After the surprising Insolvency of the manufacturer Prophete

, massive supply chain problems, then full warehouses and, as a result, clear Discounts for bicycles Not only the aficionados among cyclists have been asking themselves for weeks: how did the industry fare last year, what are the prospects? The two-wheeler industry association (ZIV

) and the two-wheel trade association (VDZ

) as representatives of the specialist trade drew a surprisingly positive picture on Wednesday and, despite large inventories, looked ahead optimistically.

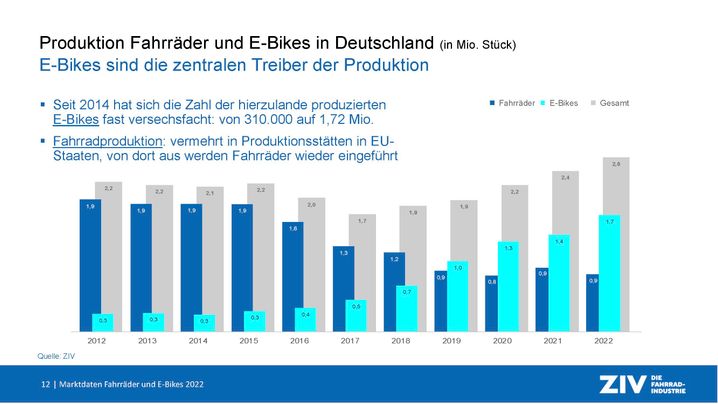

In view of the sometimes major problems that manufacturers and retailers had to contend with in 2022, the industry has done respectably overall. Domestic production climbed from around 2.4 to 2.6 million bicycles – 1.72 million or 20 percent more e-bikes (pedelecs) left the assembly halls. In contrast, the number of bicycles produced without a motor remained at 0.9 million. This means that around six times as many pedelecs were produced in Germany last year as in 2015 (see picture gallery).

“We assume that in the course of this year, for the first time, more e-bikes will be sold than non-motorized bicycles”

ZIV Managing Director Burkhard Stork

Dealers sold 4.6 million bicycles across all sales channels in 2022 – 100,000 fewer than in the previous year. Almost every second (48 percent) bike sold was a pedelec. “We assume that in the course of this year, for the first time, more e-bikes will be sold than non-motorized bicycles,” explained ZIV Managing Director Burkhard Stork.

In some product groups such as mountain bikes or cargo bikes, electric motors now dominate propulsion instead of muscle power. Not that you no longer need your legs with an e-bike, but German cyclists like it more and more comfortably.

German cyclists like it easy

While the purists prefer to rely on their muscle power and are often critical of electrically assisted bikes, the industry nevertheless benefits from this development: the sales value of all bicycles climbed by 12 percent to 7.36 billion last year due to the growing proportion of more expensive e-bikes Euro. “This is a new sales record,” emphasized ZIV boss Stork on Wednesday.

According to initial projections, the Zweirad trade association (VDZ) also reports 10 to 20 percent more sales of e-bikes, while sales of non-motorized bikes fell by up to 12 percent. Overall, the revenues of the specialist trade including affiliated workshops are likely to have increased by 8 to 10 percent. VDZ boss Thomas Kunz did not name absolute figures. At the same time, the trend towards e-bikes, with its regular inspections and maintenance intervals, means that workshops are being used to a greater extent, and according to Kunz, sales rose by around 10 percent last year.

E-bikes drive sales and workshops

The effect of the e-bike trend is also illustrated by other figures: According to ZIV, the average sales price of all bicycles across all sales channels increased by more than 200 to 1602 euros last year, mainly because the prices for e-bikes rose by 150 increased to an average of 2800 euros. For comparison: In 2019, an e-bike cost an average of around 930 euros. In specialist shops, on the other hand, an e-bike cost an average of 3570 euros last year – Stork and Kunz justified the statistically significant difference with the broader range and all sales channels, which were included in the statistics of the industry association.

photo series

The German bicycle industry 2022 in figures

9 images

Photo: ZIV

Stork did not want to let the suspicion that retailers and manufacturers might now be exploiting the hype surrounding electrically assisted bicycles stand. “It’s not the case that e-bikes are simply getting more and more expensive. Today’s customers also get more bikes for their money,” said the industry representative. At the same time, customers asked for higher-quality components such as gears or brakes, and consumers also wanted powerful batteries, good suspension, an attractive design and, above all, a long service life for their bikes.

“For some time now, the bicycle has been growing out of the role of a pure means of transport and into that of a coveted consumer product,” said Thorsten Heckrath-Rose, co-managing director of the premium manufacturer Rose Bikes in conversation with manager magazin

.

Full warehouses, prices are currently falling

Could the manufacturers last year hundreds of thousands of wheels do not assemble

Because key parts were missing from Asia, supply chain problems are now a thing of the past, Stork said. The warehouses at the manufacturers and dealers are full to bursting. The period of the pandemic-related high costs in pre-production for raw materials and transport have eased. Retailers and manufacturers would pass on the price advantages to customers (read the analysis here). What may please the customer drives the dealers to frown. VDZ boss Kunz reported on “sales with relatively large price reductions” also in specialist shops. This development is still ongoing.

Germany continues to import more bicycles and e-bikes than it produces domestically: 4.43 million (+300,000) last year. A little more than half of the almost three million imported bicycles without electric motors come from Asia. At the same time, the region supplies 27 percent of the approximately 1.45 million e-bikes imported by Germany, and 69 percent of the imported pedelecs come from EU countries.

When asked, the Zweirad-Industrie-Verband explained that German manufacturers had around 780,000 bicycles and e-bikes produced in their own workshops in other European countries. Most of these bikes would be imported back to Germany. That means: All in all, German manufacturers produced a total of 3.38 million bicycles and e-bikes at home and abroad.

“We assume that there will currently be no massive relocation of production to Europe”

ZIV Managing Director Burkhard Stork

In view of the West’s increasing conflicts with China and the massive supply problems during the pandemic, the industry had a lot of discussion last year about whether manufacturers and component manufacturers should shift their production more out of Asia. After all, a large proportion of bicycle frames and components are still produced in Taiwan, China and other Asian countries. “We assume that there will currently be no massive relocation of production to Europe,” explained ZIV boss Stork. However, the industry association expects that production in Europe will continue to gain in importance in the long term.

Even if the year 2023 for the bicycle industry “a difficult year”

As the ZIV boss recently admitted to manager magagzin, manufacturers and dealers are nonetheless confident about the future. Because politicians are also banking on new, lower-CO2 mobility for people. The industry representatives are convinced that the bicycle will make an important contribution here.

more on the subject

“Two thirds of all everyday journeys by people in town and country can be done easily by bicycle or e-bike. The bicycle industry provides the means of mass transport of the future,” says Stork. Now politicians must deliver and also invest the billions provided for in the coalition agreement for the expansion of the cycling infrastructure.