Indonesia-listed e-commerce player Bukalapak recorded 1 trillion rupiah ($68.2 million) in losses in the first three months of 2023, according to a statement late on Friday, a stark contrast from the 14.55 trillion rupiah profits in the same period a year earlier.

The profit made in Jan-March last year, however, was attributed to the substantial gains from Bukalapak’s investment in PT Allo Bank Tbk.

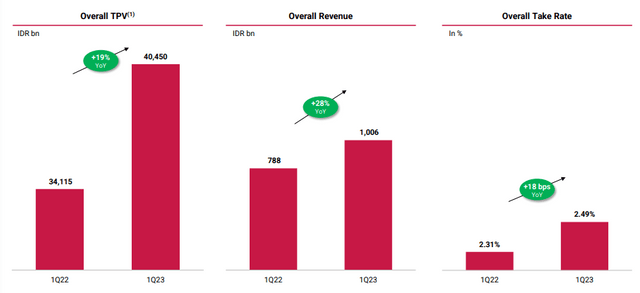

Despite the losses, Bukalapak showed several positive developments in terms of its total processing value (TPV)—the value of payments that indicates the growth in transactions made on the platform—revenue, and take rate in Jan-March 2023.

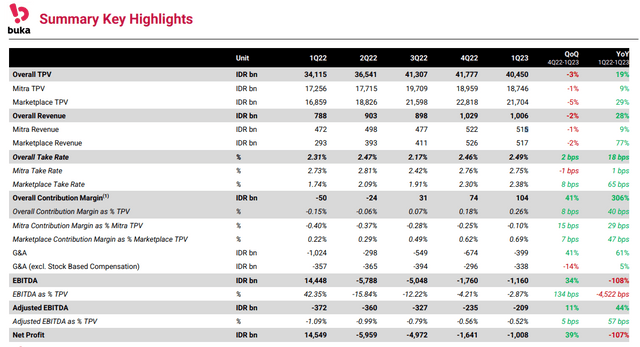

Bukalapak’s TPV grew 19% year-on-year (YoY) to 40.5 trillion rupiah in the first three months of 2023 on the back of the growth in its marketplace arm and specialty verticals. The company noted that 72% of the company’s TPV came from outside Tier-1 regions in Indonesia.

Mitra Bukalapak, the company’s online-to-offline arm, has been the growth engine of the company for some time. It booked a TPV of 18.7 trillion rupiah in the Jan-March period, showing a 9% YoY increase. Bukalapak also saw an increase in the number of registered partners to 16.8 million, from 16.1 million at the end of December 2022.

Bukalapak’s revenue in Jan-March period grew 28% YoY to 1 trillion rupiah while Mitra Bukalapak’s revenue grew 9% YoY to 515 billion rupiah. It is worth noting that the revenue of Bukalapak’s marketplace increased 77% YoY to 517 billion on the back of higher take-rate specialty verticals.

Bukalapak’s contribution margin—which is calculated as gross profit after sales and marketing costs—in the first quarter improved to 0.3% of TPV, from -0.2% of TPV in the corresponding period a year earlier.

“The company continues to focus on its strategy to deliver positive and sustainable growth, while simultaneously managing its expenses,” Bukalapak said in the statement, noting that the general and administrative expenses ratio to TPV dropped to -0.8% of TPV in the Jan-March period versus -1.0% a year earlier.

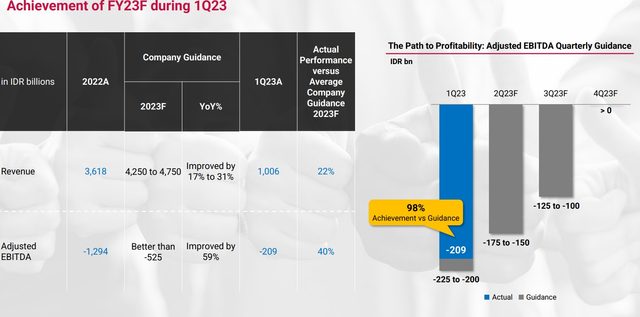

Adjusted EBITDA loss stood at 209 billion rupiah in the first three months of 2023, showing a 44% YoY improvement.

“We believe this result is in line with our conservative full-year 2023 EBITDA estimate and possibly in reach with consensus depending on the impact of Allofresh and the increase in the number of SKUs available,” Niko Margaronis, a research analyst at BRI Danareksa Sekuritas, said.

Bukalapak had recorded a net profit in 2022 on the back of its strong first quarter, despite making losses in all subsequent quarters of the year.

In its recent company presentation, Bukalapak offered guidance for 2023 that it has expected revenue of around 4.25 trillion rupiah to 4.75 trillion rupiah and adjusted EBITDA loss better than 525 billion rupiah. The company expects adjusted Ebitda breakeven in Q4 this year.

The company had cash & cash equivalents and liquid investments totalling 20.3 trillion rupiah as on end-March 2023. “With the average quarterly interest income and improved quarterly EBITDA, Bukalapak will have a runway of more than 50 years,” it said in a presentation.