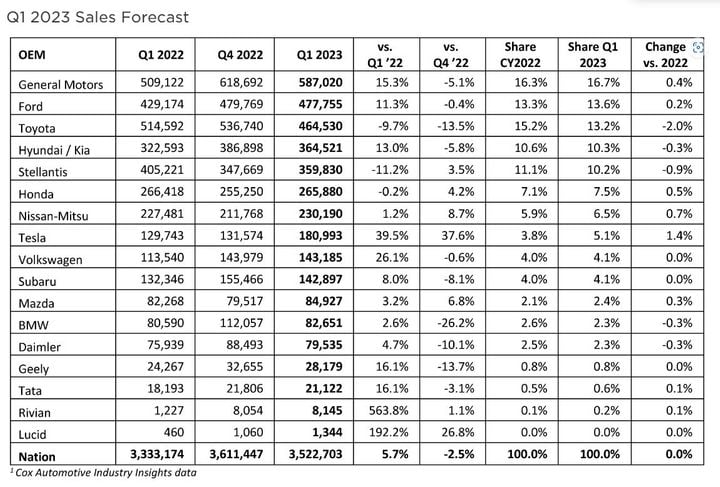

Tesla is forecast to surpass 5% market share for the first time. Improved inventory levels will help lift General Motors to become the top new vehicle seller in the U.S. in Q1.

Photo: Cox Automotive

Cox Automotive forecasts new-vehicle sales volume in Q1 will reach 3.5 million units, an increase of nearly 6% year over year, the company said in its first-quarter 2023 report.

A key driver of the increased sales is the vastly improved new-vehicle inventory level, with a notable increase in fleet activity. However, supply constraints and affordability will dampen further gains, noted Jonathan Smoke, Cox Automotive’s chief economist.

Q1 Automotive Sales Data

- Through Q1, Cox is forecasting the seasonally adjusted annual rate (SAAR) at 15 million, up more than 6% compared to 14.1 million SAAR in Q1 2022.

- However, full-year results won’t keep pace: Cox Automotive is adjusting its full-year new-vehicle sales forecast to 14.2 million. Improving new vehicle inventor is a tailwind, while elevated prices and average loan rates above 8% are headwinds.

- The new-vehicle inventory level is up roughly 70% from same period 2022.

- Fleet sales in January were up 58% year-over-year and 48% in February, with a similar increase expected in March.

- Cox is forecasting fleet sales for 2023 to be 2.2 million, up 23% from 2022.

- Improved inventory levels will help lift General Motors to become the top new vehicle seller in the U.S. in Q1, a 15% increase year over year. A year ago, Toyota was on top.

- Tesla is forecast to surpass 5% market share for the first time, with Q1 sales expected to reach 180,000, a record quarter and a gain of nearly 40% from Q1 2022.

- Tesla will be the top luxury OEM in the U.S. in Q1, by far, more than doubling sales from BMW or Mercedes.

- In Q1, the typical new-vehicle loan payment was more than $750 a month.

- New retail sales as of March 25 were down 9% year over year, while U.S. retail sales were down 14%.

- Volume weighted average of new auto loan rates on DealerTrack are up to 8.90%, up 324 basis points year over year. Used auto loan rates are up to 13.98% and up 376 basis points from a year ago, causing payments to increase by 11.3%.

- New inventory in early March was down 53% compared to 2019 with days’ supply down similarly.

- Wholesale supply is tighter by six days compared to 2019. Wholesale prices are up 5.1% for the year, and retail prices are now starting to follow.

Said Charlie Chesbrough, senior economist at Cox Automotive: “The Q1 result is surprisingly strong given all the bad economic news. But we expect the upside market experienced in Q1 won’t last throughout the year. In fact, sales volume in Q1 will be down 3% from last quarter, suggesting that market headwinds are growing. Inventory levels at some automakers are moving back up above pre-pandemic normal, suggesting that overall demand has slowed in some corners of the market.”

Said Cox: “The better-than-expected start to this year is now running into some speed bumps. Tax refund season had been ahead of last year, but now is behind last year in what matters most — that is refund dollars being dispersed both in total and as an average.

We’ve also seen that wholesale price increases throughout this year are now leading to retail price increases and that’s been bound to impact demand soon.

And throw on top of that how interest rates have moved pretty aggressively so far this year, especially in the U.S. market, as used average rates have increased more than a point and a half since the beginning of the year. These conditions are not good for demand.

Now throw in the challenges that we have with confidence likely to be impacted by a few bank failures and stock market volatility and we enter the vital spring season with real concerns about the demand continuing to stay strong. The good news is with those bank failures in the short term, we’re seeing declines in interest rates. And we’ll have to see just how long that persists.”

Originally posted on Automotive Fleet