separating the three German luxury car rivals (see data table below).

In overall retail sales, both Mercedes-Benz India and BMW Group India claim to have grabbed leadership last year. According to BMW Group India, the company has retailed about 350 vehicles, whereas Mercedes Benz India claims to have retailed around 400 EVs in 2022. However, Vahan data shows that Mercedes-Benz India registered 189 units with Audi and BMW following close behind with 156 and 155 EVs, respectively.

Vikram Pawah, managing director of BMW Group India, claims that the company has grabbed leadership in the nascent yet fast-growing luxury electric vehicle market in India. “When we entered the space, we said we will be the leaders in the EV space and we will offer the widest choice to our customers, which we have. We are adding another product today which is the i7. So, we have started on the right foot, it is a growing market, it will be a fantastic journey for us,” added Pawah.

On the other hand, the mainstream luxury market leader, Mercedes-Benz India too claims that it is a leader in EV sales by a fair margin and the numbers are even higher than what is currently being shown on Vahan. “Our actual sales are significantly higher than the Vahan data,” said Santosh Iyer, managing director of Mercedes-Benz India.

BMW Group India, the second-largest luxury carmaker in India, registered record-high volume of 11,981 units with 35% YoY growth in CY2022 and retailed about 350 electric vehicles, according to the company.

While BMW Group India currently sells two EVs in India – the iX and i4, Mercedes-Benz India offers the EQB, EQC and the flagship EQS in the country, whereas Audi India has four alternatives under its e-tron EV family.

BMW Group India claims the demand penetration has already reached 10% of its portfolio, but supplies continue to remain a big challenge. On a like-to-like basis, where there are multiple models, the penetration has already touched 30%, claims the company.

Pawah says customers in India are discerning and they want the latest technology and second is the non-dependence on public charging. “This is not the only car in the house, that is what is going to fuel the growth in India in the luxury car space. That is why we are happy that we are starting the year as a leader. If the supplies improve, we expect 30-35% of our sales could potentially come from EVs in the next 2-3 years, once supplies normalise,” he added.

Globally, BMW is expecting 15% of its total sales to come from EVs in 2023. The share of EVs in 2022 was about 9%.

Mercedes-Benz India, on the other hand, is going by a mid-term projection of 25 percent EV sales by 2025.

“We are not giving any short-term projections on EV sales as a lot depends on availability. We have a high reliance on Germany to get kits for the EQS and EQB and they are hot-selling cars worldwide as well,” Iyer said.

Mercedes-Benz India is doing its bit to expand the charging infrastructure. The company has installed around 35 ultra-fast DC chargers at its outlets across the country and it plans to grow the number in a gradual manner.

To support EV peneration, BMW too has set up fast DC chargers across 32 cities across its dealerships, and every customer gets one AC charger at home or office from the company.

Range is not a challenge, claims Pawah. “There is no dependence on the public charging network, we are opening up private charging for the public,” he signed off.

ALSO READ:

Mercedes-Benz India achieves best-ever annual sales in its history in CY2022

EV sales in India in 2022 record 210% growth, cross a million for the first time